Adobe: Fairly Valued, Fiercely Contested

A look into Adobe’s AI-powered future, its market valuation, and the silent threats investors must watch.

Note from Business Deep Dives

This is the very first post published under the Business Deep Dives banner — and it’s just the beginning. What you’re reading today is a write-up designed to kick things off and set the tone. But as the name suggests, our ultimate ambition is to deliver institutional-quality deep dives into the world’s most interesting businesses.

Over time — and especially if we begin to monetize the publication — the depth, quality, and frequency of these reports will increase substantially. That includes detailed financial models, expert insights, Monte Carlo simulations, and expansive research backed by both primary and secondary data sources.

For now, consider this an early look into what we’re building. We appreciate your readership and feedback as we grow into the full vision.

Introduction

Like nearly every company in 2025, Adobe Inc. (NASDAQ: ADBE) stands at a pivotal moment in its history. The creative software giant successfully transitioned to a subscription-based model over the past decade, delivering consistent revenue growth and strong margins. Achieving that pivot defied market skeptics, turned disruption into advantage, and maintained its leadership in productive and creative software solutions.

Now, the company seeks to do it again. This time, it’s dealing with a whole-of-society disruptor that will make or break virtually all companies over the next five years. As Adobe integrates generative AI capabilities across its product portfolio, the challenge is to predict whether the firm can once again rise above a shifting landscape, or be swallowed by the tides of change.

The only honest answer from any analyst is that we just don’t know yet. From tariffs to dizzying changes in technology and consumer tastes, a long-term prediction for any company’s fortune is a fool’s errand right now. So far, Adobe’s strategy looks promising, with financial performance beating market estimates quarter after quarter, and a massive war chest to spend on adapting to new technologies. However, major risks lie ahead.

Based on our comprehensive analysis, we believe Adobe is currently fairly valued. That recommendation may irritate stakeholders, given that the company’s stock price has already fallen over 20%, more than twice the S&P’s year-to-date drop, while its financial performance outperforms. Our thesis, like Adobe’s volatile share price since 2023, is informed by the tremendous uncertainty that looms over the company, as it tries once again to pull a pivot out of its hat. This time, the stakes are higher, the competition fiercer, and the window to adapt is smaller.

We recommend an active wait-and-see approach for those who hold Adobe stock. It will be crucial to watch financial results and forward guidance closely for signs of instability.

Recent Performance: Strong Financials, Uncertain Outlook

Adobe’s price performance, and increasingly its fundamental performance, have been driven by AI since the beginning of 2023. Despite investors initially biting their nails, Adobe has managed to consistently grow its revenue, profits and cash flow, due in part to its success in integrating generative AI into its product lineup.

The company has maintained strong financial performance over recent quarters, with consistent revenue growth and robust profitability. In Q1 2025, the company reported record revenue of $5.71 billion, representing 10% year-over-year growth. Digital Media segment revenue, which includes Creative Cloud and Document Cloud, grew 11% year-over-year to $4.23 billion, while Digital Experience segment revenue increased 10% to $1.41 billion, according to company filings.

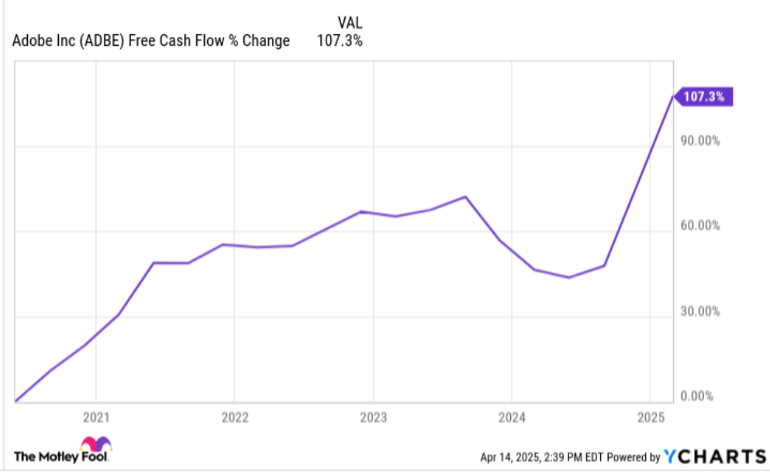

Source: YCharts

Adobe has averaged over 15% growth in free cash flow over the past five years, and just over 10% growth in the past three years. The company's subscription-based business model continues to generate impressive cash flows, with operating cash flow of $2.48 billion in Q1 2025.

A discounted cash flow that uses past performance to estimate fair value would generally call the company undervalued. For example, if we assume 13% annual growth over the next ten years, 4% terminal growth and a discount rate of 10%, Adobe is currently undervalued by roughly 25%, with a target price of $441 versus $350 at the time of writing.

The company seems to agree with its undervaluation. Adobe rewarded shareholders and provided a bullish signal by using much of that cash to repurchase shares, buying back roughly 7 million shares during the quarter.

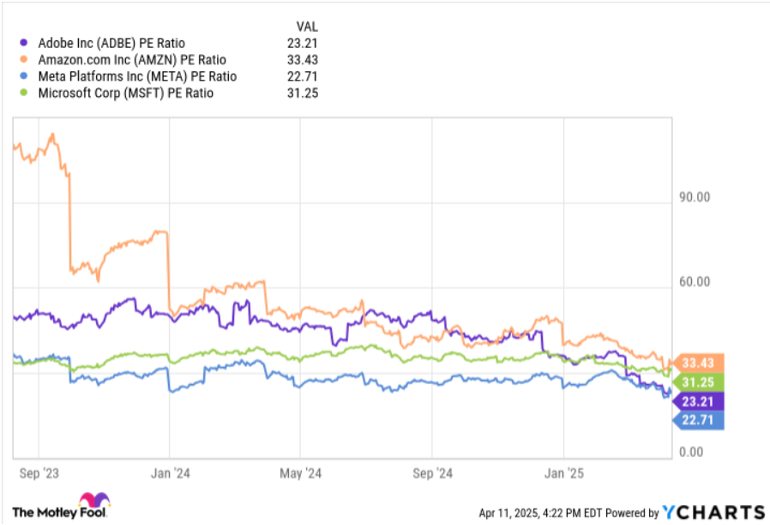

Source: YCharts

Adobe’s earnings and cash flow are substantially cheaper than most companies of its size, growth rate, and financial strength. The heavy discount isn’t about any problems in today’s financials, but fears that current trends may not hold in the future. Predictably, market anxiety boils down to AI.

AI Integration: Unlocked Synergies or Race to the Bottom?

Adobe’s AI integration strategy presents significant growth opportunities, and has already helped to boost its growth and outlook since rolling out generative AI tools in 2023. However, these factors are largely baked into its current valuation, and are appropriately discounted for the uncertainty of future growth. Performance to date and the race-to-the-bottom nature of commoditized creative tools suggests limited upside potential from current levels, and substantial risks ahead.

Like any tech company in 2025, Adobe talks about AI. A lot. Virtually every piece of marketing material, every financial report, every earnings call describes how Adobe is using generative AI to empower itself and the creators who use its products. Of course, this approach is much better than ignoring AI, and Adobe has found some early success with its AI strategy. However, it remains to be seen whether Adobe can stay ahead in terms of quality, while avoiding price pressures eating into growth and margins in the coming years.

The company reported that its AI book of business generated $125 million in Annual Recurring Revenue (ARR) in Q1, which it expects to double by year’s end. While still a tiny fraction of the firm’s total revenue, it reflects a growing foothold in the space and success in incorporating technology that has proven hard for many big firms to commercialize.

Adobe's AI strategy centers around its Firefly generative AI platform, which has been integrated across its product ecosystem, including PhotoShop and Express. So far, its main differentiators have been its native integration with Adobe’s products, which have a loyal user base, and its positioning as leader in privacy practices.

Key aspects of Adobe's AI approach include training Firefly only on licensed content with proper permissions and compensating creators who contribute to Adobe Stock for the use of their content in training. Unlike most major competitors, it does not mine content from the web. Adobe’s focus is on developing commercially safe models that avoid copyright infringement, and giving creators ownership of the content they create with Firefly.

The ethical approach may provide Adobe with a sustainable competitive advantage, particularly among enterprise customers and professional creators concerned about copyright issues.

Between strong financial performance over several quarters, successful early AI integration and its cheap valuation by any fundamental metric, most analysts are recommending to either buy or hold Adobe stock. A recent MorningStar reportreflected this idea:

“We observe a growing disconnect between our fair value estimate and current trading levels that makes little sense, given the firm’s stable fundamentals and the bear case of AI obviating the need for Creative Cloud not materializing.”

This is all true at this early stage in the AI race. However, it would be irresponsible to ignore the risks to Adobe in the coming years. Much like the subscription disruptions that it weathered from 2007 to 2015, the ground is shifting under the company’s feet. Its ability to come out stronger is not guaranteed, and its current price reflects very real uncertainty.

Where to Watch: Competition, Pricing, and the Macro Environment

On paper, Adobe’s financials look great. As one can easily confirm, the company’s recent financial performance suggests it is undervalued compared to major competitors and blue-chip stocks in general. The company has plenty of cash, and is generating more of it at a healthy clip. For this reason, nobody holding a responsible Adobe allocation should be sweating just yet. However, there are a few factors that investors will have to watch very carefully.

Cheaper Competitors, Margin Pressure

To understate, Adobe is competing in a crowded arena in 2025. Several companies, including OpenAI, Google and MidJourney, either overlap or directly compete with Adobe’s AI-bolstered product line. Importantly, these companies continue to reduce the consumer cost of using their tools, while still competing in terms of quality and application scope. For example, while using AI to edit photos was a major advantage for Adobe through Photoshop integration, that moat is quickly receding as competitors move in. This puts serious pressure on Adobe’s subscription pricing, and by extension its profit margins.

As it scales its AI offerings, Adobe may not have much room to maneuver on price. The company is among the few tech giants that has opted out of vertically integrating its server infrastructure. Its reliance on Amazon Web Services for data hosting and model training could become more expensive as it scales its data-intensive generative AI solutions. A combination of falling competitor prices and Adobe’s inability to unilaterally reduce server costs could be a major danger to profits and cash flow in the future.

Data Practices: Double-Edged Sword

Adobe has positioned itself as the ethical gen-AI platform, empowering creators and respecting the general privacy and copyright protections of the internet writ large. Adobe will likely see two countervailing forces as it tkes the high road: positive differentiation and greater customer loyalty as the reward for corporate responsibility, and margin and innovation pressures as the cost. Which effect will dominate is an open question.

Companies like OpenAI and MidJourney gobble up internet data, regardless of copyright status, because it’s a highly efficient and effective way to train the algorithms that power generative AI. By not compensating creators, ignoring privacy concerns and working with larger data sets, other companies are able to improve their models faster and at lower costs, which they can (and do) pass on to their users.

It is an open question for Adobe whether the positive or negative effects of its strategy will dominate. Customer loyalty has served Adobe well, and the public has expressed valid frustration with generative AI platforms hoovering up data. However, if today’s tech giants have taught us anything, it’s that product quality and price ultimately dominate brand affinity and privacy when it comes to software.

Consumer price sensitivity could also increase in a tougher macroeconomic environment, especially from our friends abroad.

Macroeconomic Stressors

While Donald Trump won largely on concerns about the health of the economy, his unpredictable trade policy has put a damper on market optimism. In an economic downturn, Adobe could face a one-two punch of more price-sensitive content creators who have increasingly attractive, cheaper alternatives to Adobe’s product suite. Though not unique to Adobe, trade pressures could also eat into revenues and cash flow.

Source: FRED

Conclusion

While the US famously runs a significant trade deficit in terms of goods, it is a different story when it comes to services. US services exports enjoy a surplus of roughly a quarter-trillion dollars. Digital services from companies like Spotify, Google and Adobe comprise a massive share of this service surplus. Digital services provide an obvious point of leverage as countries respond to US trade barriers. Adobe earns 25% of its revenue outside of the United States, leaving it vulnerable to boycotts, tariffs, and regulatory burden in the future.

Recommendation: Hold

Adobe stands at the intersection of creative software and artificial intelligence, with both significant opportunities and meaningful challenges ahead. The company's strong financial performance, cash generation, and early success in AI integration present a tempting investment at this price point. However, increasing competition from both established tech giants and AI-native startups poses a serious threat to Adobe's future market leadership.

Adobe's current valuation largely reflects both its growth opportunities and competitive challenges. While the company's AI integration strategy presents significant potential for revenue expansion and market share gains, these opportunities are balanced by increasing competitive pressures and the risk of disruption from AI-native startups.

Weighing these factors, we believe Adobe is fairly valued, with substantial upside if it can maintain its current financial trends. The company's strong financial performance, cash generation, and early success in AI integration are positive indicators, but these strengths are largely reflected in the current stock price when accounting for risks.

It is very important for current or prospective stakeholders to watch Adobes’ guidance and financial performance carefully. Any significant change in Adobe’s user base, pricing, or forward guidance may be a strong sell signal for the market, which has bet against company performance since early 2024.