Dexcom Inc. (DXCM): A Durable CGM Leader

Dominant CGM Franchise Leveraging Technology, Coverage Expansion, and Consumer Tailwinds to Sustain Multi-Year Growth

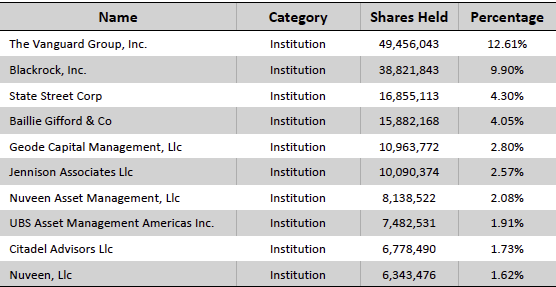

The full PDF and accompanying financial model are available here

Investment Thesis

Dexcom is a global leader in the structurally attractive and underpenetrated CGM market, benefiting from strong secular trends including rising diabetes prevalence, broadening reimbursement, and increasing adoption across insulin and non-insulin populations. Its best-in-class G-series platform, expanding OTC footprint via Stelo, and robust international growth strategy position it for sustained revenue acceleration and margin expansion. With a high recurring revenue mix, strong operating leverage, and optionality in adjacent wellness and digital health verticals, Dexcom is well-positioned to deliver long-term compounding returns.

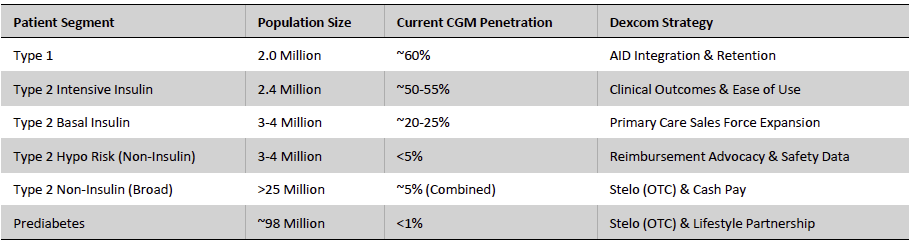

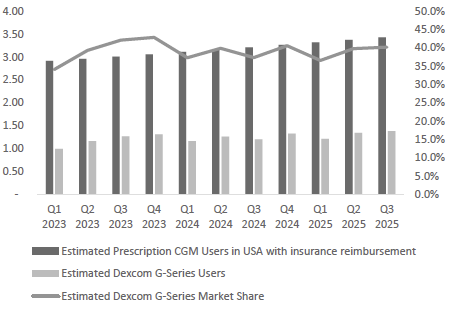

Dexcom Commands a Leadership Position in a Rapidly Expanding, Underpenetrated CGM Market: Dexcom is a dominant player in the global continuous glucose monitoring (CGM) market, which was estimated at ~$13 billion in 2024 and is expected to grow at a double-digit CAGR through the next decade. The company held approximately 35% of global CGM revenue and an estimated 74% share of the U.S. Prescription CGM market in 2024. Despite this leadership, CGM penetration remains low; fewer than 10 million patients globally use CGMs, compared to over 120 million people with insulin-treated diabetes. In the U.S. alone, Dexcom has identified more than 25 million people with diabetes who have reimbursement access but are not yet using CGM. With rising adoption across all insulin segments and broader therapy stages, the company is well-positioned to capture this significant latent demand.

Dexcom Maintains Clear Product Superiority and Clinical Differentiation Through Best-in-Class Sensor Technology and User-Centric Design: Dexcom’s G7 sensor offers industry-leading features including sub-9% MARD accuracy, a fast 30-minute warm-up time, and seamless integration with both smartphones and smartwatches. It is fully disposable and requires no calibrations, offering a hassle-free experience that compares favorably to competitors. G7 also supports automated insulin delivery (AID) via integrations with leading insulin pumps, reinforcing Dexcom’s leadership in the intensive insulin therapy segment. The new 15-day G7 sensor, rolled out in 4Q25, will reduce the cost-per-day for users and improve sensor economics. Coupled with a patient-friendly design and advanced alerting and sharing capabilities, Dexcom has built a strong competitive moat based on product reliability, user trust, and physician preference.

Structural Tailwinds Including Expanding Diabetes Burden, Clinical Validation, and Reimbursement Progress Are Driving Industry-Wide Growth: The global diabetes population is projected to reach 853 million by 2050, up from ~590 million in 2024, according to the IDF. CGM is now recognized as the standard of care across all insulin-use stages by the ADA’s 2025 clinical guidelines, reinforcing its relevance in both Type 1 and insulin-treated Type 2 diabetes. Importantly, commercial and Medicare coverage in the U.S. has expanded rapidly: Dexcom expects to have CGM access in place for nearly 6 million non-insulin Type 2 diabetics by the end of 2025, up from negligible levels just a few years ago. International coverage is also gaining momentum, particularly in Canada and Western Europe, with national health systems expanding reimbursement beyond Type 1s. These tailwinds are expected to meaningfully expand Dexcom’s addressable market over the next 3–5 years.

Aggressive Push into Non-Insulin Type 2 and Consumer Wellness Segments Positions Dexcom for Second-Wave Adoption: While Dexcom has long been the preferred CGM brand among Type 1 and intensive insulin users, its recent foray into non-insulin Type 2 diabetes and the broader wellness market is expanding its growth horizon. The launch of Stelo in August 2024 marked a strategic inflection — a 15-day wearable sensor offered OTC and via e-commerce channels, targeting millions of Americans with prediabetes and metabolic health concerns. Early signs are promising: Dexcom has seen strong reorder rates and a high subscription conversion rate among Stelo users. This expansion also allows Dexcom to diversify beyond the prescription channel, deepen its presence in primary care, and compete in the emerging bio-wearables category.

Recurring, Subscription-Driven Revenue Model Provides High Visibility and Cash Flow Stability: Dexcom’s business model is supported by a highly predictable and recurring revenue stream, with the vast majority of its sales derived from sensor reorders on a 10–15 day replacement cycle. In 2024, over 85% of Dexcom’s revenue was recurring in nature, driven by its expanding installed base of active users across both G-Series and Stelo platforms. With monthly sensor usage and growing adoption of subscription-based models, the company benefits from high revenue visibility and strong customer retention. This recurring revenue base supports not only stable cash flow generation but also provides a foundation for operating leverage as fixed costs are amortized over a growing volume of shipments.

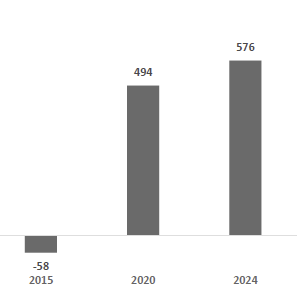

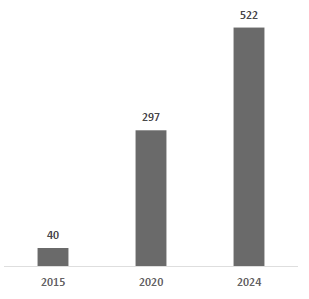

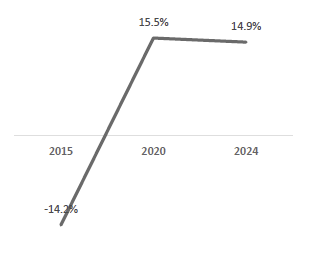

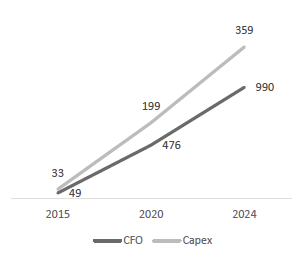

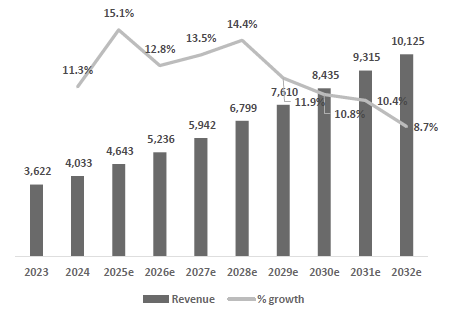

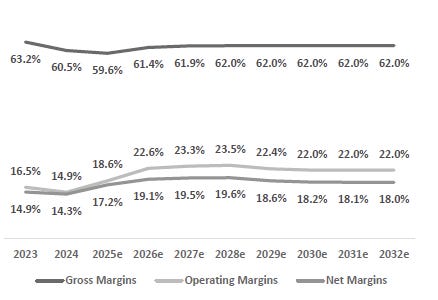

Strong Financial Performance and Improving Operating Leverage Underpin Long-Term Margin Expansion: Dexcom is guiding for FY25 revenue of $4.63–$4.65 billion, representing ~15% YoY growth. It expects to generate approximately $1.4 billion in adjusted EBITDA this year, with an EBITDA margin of 29–30%. Non-GAAP gross margin is expected to be ~61%, while operating margins are targeted at 20–21%. Margin expansion is being driven by automation, scaling efficiencies in high-throughput facilities in Arizona and Malaysia, and the improved unit economics of longer-duration sensors. The transition of more business to the pharmacy and OTC channels is also helping lower fulfillment costs. With continued volume growth and cost optimization, Dexcom remains on track to expand margins over the medium term.

A Durable Competitive Moat Built Around Ecosystem Lock-In, Brand Trust, and Clinical Integration: Dexcom has built a defensible position through strategic ecosystem integration — it is the preferred CGM partner for leading insulin pump players including Tandem and Insulet, and offers extensive API connectivity to digital health platforms, apps, and wearables. The company has one of the highest Net Promoter Scores in the diabetes device industry, and its data-sharing capabilities, predictive alerts, and advanced software tools have made it the CGM of choice among physicians and tech-savvy patients. The company has also resolved its multi-year IP litigation with Abbott, removing legal overhang and enabling both firms to focus on market expansion. Combined with robust real-world evidence and payer-aligned outcomes (e.g., fewer hospitalizations), Dexcom’s franchise is protected by both technological and clinical barriers to entry.

Vast International Opportunity Across Underpenetrated Markets with Tiered Portfolio Strategy Driving Global Access: Dexcom has added over 4 million covered lives internationally over the past three years. The company is expanding via a mix of direct market entry (e.g., Japan, Saudi Arabia) and distributor-led models, with plans for further direct expansion in 2025. It has launched a tiered product strategy, with G-Series sensors offered in premium reimbursement markets and Dexcom ONE+ tailored for more price-sensitive geographies. Penetration remains low outside the U.S. — for example, only ~7% of Type 1 diabetics in China currently use CGM, with projections to reach 38% by 2030. As reimbursement improves and awareness grows in Asia-Pacific, Eastern Europe, and Latin America, international markets are poised to become a more significant share of Dexcom’s topline.

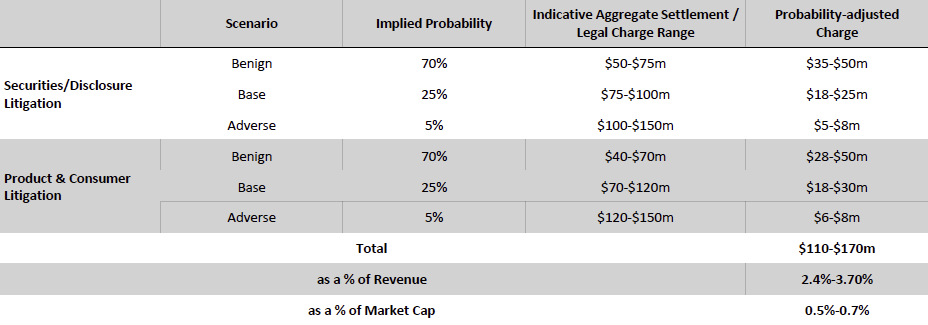

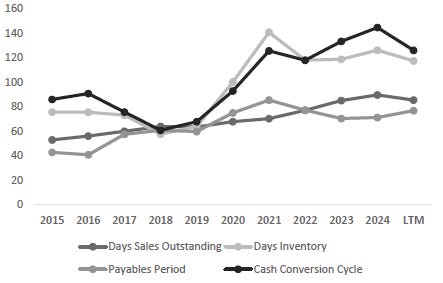

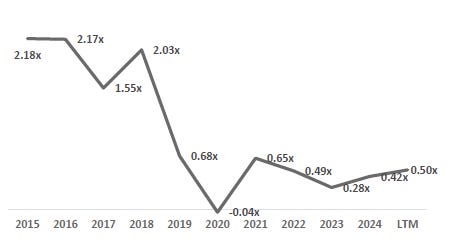

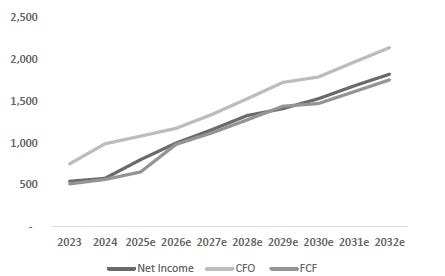

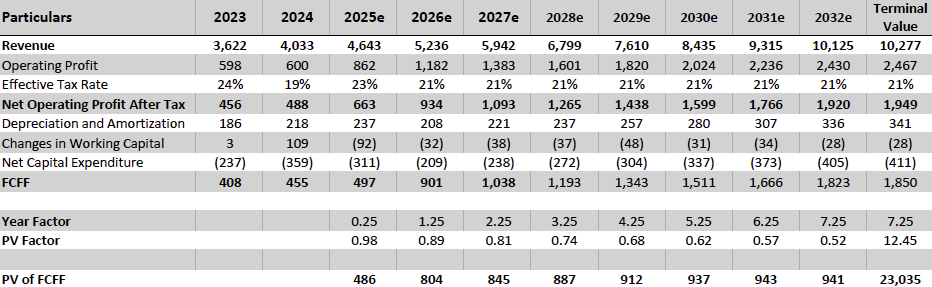

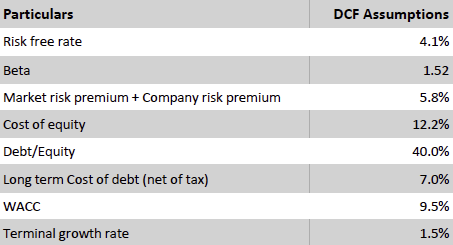

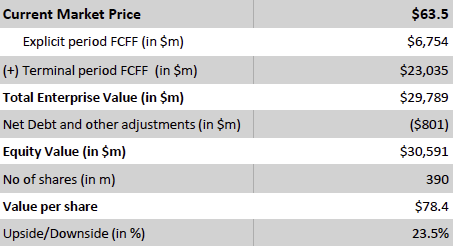

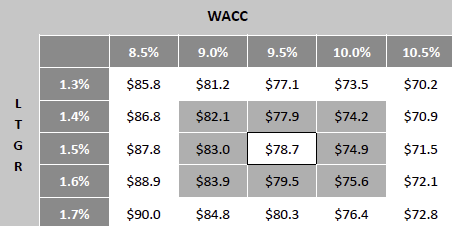

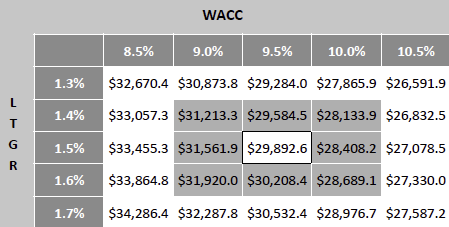

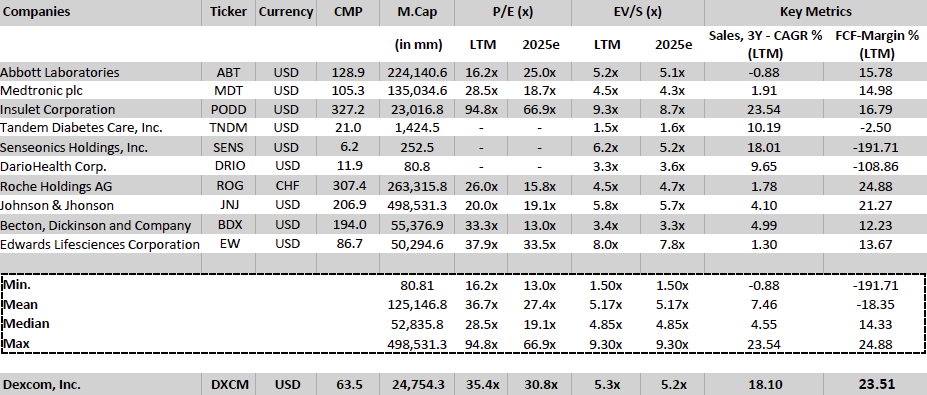

Valuation Re-rating Expected as Operational Headwinds Subsides, CGM Penetration Broadens, and Leadership Position Strengthens: Dexcom’s long-term upside is supported by low CGM penetration across multiple patient cohorts and grographies. New access pathways, especially Stelo’s OTC/self-pay channel remain early and is expected to become a meaningful incremental growth driver as adoption scales. Against this backdrop, we model a 12% five-year U.S. revenue CAGR and a 14% five-year international revenue CAGR. We also underwrite a gradual normalization in gross margins as transitory operational frictions unwind, with operating leverage expanding EBIT margins and improving working-capital dynamics support stronger cash conversion. Based on these assumptions, applying a 1.5% terminal growth rate and a 9.5% discount rate that includes a 1.5% company-specific premium for recent execution volatility quality/regulatory headline risk, and litigation overhangs, we derive an intrinsic value of $78.4 per share. Relative to the current level, this valution implies an upside of 23.5%.

Levers & Catalysts:

G7 Fifteen-Day Sensor Expands Margins

Resolution of Global Lawsuits and Complaints

Expanded Medicare Coverage for Non-Insulin Type 2s

Acceleration in International Reimbursement Approvals

Commercialization of AI-Driven CGM Decision Tools

Launch of New CGM Form Factors or Wearables

Company Overview

Dexcom, Inc. (NASDAQ: DXCM) is a global medical device company specializing in the design, development, and commercialization of continuous glucose monitoring (CGM) systems for diabetes and metabolic health. Founded in 1999 and headquartered in San Diego, California, the company operates globally with a commercial presence across North America, Europe, and multiple international markets. Since its first FDA approval in 2006, Dexcom has led CGM innovation through successive product generations. Its major platforms include the Dexcom G6, launched in 2018 as the first CGM to receive the FDA’s integrated CGM (iCGM) designation, enabling seamless interoperability with automated insulin-delivery systems (AIDs) and establishing Dexcom as the technological standard for connected diabetes care. The Dexcom G7, launched in 2023 with 510(k) clearance, advances accuracy and usability with a MARD (Mean Absolute Relative Difference) of 8.2% and 94.1% of readings within 20% of comparator values, while Dexcom is preparing to introduce an FDA-cleared 15-day wear version potentially by late 2025 or early 2026.

The company has broadened its portfolio with Dexcom ONE and ONE+ for value-sensitive international markets and expanded into the consumer and non-insulin Type 2 segment with Stelo, launched in 2024 as the first FDA-cleared OTC glucose biosensor for adults with prediabetes and Type 2 diabetes not using insulin. Dexcom also collaborates with Verily Life Sciences (an Alphabet company, formerly Google Life Sciences) on next-generation sensing technologies and, in 2021, launched Dexcom Ventures to invest in emerging CGM, analyte-monitoring, and medical cybersecurity technologies.

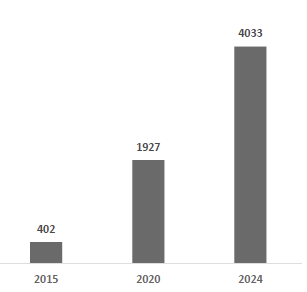

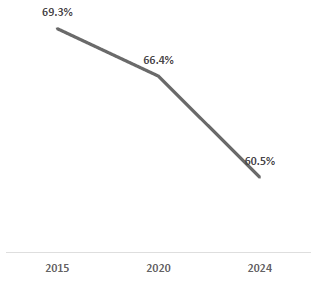

Dexcom has demonstrated sustained financial momentum, expanding revenue from $1.93 billion in 2020 to $4.03 billion in 2024, representing an impressive CAGR of ~20%. The company now holds the leading share of the U.S. prescription real-time CGM market and is the global leader in the premium, iCGM-grade therapeutic segment, underlining its deeply entrenched position in the highest-value portion of the CGM landscape.

Exhibit 1: One of Dexcom’s Fulfillment Facility. Source: Dexcom

Dexcom’s revenue model is anchored in a recurring razor–razor blade structure, with disposable sensors serving as the primary revenue driver given their 10/15-day wear cycle. Legacy platforms like G6 use replaceable transmitters, while receivers contribute limited one-time sales. Broad reimbursement coverage in developed markets supports adoption among insulin-using patients, and integrations with automated insulin-delivery (AID) systems further expand sensor utilization. Internationally, Dexcom combines direct sales, distributors, and e-commerce channels, supported by a tiered product strategy (G7 → ONE/ONE+ → Stelo) that captures premium, mid-market, and OTC consumer segments. The company manufactures its products across facilities in San Diego, California; Mesa, Arizona; and Penang, Malaysia, encompassing approximately 80,600 sq ft of laboratory space and 159,600 sq ft of controlled-environment rooms, with a major new facility under construction in Athenry, Ireland, to expand capacity.

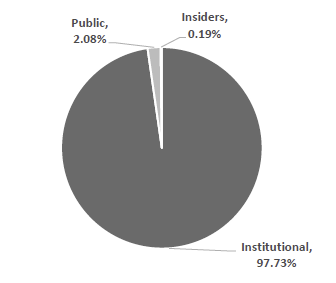

Over the recent years, however, Dexcom has undertaken several recalls across its CGM ecosystem, including a Class I recall of G6, G7, ONE, and ONE+ receivers for speaker failures, multiple Class I software recalls involving G7, ONE+, and G6 Android app versions that suppressed or failed to deliver critical alerts, and a Class II recall of the legacy G6 for hydroxyurea-related interference. These issues, linked to broader FDA-flagged quality-system documentation gaps, are being addressed via targeted remediation. Management has stated that the recalls are not expected to have a material financial or operational impact, a view supported by current performance: revenues have continued to grow despite these challenges, rising from $3.95 billion in 3Q FY2024 to $4.52 billion on an LTM basis, with quarterly year-over-year growth maintaining a resilient 9–16% range. In parallel, Dexcom is enhancing its digital and generative AI capabilities across its software ecosystem to improve predictive analytics, personalization, and long-term patient engagement, reinforcing its technology leadership as it implements compliance remediation.

With global diabetes prevalence expected to reach 853 million adults by 2050 and CGM penetration still low in non-insulin Type 2 populations, Dexcom has a substantial runway for adoption. The company competes primarily with Abbott’s FreeStyle Libre platform but maintains differentiation through real-time data accuracy, iCGM-grade interoperability, automation-ready integration, and strong clinical performance. Overall, Dexcom is positioned as a global CGM leader in an oligopolistic market with high-margin recurring revenue, expanding manufacturing scale, and a product ecosystem aligned with long-term growth in metabolic health technology.

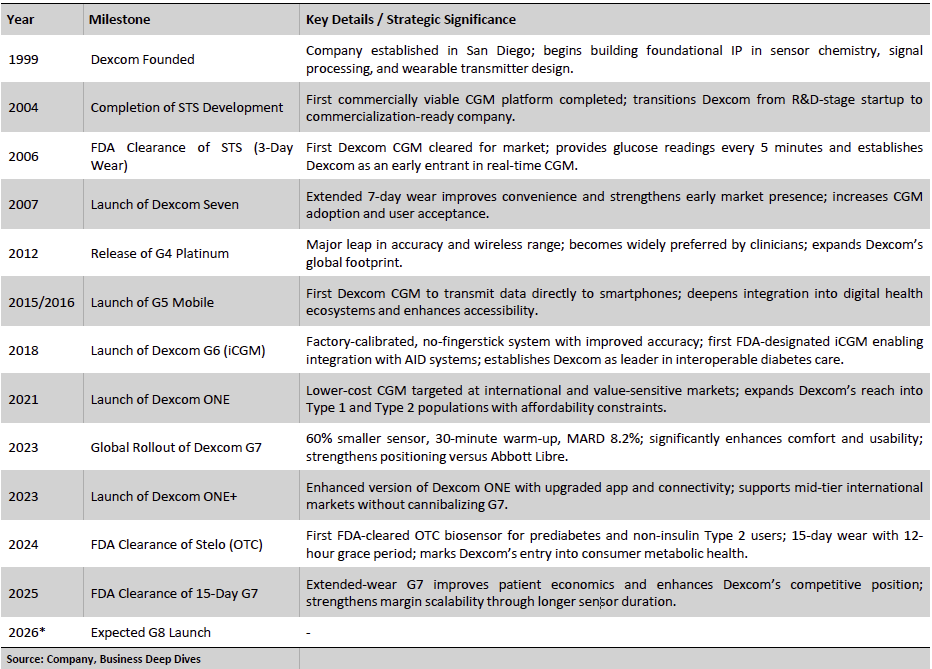

Exhibit 2: Key Milestones

An Ecosystem Approach Towards Metabolic Healthcare

Dexcom’s evolution over the past decade reflects a deliberate shift from a specialized diabetes-technology company to a broad-based metabolic health platform with solutions spanning the full continuum of patient and consumer needs. The company has expanded beyond a single premium CGM offering into a tiered ecosystem that supports intensive insulin management, broadens access in value-sensitive international markets, and now reaches earlier-stage metabolic consumers outside the traditional prescription pathway. This progression demonstrates Dexcom’s strategy to serve a wider and more diverse population while building a scalable, recurring-revenue foundation. The sections that follow break down how this strategy takes shape across its key product families and how each layer contributes to Dexcom’s long-term growth and competitive positioning.

DexCom G-Series: Flagship rtCGM Franchise

Before the development of Dexcom’s CGM systems, glucose monitoring relied on tools that offered only partial and often unreliable insights into glycemic control. Urine glucose testing (once the primary method) provided delayed and imprecise readings because glucose was detected only after renal filtration. The introduction of portable blood glucose meters in the 1960s and 1970s, beginning with Ames’ Dextrostix strips and later handheld electrochemical meters, improved accuracy but still delivered only intermittent snapshots of glucose levels. Despite the scientific foundation for continuous sensing having been established in 1965 with Dr. Leland Clark’s enzyme-based electrochemical biosensor design, self-monitoring of blood glucose (SMBG) persisted as the standard of care due to manufacturing, miniaturization, and consumer hardware limitations. However, SMBG’s structural barriers, such as painful fingersticks, emotional distress from fluctuating glucose values, and difficulty interpreting isolated readings, resulted in low adherence across global insulin-using populations, with daily SMBG use ranging from only 13% to 32% in major markets despite subsidized or free meters. These limitations reveal a long-standing unmet need for real-time, continuous data, precisely the gap Dexcom’s G-Series franchise was designed to address.

Exhibit 3: Dexcom G4 (Left) and Dexcom G5 (Right). Source: Company Website

Dexcom’s G-Series platform represents the technological backbone of the company’s commercial success and has played a defining role in shaping the modern CGM landscape. The franchise evolution began with the G4 Platinum (2012), which delivered a major leap in analytical performance, featuring a ~13% Mean Absolute Relative Difference (MARD), stronger wireless reliability, and real-world transmission often extending to approximately 20 feet. Additionally, it enabled early insulin-pump integration through the waterproof Animas Vibe (an integrated insulin pump developed by Animas). This was the first CGM generation that offered clinically meaningful trend accuracy alongside stability, laying the architectural foundation for Dexcom’s subsequent systems. The G5 Mobile (2015) advanced Dexcom into connected diabetes care by becoming the first CGM to transmit real-time glucose data directly to smartphones, eliminating the need for a dedicated receiver. It introduced Bluetooth-enabled transmitters, remote monitoring for up to five followers, and access to Dexcom Clarity for cloud-based analytics, capabilities that significantly improved caregiver oversight and broadened appeal across pediatric and adult populations. Together, G4 and G5 established Dexcom’s early leadership in sensor accuracy, wireless reliability, and digital integration.

The franchise reached its largest inflection point with the G6 (2018), which transformed Dexcom into the dominant premium CGM provider. The G6 introduced factory calibration with no routine fingersticks, a fully automated one-button applicator, enhanced adhesive stability, and a 10-day wear sensor supported by redesigned chemistry. FDA clinical review demonstrated a MARD of ~9.6% and nearly 90% of readings within ±20%/20 mg/dL, marking a material improvement over prior generations. The G6 also removed acetaminophen interference, added predictive hypoglycemia alerts like Urgent Low Soon, and, most importantly, became the first device ever to receive the FDA’s integrated CGM (iCGM) designation. This De Novo classification established the regulatory framework enabling CGM systems to interoperate seamlessly with automated insulin-delivery (AID) pumps, effectively elevating Dexcom’s sensor from a standalone device to a therapy-enabling platform. This regulatory milestone catalyzed broad pump-ecosystem partnerships and accelerated CGM utilization as AID adoption grew. From 2020 onward, the G6 became Dexcom’s most commercially successful product, contributing over $2 billion in annual revenue, anchoring its razor–razor-blade model, and driving global reimbursement expansion.

Exhibit 4: Dexcom G6 (Left) and Dexcom G7 (Right). Source: Company Website

The G7 (2022 FDA clearance) represents the most substantial architectural overhaul in the franchise to date. The device integrates the sensor and transmitter into a fully disposable, 60% smaller, all-in-one unit, reducing on-body footprint and simplifying insertion. It offers a 30-minute warm-up (the fastest among major CGMs), 10-day wear plus a 12-hour grace period, expanded wear-site flexibility, and a sub-9% adult MARD with strengthened rate-of-change performance via improved filtering algorithms. The G7 maintains full compliance with FDA iCGM special controls, ensuring compatibility with next-generation AID platforms, and supports 24-hour on-body data retention during communication gaps. Dexcom is now preparing to commercialize an FDA-cleared 15-day wear version of G7, expected to materially improve gross margins by reducing per-patient sensor volumes while protecting cost-per-day economics. As of 2024–2025, the G6 and G7 together generate the majority of over $4 billion in annual revenue, forming the financial and technological foundation of Dexcom’s long-term growth strategy as it expands deeper into Type 2 diabetes, prediabetes, and metabolic-wellness segments.

Dexcom One/One+: Value Segment and International Expansion Lever

Dexcom’s introduction of Dexcom ONE (2021) and ONE+ (2023) represents a strategic shift to expand the company’s presence across lower-cost and value-sensitive CGM markets globally. While the company’s G-Series franchise anchors the premium segment through clinical performance, iCGM interoperability, and AID integrations, the ONE platform addresses the largest barrier to CGM adoption outside the U.S.: price accessibility. Built on the validated G6 sensing architecture, Dexcom ONE delivers factory calibration (no fingersticks), 10-day wear, and 5-minute real-time readings, while stripping away AID integration and advanced alerting to reduce system complexity and cost. This intentional feature differentiation allows Dexcom to tier its pricing without cannibalizing G7 demand, enabling the company to pursue segments historically dominated by Abbott’s low-priced FreeStyle Libre lineup. For Dexcom, ONE provides an on-ramp to millions of insulin-using Type 1 and Type 2 users in markets where reimbursement ceilings or out-of-pocket affordability previously constrained CGM adoption.

Dexcom ONE+ extends this positioning further by enhancing the user experience (improving the mobile app interface, simplifying onboarding, and refining alert logic) while maintaining a meaningfully lower price point than G7. Importantly, ONE+ began its rollout in early 2024 in Spain, Belgium, Poland, and later the Netherlands, regions that have historically applied strict price caps on reimbursed CGM devices. The platform is engineered around healthcare-professional feedback to reduce training and clinic burden, which is critical in geographies where endocrinology infrastructure is limited. By keeping ONE+ as a non-AID, standalone RT-CGM, Dexcom protects its premium G-Series pricing while positioning ONE/ONE+ as the logical choice for early CGM adopters, lower-income patients, and payors demanding cost-effective options. This design also supports a “laddered” adoption strategy: patients may begin on ONE/ONE+ and later transition to G7 or G8 as reimbursement, disease progression, or AID availability evolves.

Exhibit 5: Dexcom ONE (Left) and Dexcom ONE+ (Right) Products. Source: Company Website.

Strategically, the ONE platform is central to Dexcom’s international growth algorithm. As of 2024, international revenues account for roughly 33–35% of total Dexcom revenue, and growth in this segment consistently outpaces the U.S. business, driven largely by broader Type 2 reimbursement and lower-priced CGM offerings. In markets where Dexcom has launched ONE/ONE+, management has cited accelerated new-patient additions, lower onboarding friction, and improved penetration in previously underrepresented Type 2 cohorts. Abbott’s Libre continues to lead in the value-priced segment, but ONE/ONE+ materially strengthens Dexcom’s competitive presence where pricing pressure is most intense. For example, in Central and Eastern Europe, Dexcom’s market share gains have closely coincided with ONE adoption, reflecting the segment’s sensitivity to affordability rather than technology differentials alone. As global reimbursement frameworks evolve toward funding CGM for insulin-using Type 2 patients (now visible in markets such as the U.K., Spain, Germany, and parts of Asia), Dexcom’s ability to offer a tiered product stack becomes a structural advantage that broadens its total addressable market.

Financially, ONE/ONE+ functions as a volume lever within Dexcom’s recurring-revenue model. Although average selling prices (ASPs) are lower than for G-Series devices, the platform benefits from mature G6 manufacturing lines and high sensor yields, supporting attractive unit economics even at reduced pricing. As a result, ONE/ONE+ delivers incremental operating leverage as scale increases. Importantly, these products expand Dexcom’s global insulin-using Type 2 CGM opportunity, a population exceeding 80 million patients across reimbursed and emerging markets by 2030, which is far larger than the insulin-using Type 1 population to which Dexcom has historically catered. Management commentary and regional performance trends indicate that the ONE platform has started making a meaningful contribution to international revenue growth, supporting Dexcom’s multi-year trajectory toward mid-teens global revenue growth, despite intensifying competition. As the company deploys the 15-day G7 and prepares the multi-analyte G8 at the premium tier, ONE and ONE+ anchor the value tier, creating a balanced portfolio that expands Dexcom’s reach while protecting blended margins.

DexCom Stelo: Non-Insulin and Pre-Diabetes Opportunity

The non-insulin Type 2 diabetes population represents one of the largest untapped opportunities in glucose monitoring, encompassing tens of millions of adults who manage dysglycemia through lifestyle measures and oral therapies rather than insulin, and who have historically remained outside reimbursed CGM access. In the U.S., Dexcom estimates that more than 25 million adults with Type 2 diabetes are not using insulin, a segment with meaningful metabolic-health needs but limited exposure to real-time glucose data due to prescription barriers, payer constraints, and the medical orientation of traditional CGMs. An equally significant opportunity exists in pre-diabetes, a condition affecting an estimated 98 million U.S. adults (more than 1 in 3), where individuals are increasingly seeking metabolic insight to guide weight-loss efforts, optimize nutrition, and prevent disease progression, yet remain entirely outside the traditional clinical CGM pathway. Stelo directly addresses both groups by offering accessible, real-time glucose visibility at a stage when behavior-driven interventions have the greatest impact.

Introduced in 2024 as the first FDA-cleared over-the-counter (OTC) glucose biosensor, Stelo marks Dexcom’s entry into the consumer metabolic-health category and extends the company beyond its traditional insulin-using base. Built on the G7 sensing architecture, the device offers a 15-day wear period and a 12-hour grace window, with glucose values presented every 15 minutes. Key clinical features, such as trend arrows, predictive alerts, and automated insulin delivery (AID) integration, are intentionally omitted to align with its positioning as a lifestyle and wellness tool rather than a therapeutic device.

Exhibit 6: Dexcom Stelo. Source: Company Website

Stelo opens a broad new access point by removing prescription requirements and reducing friction for first-time glucose-monitoring users. The device also leverages Dexcom’s established G6/G7 manufacturing lines and high sensor yields, which help maintain attractive unit economics even at lower price points. In addition, the product positions Dexcom at the forefront of a fast-growing metabolic-wellness landscape shaped by rising GLP-1 therapy adoption, employer-sponsored metabolic programs, and consumer interest in glucose-responsive nutrition. By onboarding users earlier in their metabolic journey (spanning pre-diabetes through non-insulin T2D), Dexcom gains recurring access to behavioral glucose data that strengthens its analytics capabilities and supports more tailored engagement. This early entry establishes familiarity with Dexcom’s ecosystem and creates a natural progression pathway into ONE/ONE+ or G-Series systems if clinical needs later intensify, expanding lifetime value and reinforcing ecosystem retention.

Dexcom’s Integrated Business Model and Global Reimbursement Alignment Create a Scalable High-Retention CGM Commercial Flywheel

Dexcom operates a high-recurring-revenue, hardware-plus-consumables business model centered on its growing installed base. Disposable 10–15-day sensors generate 80–85% of revenue, while hardware components, reusable transmitters/receivers, serve as low-margin entry points. The model functions as a modern razor–razor-blade system, where each new patient converts into stable, recurring sensor revenue and predictable lifetime value.

Dexcom operates a high-recurring-revenue, hardware-plus-consumables business model

For most prescription CGM products, the commercial funnel begins with a clinician-issued prescription, which determines whether the patient enters through the pharmacy benefit channel or the durable medical equipment (DME) channel (mutually exclusive insurance pathways). A multi-channel go-to-market system supports this recurring-revenue engine. In the U.S., the pharmacy benefit channel has become the dominant onboarding pathway due to faster authorizations, simpler insurance processing, and stronger refill adherence. Meanwhile, the DME channel remains relevant for pediatrics and complex cases that require specialized training. Dexcom’s position is reinforced by deep Automated Insulin Delivery (AID) ecosystem partnerships (Tandem t:slim X2, Insulet Omnipod 5, Beta Bionics iLet), where iCGM interoperability effectively locks Dexcom sensors into closed-loop pump therapy, thereby increasing retention and driving premium-tier utilization. Outside the U.S., Dexcom utilizes a combination of direct sales, distributor partnerships, and government tenders across Europe, the Asia-Pacific region, Latin America, and the Middle East, aligning product allocation with local reimbursement and pricing regulations. Premium CGM products, such as G7, are prioritized in fully reimbursed markets, including the U.S., the U.K., Germany, France, Japan, and Australia. In contrast, value CGM products, such as the Dexcom ONE/ONE+, are positioned for tender- or price-regulated markets, including Spain, Poland, Belgium, and the Nordics, to expand Type-2 access without diluting G7 pricing. In emerging regions, including the Middle East, Brazil, Mexico, and Southeast Asia, distributor-led models manage regulatory pathways and logistics, enabling cost-efficient expansion.

Dexcom’s commercial architecture is amplified by a broad digital-health ecosystem, integrating with Apple Health, Google Fit, electronic health record (EHR) systems, telehealth programs, and metabolic-wellness platforms. The company’s CGM data also interfaces with leading consumer wearables, including the Oura Ring and Garmin devices, alongside clinic-facing platforms such as Glooko, enabling combined insights across glucose, sleep, recovery, activity, and clinical decision-support workflows. Collaborations with Verily and the Dexcom Ventures portfolio extend the roadmap toward multi-analyte sensing and metabolic intelligence. The launch of Stelo, Dexcom’s OTC biosensor, adds a direct-to-consumer (D2C) e-commerce channel for non-insulin Type-2 and prediabetes users, opening a frictionless entry point into Dexcom’s ecosystem.

Dexcom’s business model, channel strategy, and ecosystem alliances operate as an integrated commercial flywheel in which broad, low-friction access pathways feed into a highly retentive, high-frequency sensor platform. This structure supports durable recurring revenue, scalable margin expansion, and a reinforced competitive position across both core diabetes management and the broader metabolic-health market.

Dexcom’s business model, channel strategy, and ecosystem alliances operate as an integrated commercial flywheel in which broad, low-friction access pathways feed into a highly retentive, high-frequency sensor platform

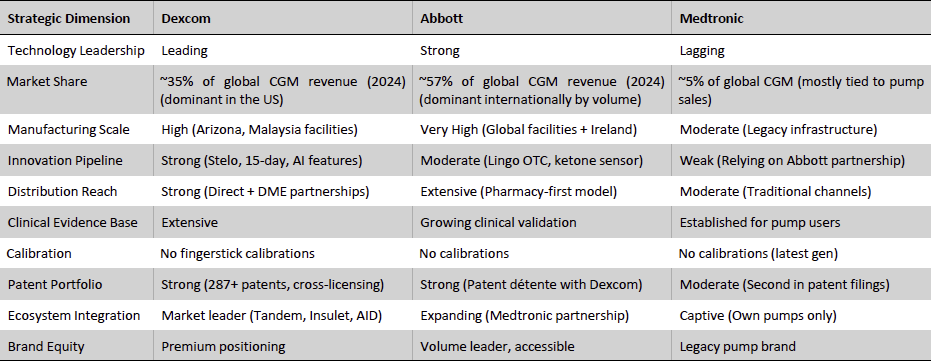

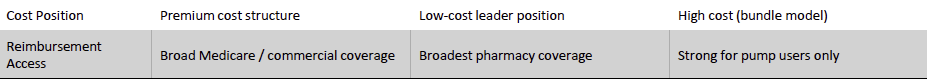

A critical enabler of this commercial flywheel is the global pricing and reimbursement environment, which ultimately determines the speed and depth of real-world CGM adoption. Pricing and reimbursement play a defining role in Dexcom’s global adoption profile, acting as the primary gatekeeper of CGM accessibility across premium, value, and consumer markets. Adoption remains highly reimbursement-elastic in most countries, with uptake accelerating sharply following coverage expansion for insulin-using Type 2 patients in markets such as Germany, Spain, and the U.K. Against this backdrop, Dexcom’s tiered portfolio aligns with distinct pricing and reimbursement structures. Understanding these pricing tiers and how reimbursement frameworks shape real-world adoption is critical for evaluating Dexcom’s ability to scale globally while maintaining balanced margins.

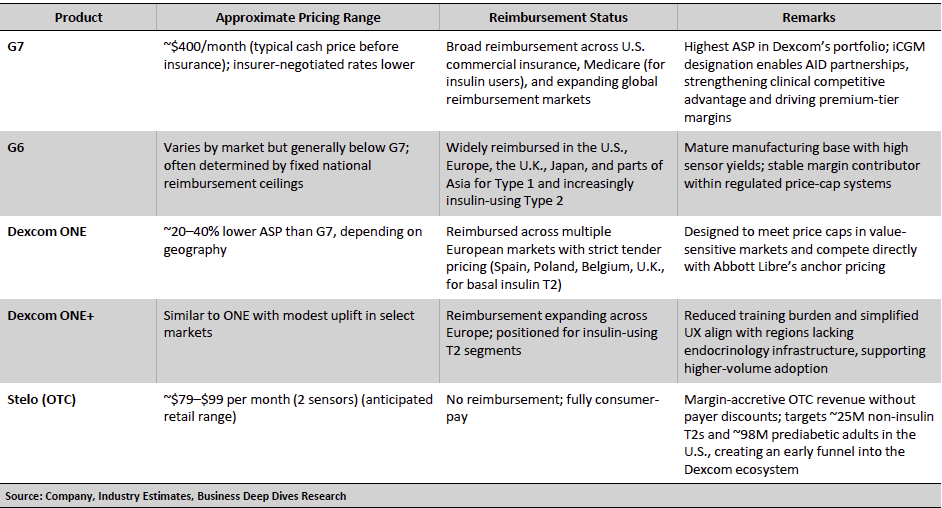

Exhibit 7: Dexcom Pricing and Reimbursement Overview

Premium G-Series pricing remains supported by strong clinical evidence, iCGM interoperability, and the upcoming transition to 15-day wear, which is expected to enhance per-patient profitability by reducing annual sensor volumes. ONE/ONE+ fits within strict tender-based reimbursement ceilings across Europe and serves as Dexcom’s principal lever for penetrating price-sensitive, insulin-using Type 2 populations, where Abbott Libre has historically established the reference point. Stelo introduces a fully cash-pay channel that bypasses payer friction entirely, tapping into the large non-insulin Type 2 and prediabetes segments. Together, these pricing tiers form a coherent strategy that broadens Dexcom’s reach while protecting blended margins as the company scales across both clinical and consumer metabolic health markets.

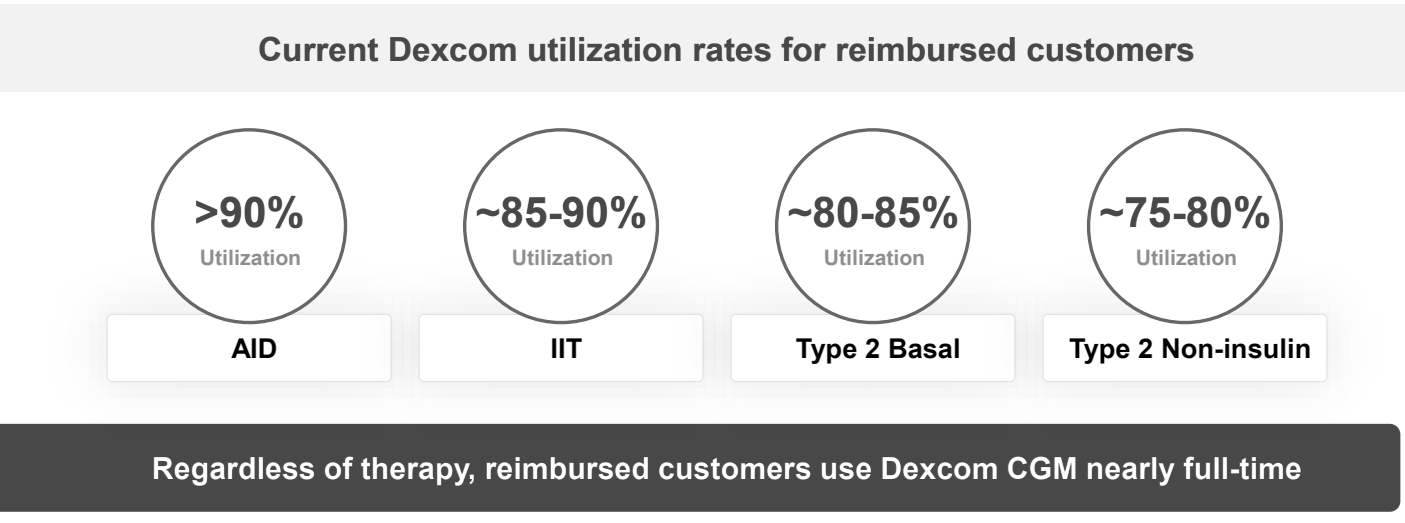

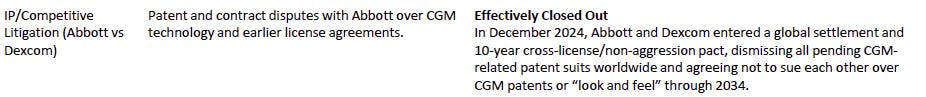

Exhibit 8: Utilization Rates for Reimbursed Dexcom CGM Users by Therapy Class. Source: Company Presentation

Reimbursement also plays a significant role in determining how consistently patients use Dexcom’s products once they are initiated. Across reimbursed channels, real-world data shows that patients maintain exceptionally high wear-time, with automated insulin delivery (AID) users exceeding 90% utilization, intensive insulin patients sustaining 85–90%, basal-only Type 2 users remaining near 80–85%, and even non-insulin Type 2 patients, traditionally a low-engagement group, wearing sensors roughly 75–80% of the time (utilization reflects the percentage of total days that users actively wear and run their Dexcom CGM). These levels reflect CGM becoming an everyday tool rather than an occasional device once cost barriers are removed. For Dexcom, high utilization directly strengthens recurring revenue per patient, improves retention, and increases lifetime value, while giving payers evidence of sustained clinical engagement. As reimbursement frameworks expand across Type 2 segments globally, this pattern of high and persistent utilization becomes a powerful driver of both adoption velocity and long-term economic contribution per user.

The Historical Evolution of Continuous Glucose Monitoring from Early Biochemical Instability to Dexcom’s Category-Defining Engineering and Commercial Breakthroughs

The origins of continuous glucose monitoring trace back to the late 1970s and early 1980s, when researchers first explored the biochemical feasibility of measuring glucose in interstitial fluid (ISF) rather than capillary blood. Early experimental systems were large, tethered devices used in controlled hospital environments with needle-based microdialysis probes. These prototypes demonstrated that ISF glucose trends correlated with blood glucose, but they were impractical for home use due to large lags, poor stability of enzyme-based sensors, and significant tissue irritation. Through the 1980s and early 1990s, academic interest persisted, but the technology remained biologically unstable and commercially non-viable.

The mid-1990s marked the first meaningful transition from concept to practical sensing, driven by advances in enzyme-based electrochemical biosensors, particularly glucose oxidase–based amperometry, that enabled smaller, more stable, and partially implantable sensor filaments. This technological progress coincided with a profound shift in diabetes management following the Diabetes Control and Complications Trial (DCCT, 1993), which established the importance of tight glucose control and created strong clinical demand for continuous, real-time monitoring tools. By 1999, these trends converged in the first FDA-cleared professional CGM systems from Medtronic/MiniMed, which offered 72-hour retrospective glucose profiles for clinician interpretation.

Exhibit 9: First-Generation Medtronic MiniMed CGM Device (1999) (Left) and Early MiniMed CGM in Typical On-Body Configuration (Right). Source: Medtronic

The early to mid-2000s saw the first true commercial CGMs with real-time data and alarms. Medtronic’s Guardian RT and Abbott’s early Navigator platform offered continuous readouts, but accuracy remained inconsistent, sensor wear was short (typically 3–5 days), receiver communication was unreliable, and calibration demands were heavy. These structural weaknesses confined CGM to a narrow therapeutic niche of highly motivated Type-1 users managed within endocrinology clinics. CGM was still “adjunctive” (meaning it was not approved for insulin-dosing decisions), which further limited its adoption and reimbursement. Commercially, CGM had not yet segmented: all products were premium, high-cost, high-training-burden devices.

The 2010s introduced the convergence of biochemical stability, improved membrane design, and advanced algorithms capable of smoothing noise and accounting for physiologic ISF lag. Bluetooth connectivity, cloud infrastructure, and smartphone apps transformed CGMs from medical tools into data platforms. High-quality randomized controlled trials (RCTs) (e.g., DIAMOND) have demonstrated meaningful A1c reductions and a lower risk of hypoglycemia, helping payers recognize the clinical and economic value of CGM. Regulatory agencies responded with updated frameworks, culminating in non-adjunctive labeling and, by 2018, the iCGM designation, standardizing requirements for accuracy, reliability, and interoperability with insulin pumps

Exhibit 10: Medtronic’s Guardian RT (2004) (Left) and Abbott’s Freestyle Navigator (2008) (Right). Source: Medtronic, Abbott

This era also introduced the first major market segmentation. Abbott’s FreeStyle Libre, launched in 2014 in Europe, represented a structural reset: factory-calibrated, 14-day wear, lower-cost, and simple to apply—built for primary care and broad reimbursement rather than just specialist management. Libre expanded CGM beyond the high-touch, high-ASP niche into value and tender-driven segments, particularly in Europe and parts of Asia. The CGM market is now bifurcated for the first time: premium therapeutic systems focused on real-time accuracy, alarms, and pump integration, and value flash systems optimized for affordability, simplicity, and large population reach.

The late 2010s to early 2020s witnessed a further structural shift, as accuracy improved to even lower MARDs (e.g., ~10–15%), sensors became factory-calibrated, and wear time extended to 10–14 days. Connectivity strengthened ecosystems: caregiver follow-up apps, real-time alerts, and cross-device cloud integration. Automated insulin delivery (AID) became a reality, transforming CGM into the control sensor of hybrid closed-loop systems. This elevated CGM from a monitoring tool to a therapeutic infrastructure layer central to modern diabetes care. The premium segment crystallized around high-performance systems capable of AID integration and supported by robust regulatory frameworks such as iCGM.

By the 2020s, CGM had crossed into the mass-market health sector. Sensor miniaturization, simplified insertion, improved adhesives, and extended wear options (culminating in disposable architectures, such as the Dexcom G7) have removed historical adoption barriers. Market size estimates placed global CGM revenue in the US$13-14 billion range in 2024 (based on figures from Grand View Research and Mordor Intelligence), with CAGRs in the mid-teens to high-teens, reflecting both clinical expansion and burgeoning consumer interest.

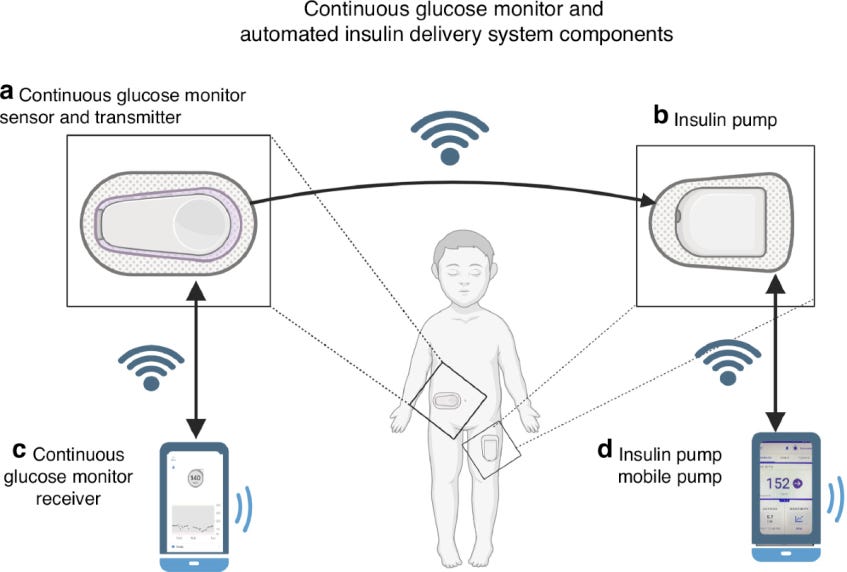

Exhibit 11: CGM and Components of a Modern Automated Insulin Delivery (AID) System. Source: nature.com

As devices became smaller, cheaper, and easier to use, new entrants targeted non-insulin Type-2 diabetics and even non-diabetic metabolic health users. This drove the formation of the third modern segment: consumer-facing, wellness-oriented OTC biosensors. These devices emphasize behavioral insight, athletic performance, and metabolic tracking rather than insulin dosing or AID compatibility.

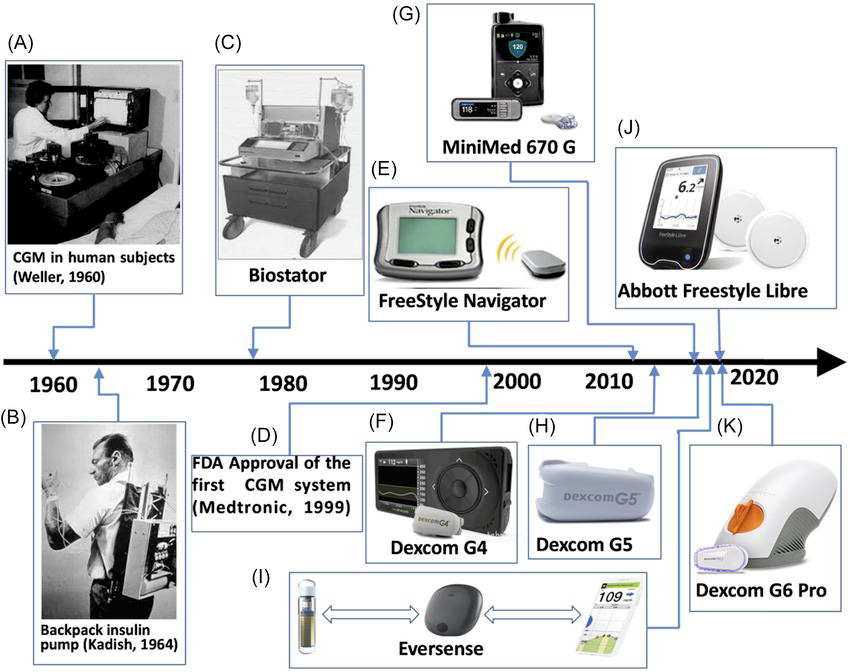

Exhibit 12: Timeline of Key Milestones in Continuous Glucose Monitoring and Diabetes Technology. Source: researchgate.net

Entering 2023–2025, next-generation sensors achieved single-digit MARD (7-9%) and 15-day wear, shrinking form factors by 60%+ and integrating more deeply with digital health ecosystems. The CGM market today reflects decades of cumulative advances: high-accuracy therapeutic sensors forming the premium segment; affordable, longer-wear systems filling the value segment; and emerging OTC sensors expanding into metabolic wellness. The historical trajectory of CGM thus shows a clear progression from a single niche tool to a diversified, multi-segment global category driven by engineering progress, clinical validation, and expanding economic access.

Exhibit 13: Dexcom G7 (Left) and Abbott FreeStyle Libre 3 (Right). Source: Dexcom, Abbott.

Early CGM Limitations Kept Adoption Confined

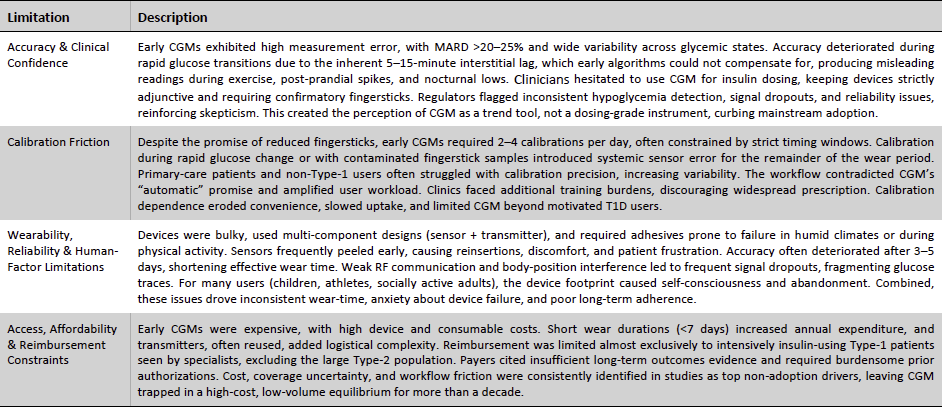

Despite its clinical promise, early continuous glucose monitoring (CGM) technology faced a series of structural limitations that kept adoption confined to specialist-led, Type-1–dominant niches for more than a decade. These constraints were not superficial product flaws but fundamental barriers across accuracy, workflow burden, human-factor tolerability, and economic accessibility, each reinforcing the other and suppressing the category’s scalability. Clinical skepticism stemming from high error rates, the friction of mandatory fingerstick calibrations, the discomfort and unreliability of early hardware, and restrictive reimbursement policies collectively prevented CGM from delivering on its intended value proposition of real-time, automated glucose visibility. Understanding these limitations is essential to appreciate how subsequent engineering, regulatory, and commercial breakthroughs, led largely by Dexcom, unlocked the broader CGM market.

Exhibit 14: Limitations of Early CGM Systems. Source: Business Deep Dives’ Research

The evolution of Dexcom’s technology and strategy directly mirrors the process of removing the fundamental barriers that once constrained CGM adoption. By advancing sensor chemistry, improving algorithmic accuracy, eliminating calibration friction, miniaturizing hardware, and building a robust connectivity and interoperability ecosystem, Dexcom progressively addressed the clinical, human-factor, and economic limitations that defined early CGM systems. Coupled with a tiered commercial portfolio and expanded reimbursement reach, these innovations repositioned CGM from a specialist-focused monitoring aid into a mainstream, dosing-grade platform with broad therapeutic and consumer relevance.

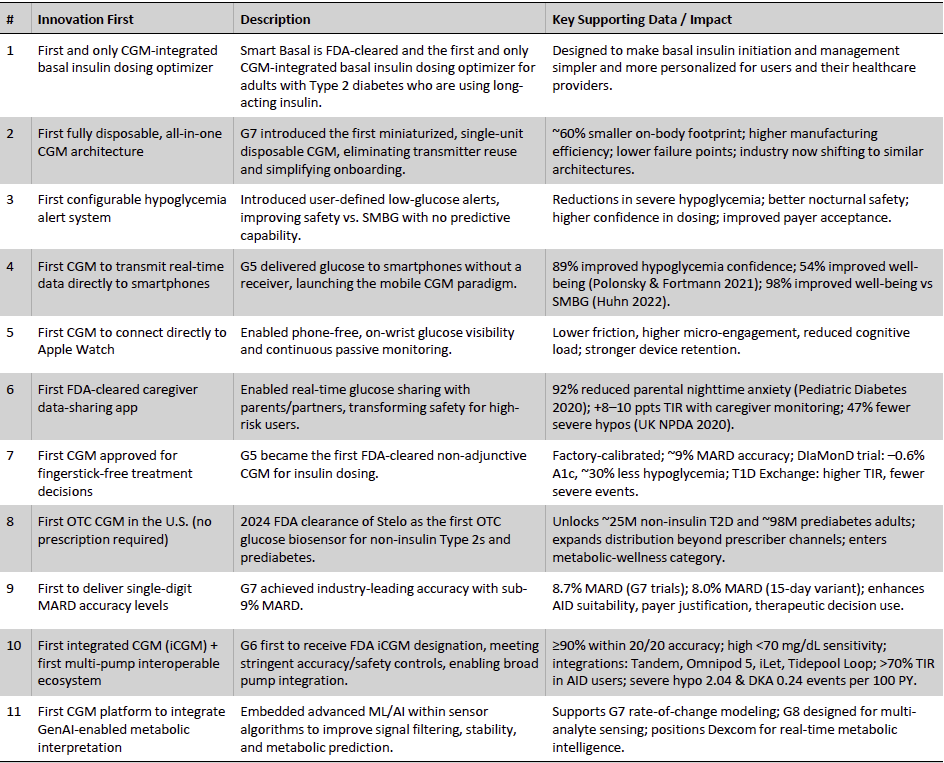

Dexcom’s technology roadmap has been defined by a consistent pattern of category-shaping “firsts” that have materially expanded the addressable CGM market and deepened the company’s strategic moat. Since its initial FDA clearance in 2006, Dexcom has consistently delivered foundational advances in sensor accuracy, metabolic insight, device usability, and system interoperability; developments that have, over time, transformed CGM from an adjunctive monitoring tool into a core therapeutic technology for both insulin-using and non-insulin Type 2 populations. What follows highlights the key innovations that shaped Dexcom’s leadership position and continue to reinforce platform stickiness, reimbursement traction, and long-term share capture.

Exhibit 15: Key Innovations that Shaped Dexcom’s Leadership Position. Source: Company Presentation, Press Release, Business Deep Dives’ Research

These technology firsts collectively reflect Dexcom’s sustained innovation momentum, supporting its premium pricing structure, broad reimbursement access, and leadership in AID-compatible CGM. Equally, they provide a platform enabling expansion beyond Dexcom’s historical insulin-using base into value-tier reimbursed markets and the sizable OTC metabolic wellness segment. This innovation architecture reinforces Dexcom’s competitive durability, supports management’s mid-teens revenue CAGR framework, and solidifies the company’s position as the structural leader in continuous glucose monitoring.

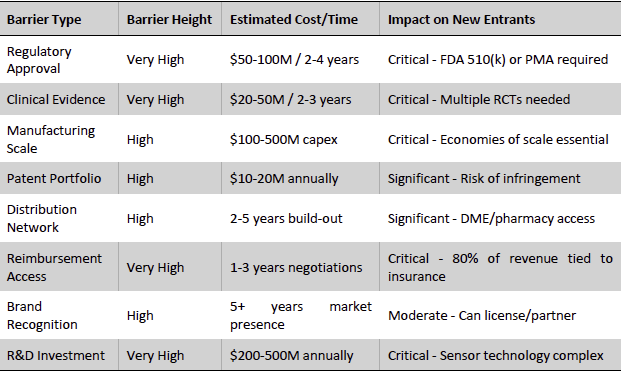

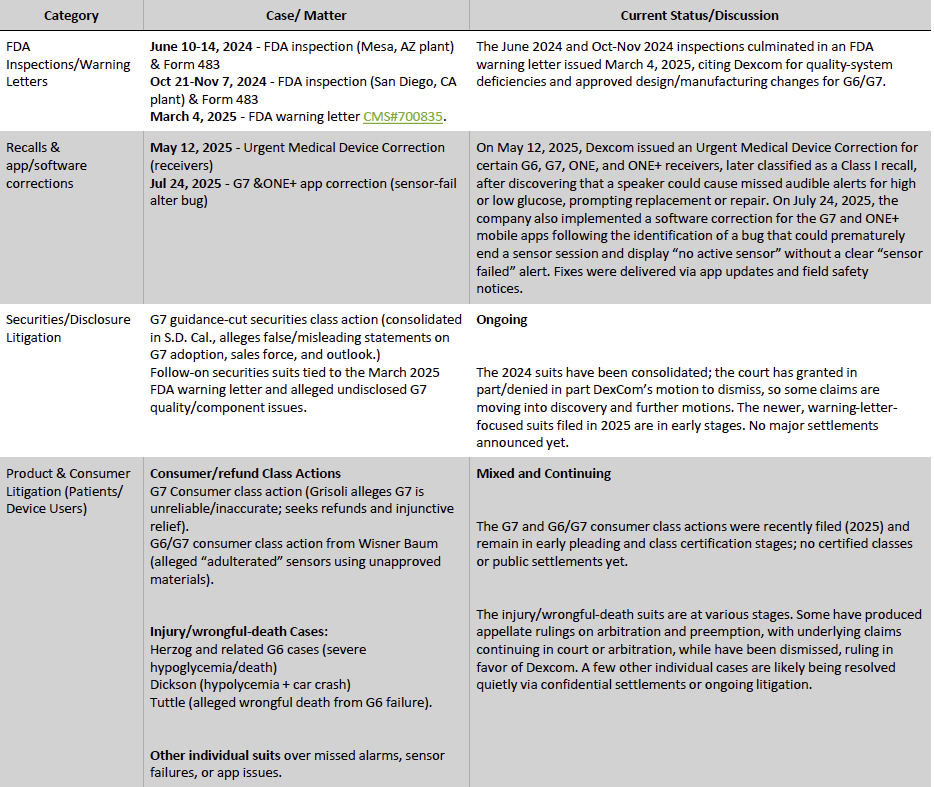

Dexcom is one of the Global CGM Leaders in an Oligopolistic Market

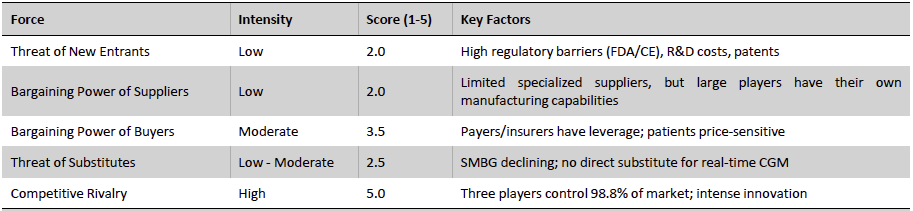

Continuous glucose monitoring (CGM) has evolved into an oligopolistic global industry dominated by a few players. The market structure is characterized by high barriers to entry, including complex R&D, strict regulatory requirements, and the need for reliable manufacturing at scale. Two companies, Dexcom and Abbott, capture the vast majority of industry revenues, with Medtronic a distant third. Rivalry among these incumbents is focused on innovation and market expansion rather than price wars, reflecting the growing demand and relative pricing power sustained by their differentiated technology and brand loyalty. Meanwhile, the threat of new entrants and substitutes remains contained by the significant technological and clinical validation hurdles, although a pipeline of startups and tech giants are eyeing the space (discussed further below). Overall, the global CGM arena offers robust growth, underpinned by rising diabetes prevalence, improving reimbursement, and consumer wellness trends – an attractive landscape where Dexcom holds a leadership position.

Exhibit 16: CGM Industry Barriers to Entry. Source: Business Deep Dives’ Research

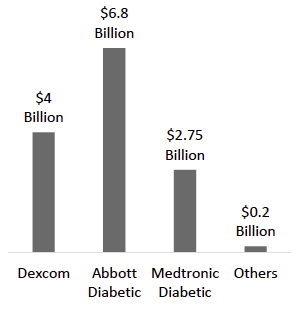

Exhibit 17: 2024 Diabetes Business Revenue. Source: Company Data, Business Deep Dives’ Research

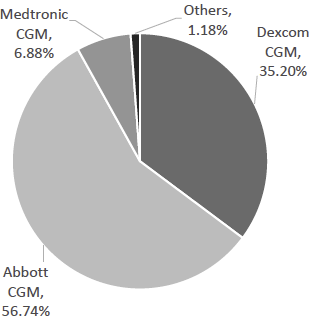

Exhibit 18: Estimated CGM-Only Market Share. Source: Company Data, Business Deep Dives’ Research

Industry Structure and Growth Drivers

The global CGM industry is effectively a duopoly. Dexcom and Abbott together account for an estimated ~90% of worldwide CGM revenues, creating a market dynamic with a few dominant competitors and high entry barriers. Medtronic and a handful of smaller players share the remainder. This concentration reflects the significant R&D investment and proprietary expertise required to develop accurate, wearable glucose sensors, as well as the need to navigate regulatory approvals in major markets. New entrants face formidable obstacles in matching the incumbent players’ sensor accuracy, manufacturing scale, and established distribution networks.

Despite this concentrated structure, the CGM market is expanding rapidly, fueled by powerful secular drivers:

Diabetes Epidemic: Over 530 million adults globally have diabetes, a figure projected to reach 640+ million by 2030. Within this, Type 1 diabetes (requiring intensive insulin therapy) affects ~1.2 million youth and millions of adults, and a growing subset of Type 2 diabetics require insulin. This expanding patient pool creates steady demand for better glucose monitoring. Yet current CGM penetration is still low (only about 10 million people worldwide (≈2% of diabetics) use CGMs), indicating immense runway for growth as CGM becomes standard of care.

Clinical Outcomes and Standard of Care: Mounting evidence shows CGM use improves glycemic control, reduces hospitalizations, and enhances quality of life for both Type 1 and Type 2 diabetes. Professional guidelines have broadened recommendations – the American Diabetes Association’s 2025 Standards of Care recognize CGM benefits even for Type 2 patients not on insulin. This has elevated CGM to a standard of care for insulin-treated diabetes and increasingly for broader populations. As clinical adoption spreads, CGM use is expected to continue rising in all segments.

Reimbursement Expansion: Payers worldwide are expanding coverage for CGM, which has been critical to uptake. In the U.S., all major insurers (including the three largest PBMs) now cover CGM for anyone with diabetes, not just those on intensive insulin. By the end of 2025, Dexcom expects to have commercial coverage in place for ~6 million U.S. Type 2 diabetics not on insulin – a massive new addressable group. In Europe, national health systems in many countries now reimburse CGMs for Type 1s and are beginning to include high-risk Type 2s. Japan and other developed markets have also seen coverage broaden in recent years, though reimbursement and access still vary by country. This payer support is a critical growth enabler, turning CGM from a niche technology into a mainstream diabetes management tool.

Consumer Health and Wellness Trends: Beyond traditional diabetes management, there is a rising interest in CGM for wellness, prevention, and athletic optimization. Both major players have launched consumer-focused offerings: Abbott’s new Lingo biowearable and Dexcom’s Stelo (the first FDA-cleared over-the-counter CGM) target health-conscious individuals looking to monitor glucose for diet, fitness, or prediabetes management. While still an emerging segment, this reflects a broader trend of CGM moving into the general health wearable market, potentially tapping into a much larger user base over time. This trend could further accelerate demand and normalize glucose tracking as part of everyday health.

Taken together, these drivers have resulted in strong industry growth. The global CGM market was ~$13 billion in 2024 and is projected to more than double by the early 2030s, growing at double-digit annual rates. Importantly, growth is not limited to one region or cohort – penetration is increasing across all insulin therapy segments and geographies, albeit from different starting points. In the U.S. (the most mature market), an estimated ~60% of Type 1 diabetics use a CGM, but only ~50% of Type 2 diabetics on intensive insulin therapy do, and a small single-digit percentage of non-insulin Type 2s do. Other countries trail the U.S. in adoption; for example, China’s CGM use among Type 1s is only ~7% (expected to reach ~38% by 2030). These gaps underscore the significant runway remaining as CGM adoption broadens from the current early-adopter populations to the much larger pool of insulin-dependent Type 2s, basal-insulin users, and beyond.

Exhibit 19: U.S. Market Penetration Analysis (December 2024 Data). Source: Dexcom Investor Presentation.

Competitive Overview

From Porter’s Framework perspective, the industry’s attractive growth and concentrated structure confer advantages but also shape strategic dynamics. Barriers to entry are high (as noted, new competitors must overcome technical, clinical, and regulatory challenges). Supplier power is moderate – while specialized components (sensors, membranes) are needed, both Dexcom and Abbott have vertically integrated significant manufacturing capabilities and can negotiate with suppliers due to their scale. Buyer power mainly resides with payers and healthcare systems; as CGM becomes a larger expenditure line, payers are pushing for cost-effectiveness, but so far, the differentiated health outcomes justify premium pricing, and the duopoly structure limits buyers’ alternatives. The threat of substitutes (such as traditional finger-stick glucometers) is diminishing as CGMs’ continuous data and outcomes benefits far outstrip those of legacy solutions – indeed, finger-stick testing is increasingly seen as an adjunct rather than a true substitute for intensively managed patients. Future non-invasive glucose monitoring (e.g., via smartwatches) could become a disruptive substitute, but such technology remains experimental today. Finally, competitive rivalry is contained to a few firms that are each enjoying expanding sales – competition manifests in product improvements and marketing rather than price-cutting. In summary, the industry’s structure and forces overall favor incumbent leaders and support sustained growth and profitability.

Exhibit 20: CGM Industry Porter’s Framework Analysis. Source: Business Deep Dives’ Research

Dexcom’s Leadership and Competitive Moat

Dexcom has established itself as the global CGM leader through a focused strategy and multi-faceted competitive moat. The company’s core strengths span technology, innovation pace, user experience, and ecosystem integration, which together have built a strong franchise with significant brand equity among patients and providers.

Technology and R&D Excellence: Dexcom’s singular focus on CGM has enabled it to consistently lead in sensor performance. It pioneered real-time CGM and has iterated rapidly through seven generations of devices. The latest G7 sensor offers industry-leading accuracy (MARD ~8-9%), 24/7 real-time readings to smart devices, and a 30-minute warm-up – all in a wearable the size of a coin. Dexcom’s history of innovation (from the first calibration-free CGM to the first FDA-designated iCGM) underscores a moat in technical know-how and IP. The company continues to invest heavily in R&D (both hardware and software): for example, it is rolling out a 15-day wear for G7 sensors to further improve convenience and cost-efficiency. Dexcom’s pipeline extends to next-generation sensors and form factors, including strategic forays into new technologies – it recently invested $75 million in the smart-ring maker Oura to explore integrating CGM with wearable platforms. This culture of innovation helps Dexcom stay ahead of competitors on the tech curve.

Product Design and User Experience: A key competitive differentiator for Dexcom is the ease-of-use and patient-centric design of its CGM systems. The G7 features an all-in-one applicator (simple one-push insertion), no fingerstick calibrations, and customizable alerts for high/low glucose – features honed over years of user feedback. Compared to many competing devices, Dexcom’s sensors have been lauded for comfort and reliability (e.g., fully disposable, waterproof, and with very few signal dropouts). The company also excels in data presentation and analytics: its Dexcom mobile app and Clarity software provide intuitive real-time graphs, predictive alerts, and retrospective reports that help users and clinicians make informed therapy adjustments. Moreover, Dexcom pioneered the “share” function, allowing users to automatically share glucose readings with family or caregivers – a critical feature for parents of diabetic children and a differentiator that builds network effects. Collectively, these product features drive strong customer loyalty and brand advocacy; Dexcom enjoys high Net Promoter Scores and word-of-mouth reputation as the gold-standard CGM, especially in the intensive insulin-using community.

Integrated Digital Ecosystem: Dexcom has built a robust ecosystem around its CGM that reinforces its competitive moat. Its devices seamlessly integrate with an array of insulin delivery systems and digital health platforms. Dexcom is the partner of choice for most insulin pump companies – its G6/G7 sensors integrate with Tandem’s t:slim and Control-IQ system, Insulet’s Omnipod 5, and other upcoming automated insulin delivery (AID) systems. This gives Dexcom a distribution advantage and sticky installed base in the tech-savvy Type 1 segment. The company also opened up APIs for third-party developers, enabling apps and even consumer wearables to pull CGM data (e.g., Garmin and Apple Health integrations). Such connectivity positions Dexcom at the center of the diabetes tech ecosystem. Additionally, Dexcom’s data cloud (with millions of patient‐days of glucose data) is a valuable asset – it is being leveraged to demonstrate outcomes to payers and to develop decision support algorithms. In sum, the more Dexcom’s CGM becomes enmeshed in patients’ broader diabetes management (pumps, apps, telemedicine, etc.), the stickier its product becomes and the harder it is for a rival to displace.

Sales, Distribution and Support: Another element of Dexcom’s moat is its strong commercial infrastructure and focused go-to-market approach. The company has a direct sales force targeting endocrinologists and diabetes clinics, a growing presence in primary care for Type 2 patients, and partnerships with pharmacy distributors and durable medical equipment (DME) suppliers. Dexcom significantly expanded its U.S. sales force in 2023-2024 to drive penetration into new patient groups. It has also transitioned more distribution to the pharmacy channel, making it easier and cheaper for patients to obtain sensors (often just a co-pay, like a drug). This multi-channel strategy (DME for some insulin pump users, pharmacy retail for broader access) maximizes Dexcom’s reach. Furthermore, Dexcom provides extensive customer support, training, and onboarding for new users – from online tutorials to 24/7 helplines – which enhances adoption and retention. The company’s efforts in provider education, patient advocacy, and even direct-to-consumer awareness campaigns (e.g. TV ads, celebrity ambassadors) have bolstered its brand recognition. These commercial strengths complement its product advantages to sustain Dexcom’s leadership.

Brand Equity: After over a decade in the market, “Dexcom” has become synonymous with CGM for many patients and healthcare providers. This brand equity is reinforced by clinical trust – Dexcom’s devices are widely regarded as highly accurate and reliable. For instance, a Healthline review noted Dexcom as “the most accurate and comfortable full-featured CGM on the market”. Such reputational advantages can influence prescribing: endocrinologists often preferentially prescribe Dexcom for Type 1 patients, and many patients who’ve tried multiple sensors show a preference for Dexcom’s alerting and data-sharing capabilities. The company’s long-running presence also means it has amassed real-world evidence and endorsements (in trials and by key opinion leaders) that newer entrants lack. This intangible asset of trust is a powerful moat in a healthcare market, where clinical outcomes and reliability are paramount.

Overall, Dexcom’s competitive moat is the product of a full-spectrum strategy: cutting-edge technology, user-friendly design, integrated partnerships, strong distribution, and a trusted brand. These factors have enabled Dexcom to not only attain the #1 position in many markets (e.g., an estimated ~74% share of the U.S. prescription CGM market in 2024) but also to sustain premium pricing and high margins. Even as competitors play catch-up, Dexcom’s head start and holistic strengths continue to give it an edge in the marketplace.

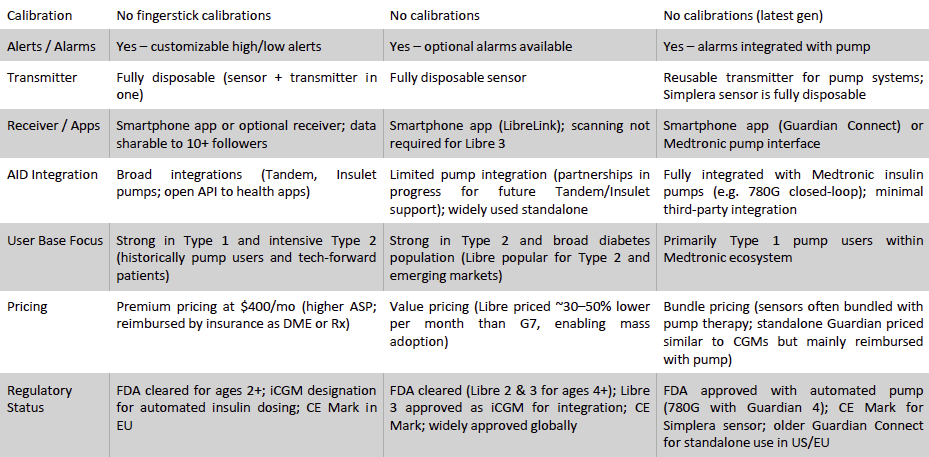

Competitive Landscape: Abbott and Medtronic

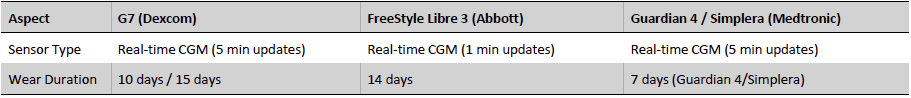

Dexcom’s primary competitors are Abbott and Medtronic, each bringing different strengths to the CGM landscape. The competitive dynamics can be viewed along key dimensions – technology, user base, pricing model, regulatory status, and geographic reach, which are summarized in the comparison matrix below and discussed thereafter.

Exhibit 21: Leading CGMs Comparison. Source: Business Deep Dives’ Research

Abbott Laboratories – FreeStyle Libre: Abbott is Dexcom’s fiercest competitor, with a highly successful CGM franchise built on the Libre series. Abbott’s FreeStyle Libre took a disruptive approach when introduced (Libre 1 in 2014) as a lower-cost “flash” glucose monitor – users scanned a sensor with a reader to get glucose readings. This value-focused model opened up CGM to millions who couldn’t access or afford real-time CGMs. Over time, Abbott has iterated Libre to add more advanced features: the current Libre 3 is a full real-time CGM with continuous Bluetooth data, optional alarms, and a tiny profile. Abbott reports ~7 million users on Libre worldwide (a user base larger than Dexcom’s), reflecting its strong uptake, especially among Type 2 diabetics and in markets outside the U.S., where cost sensitivity is high. Abbott’s key strength is cost leadership and scale. Libre’s pricing undercuts Dexcom (often by 30-50%), making it an attractive option for payers looking to expand CGM access cost-effectively. The company has huge manufacturing capacity (recently opening a 323,000 sq ft facility to produce Libre sensors at scale), enabling it to meet global demand and benefit from economies of scale. Abbott is aiming for $10 billion in Libre annual sales by 2028, implying continued double-digit growth.

In terms of technology, Abbott has closed much of the gap with Dexcom: Libre 3’s accuracy (~8-9% MARD) and features are now comparable to Dexcom’s, and it gained FDA’s iCGM designation for pump integration. However, some differences remain: Dexcom has a 15-day wear (while Libre has 14-day wear), and Dexcom currently offers more flexible alerts and data sharing functionalities out of the box. Abbott’s strategy heavily emphasizes accessibility and simplicity – Libre sensors are often available through pharmacies without extensive paperwork, and Abbott even launched Libre 2 and 3 in an “OTC” style model in some markets (e.g., no prescription required in certain countries), foreshadowing the blurred line between medical device and consumer tech. Additionally, Abbott is pushing into non-diabetes wellness with its Lingo line, leveraging the Libre technology for athletes and lifestyle users.

Geographically, Abbott leads in Europe, Asia, and other regions where it leveraged Abbott’s broad global footprint and aggressive pricing to win government tenders and reimbursement early. For instance, in many European countries, Libre was adopted in national health systems before Dexcom, giving Abbott a larger installed base in Type 2 segments. That said, Dexcom has been catching up internationally (for example, launching G7 widely in Europe in 2023 and expanding in Asia). In the U.S., Abbott’s market share is significant in the Type-2 segment, particularly Medicare patients and others for whom Libre’s pharmacy availability and lower cost make it a first choice. Still, Dexcom retains a leadership among U.S. intensive insulin users (with one estimate putting Dexcom’s U.S. CGM share at ~74% in 2024). The two companies are now in a tight race, with Abbott emphasizing volume and broad adoption, and Dexcom emphasizing premium technology and integration. Notably, after years of patent litigation between them, Dexcom and Abbott settled all patent disputes in late 2024 with a cross-license agreement. This detente likely means both will focus on commercial competition and growth rather than courtroom battles going forward, a positive for the market’s expansion.

Medtronic – Guardian/Simplera: Medtronic, a diabetes technology pioneer, has a smaller presence in CGM as the third major player. Medtronic’s CGM offerings (Guardian Connect standalone CGM, and Guardian sensors integrated with its MiniMed insulin pumps) historically lagged in user experience. Previous generations (Guardian 3) required twice-daily calibrations and had a longer warm-up, which, combined with less user-friendly software, led many patients to favor Dexcom or Abbott sensors. However, Medtronic has been iterating to improve its CGM tech. Its Guardian 4 sensor eliminated fingerstick calibrations and improved accuracy, and the newest Simplera sensor (launched with the MiniMed 780G pump in 2023) is a fully disposable, easier-insertion CGM that is about half the size of prior models. These advancements aim to narrow the gap with Dexcom/Abbott. Medtronic’s clear advantage is vertical integration with its insulin pumps: it offers an all-in-one insulin delivery system with built-in CGM and automated insulin dosing (the MiniMed 780G with Simplera sensors, for example, can automatically adjust insulin for high glucose however, it has a shorter 7-day wear only). For some patients, especially long-time Medtronic pump users, the convenience of a single-provider solution is compelling. Medtronic’s CGM user base is thus heavily composed of those on its pumps – it has relatively low penetration among MDI (multiple daily injection) patients using standalone CGM.

Medtronic’s Diabetes segment’s annual revenue is about $2.75 billion (which includes pumps and CGM), of which CGM is a subset. We estimate Medtronic’s CGM-specific share is in the mid-single digits globally. The company is strongest in certain geographies (e.g., some European markets where it has a legacy pump base) and in the Type 1 pump-intensive segment. Going forward, Medtronic is investing to remain competitive – it obtained CE Mark for Guardian 4 and Simplera, and is pursuing broader international approvals. It also acquired an insulin patch-pump company (EOFlow) to offer a tubeless pump system, potentially pairing with its CGM to better compete against the Dexcom–Insulet alliance. However, Medtronic faces an uphill battle to win back patients who have switched to Dexcom CGM on alternate pump platforms, and to convince MDI users to adopt its standalone CGM (Guardian Connect has seen limited uptake against Libre and G7). From a strategic view, Medtronic’s presence does moderate the competitive intensity – it ensures Dexcom and Abbott are not alone – but at present it plays a secondary role. For Dexcom, Medtronic’s main competitive threat is indirect: if Medtronic’s integrated pump+CGM systems gain traction, that could limit Dexcom’s growth in pump integrations. Yet current trends show many tech-savvy patients favor the interoperability of Dexcom with various pumps over the lock-in of Medtronic’s ecosystem.

Exhibit 22: Dexcom vs Abbott vs Medtronic Strategic Positioning. Source: Business Deep Dives’ Research

Other competitors in traditional CGM are relatively minor today. Companies like Roche and Senseonics have niche positions. Roche, which long focused on blood glucose meters, recently gained CE approval for its new Accu-Chek “SmartGuide” CGM with an AI-powered decision support – it’s planning limited European launches. This marks Roche’s attempt to re-enter the CGM race, though its impact remains to be seen. Senseonics is discussed under “emerging players” below due to its unique implantable approach. Overall, Dexcom and Abbott face each other as chief rivals, with Medtronic and a few others occupying smaller slices of the market.

Emerging Entrants and Disruption Potential

Emerging technologies like implantable sensors (Senseonics), non-invasive wearables (Apple, Know Labs), and skin-based biosensors (Biolinq) aim to disrupt the CGM space but currently lack the accuracy, scale, or regulatory traction to challenge incumbents. While disruption risk is limited in the near term, Dexcom must stay ahead through innovation, partnerships, and expansion into adjacent wellness markets.

Given the attractive growth prospects of CGM, a number of emerging players and new technologies are attempting to enter or disrupt the market. While none have yet achieved material market share, they represent the future competitive landscape that Dexcom must monitor:

Senseonics (Eversense) – Senseonics offers the world’s first and only long-term implantable CGM. Its Eversense system uses a tiny sensor implanted under the skin (by a quick outpatient procedure) that can last 180 days (recently extended to 365 days in its new version). A removable transmitter worn over the implant sends readings to a smartphone and vibrates on-body for alerts. The Eversense appeals to a subset of patients who dislike frequent sensor changes or have skin reactions to transcutaneous sensors. It also boasts a high accuracy (MARD ~8.5%) and the convenience of removing/re-attaching the transmitter as needed. In 2024, the FDA approved the 365-day Eversense, giving Senseonics a potential boost in competitiveness. However, adoption has been modest so far – the need for implantation and periodic replacements by a healthcare provider limits its appeal versus fully patient-applied sensors. Senseonics has partnered with Ascensia Diabetes Care for global distribution to improve its reach. The company positions Eversense as complementary, targeting patients dissatisfied with traditional CGMs. Disruption potential: moderate in niche segments (some Type 1s who want an implant), but unlikely to unseat the incumbents for mainstream users unless it significantly improves convenience/cost. Dexcom’s strategy of smaller, easier sensors is arguably a response to the comfort concerns that Senseonics highlights.

Non-invasive Wearables (Apple and others) – Perhaps the most hyped potential disruptor is the idea of non-invasive glucose monitoring integrated into mainstream consumer wearables (e.g. smartwatches). Apple Inc. has long been rumored to be developing a glucose sensor for the Apple Watch that requires no needles. Reports in early 2023 suggested Apple had made progress on an optical absorption spectroscopy method, but a commercial product is still likely years away, if feasible. Other startups (e.g. Know Labs, Movano) are exploring radio-frequency spectroscopy, lasers, or fluorescence to measure glucose without piercing the skin. To date, no non-invasive device has achieved the accuracy and reliability required for medical use, despite decades of attempts. If Apple or another tech giant eventually cracks this problem, it could be a game-changer, introducing glucose tracking to potentially tens of millions of wearable users and bypassing the need for disposables. However, experts remain cautious – the physics and interferences involved in non-invasive glucose sensing are daunting. In the medium term, these efforts pose limited direct threat to Dexcom’s core market (insulin-dependent diabetics need proven accuracy), but they are a space to watch closely. Notably, Dexcom’s investment in Oura (a smart ring company) hints it is preparing for a more interconnected wearable future. Dexcom and Abbott may end up partnering with or supplying data to the Apples of the world, rather than being displaced overnight.

Biosensor Startups (next-gen CGM) – Beyond non-invasive, several startups are reimagining CGM with novel approaches. Biolinq, for example, is developing a wireless “patch” CGM that sits on the skin with microscopic sensing elements – it’s described as “needle-free” (no traditional cannula) and recently obtained FDA de novo clearance for its first-gen device aimed at Type 2 diabetics not on insulin. Biolinq’s patch uses an array of micro-sensors and an LED indicator for glucose ranges, potentially offering a simpler, cheaper monitoring for the broader Type 2 population. It plans a U.S. launch in early 2026. Another company, Nemaura (with SugarBEAT), has a skin-patch CGM that uses a mild electrical current to draw glucose from interstitial fluid – it’s approved in Europe but still early stage. Verily (Alphabet’s life sciences arm) previously partnered with Dexcom to develop a miniature CGM; that resulted in the Dexcom G7’s precursor and the new Dexcom Stelo for the Type 2 market. Roche’s new CGM (as mentioned) shows even large traditional device players still see room to enter. Ypsomed and Ascensia have also partnered (the latter distributing Senseonics) to offer alternatives. Overall, while these emerging players each target slices of the market – whether the non-insulin Type 2 segment, hospital use, or niche wearable markets – they underscore that innovation in glucose monitoring is ongoing. Dexcom will need to leverage its scale and experience to either acquire, partner, or out-innovate these newcomers. At present, none have achieved the combination of accuracy, regulatory approval, and commercial scale to pose a serious challenge to Dexcom’s and Abbott’s dominance. But the disruption potential is notable in the long term, particularly in the non-insulin and wellness realms where a simpler/cheaper monitor could grow the market dramatically (for instance, tapping into the ~90+ million pre-diabetics).

In summary, Dexcom operates from a strong incumbent position but cannot be complacent. The CGM competitive moat that exists today (few players, high technical barriers) may erode over time if new technologies prove viable. Dexcom appears cognizant of this – evidenced by its own expansion into broader markets (OTC Stelo for non-insulin users) and its vigilance on technology (investing in novel wearables). The most likely scenario in the near-to-mid term, however, is that the major players remain the same, and emerging entrants either carve out small niches or eventually get integrated/partnered with the incumbents. The vast clinical validation and trust required in diabetes management give an inherent advantage to established CGM makers.

Global Outlook: Market Size, Penetration, Regional Dynamics, and Pricing Trends

Industry estimates place the CGM market at $13–14 billion in 2024, with potential to exceed $30 billion by early next decade. Given Abbott and Dexcom’s combined ~$11 billion revenue in 2024 and ~15%+ projected CAGRs, actual market growth may outpace forecasts. Expansion into non-insulin Type 2 users and emerging markets remains the key driver.

The outlook for the global CGM market is robust, with substantial growth opportunities across patient segments and geographies. As of 2025, the market is still in an early-to-mid adoption phase, characterized by accelerating penetration in intensive insulin users and initial expansion into broader populations. Key aspects of the global outlook include:

Market Size & Growth – Industry estimates put the CGM market at roughly $13–14 billion in 2024, and forecasting to exceed $30 billion by early next decade. However, these figures may prove conservative given recent momentum: Abbott alone reached $6.8 billion in diabetes device sales in 2024 (mostly CGM), and Dexcom $4.0 B, for a combined ~$11 billion between them. Both companies project strong growth (~15%+ CAGR) in coming years. Abbott’s target of $10 billion in Libre sales by 2028 and Dexcom’s trajectory (nearly $4.6 billion guided for 2025) suggest the market could far surpass current forecasts. The introduction of CGM to new user groups (Type 2 on basal insulin, non-insulin diabetics, etc.) and new geographies (emerging markets) will be the primary growth levers. We expect double-digit growth to continue in the near term, with a potential tapering to high single digits later in the decade as the Type 1 and Type 2 intensive segments approach saturation in developed markets.

Penetration by Patient Segment – As discussed earlier, penetration is highest in Type 1 diabetes and intensive insulin users. In many developed countries, 50–80% of Type 1s are now on CGM, though some markets lag (e.g., China ~7%). Among Type 2 diabetics on multiple daily injections (MDI), U.S. usage is ~50%, but much lower elsewhere. A huge growth frontier is the basal-insulin Type 2 population and those on oral meds with hypoglycemia risk – collectively tens of millions who historically were not targeted for CGM. In the U.S., payers have started to cover these groups; by end-2025, ~6 million non-insulin Type 2s will have coverage for Dexcom. As outcomes data and real-world evidence accumulate showing benefits (e.g. better A1c control even in non-insulin users), we anticipate standard of care will shift toward offering CGM broadly in Type 2 diabetes management. This could unlock the largest wave of CGM adoption yet. Even gestational diabetes and pre-diabetes are on the radar (some guidelines suggest CGM in high-risk pregnancies, and wellness use in pre-diabetics is growing), though these are nascent areas. Long term, if even a quarter of non-insulin diabetics worldwide adopt CGM, the market volume would be several-fold larger than today

Regional Dynamics – The CGM market exhibits different adoption curves by region, influenced by healthcare infrastructure, reimbursement, and diabetes demographics:United States: The U.S. is the single largest CGM market (~$3–4B in 2024 sales for Dexcom, plus substantial Abbott U.S. sales). Adoption is advanced among Type 1s and insulin-intensive Type 2s, thanks to broad insurance coverage (including Medicare) and strong clinical advocacy. The U.S. also leads in integrating CGM with insulin pumps and digital health. Growth in the U.S. is now being propelled by expanding coverage to all Type 2 diabetics (private insurers and Medicare recently authorized CGM for non-insulin users with history of hypoglycemia or poor control). This could dramatically increase the addressable U.S. user pool (tens of millions of additional lives). Pricing in the U.S. remains relatively high – Dexcom and Abbott have managed to maintain price levels, with reimbursement smoothing the cost to patients. While payers negotiate rebates, the strong clinical value of CGM has so far preserved pricing power; for instance, Dexcom’s U.S. average selling price per patient has only modestly eroded even as volume grew. We expect U.S. CGM revenue to continue growing in mid-teens percent annually, driven more by volume than price.

CGM adoption varies significantly by region, with the U.S. leading in uptake due to broad reimbursement and clinical integration, particularly among insulin-intensive patients. Europe trails slightly but is expanding coverage for Type 2s, while emerging markets like China and India represent large long-term opportunities constrained by affordability and access. Hospital-based CGM use remains nascent but could evolve into a meaningful vertical as standards of care shift.

Europe: Europe is a large and growing CGM region, though somewhat behind the U.S. in uptake and revenue. Key countries like UK, Germany, Nordics, Netherlands, and France have established reimbursement for Type 1s (often making CGM available to most T1 patients at little personal cost). As a result, Type 1 penetration in some of these countries is high – e.g., Germany reportedly has ~60% of Type 1s on CGM. Many European health systems are now trialing or beginning coverage for Type 2s on insulin, albeit with stricter criteria than the U.S. (often requiring uncontrolled diabetes or hypoglycemia unawareness). The pricing environment in Europe is tighter, as centralized healthcare purchasers drive hard bargains – Abbott’s Libre gained an edge by offering a very low cost per sensor, pushing Dexcom to offer value-based arrangements or lower-priced bundles to compete in tenders. Nonetheless, Europe remains a growth driver for Dexcom (international revenue grew ~30% in 2024) and Abbott. Regional nuances: Germany and Scandinavia have high adoption; Southern and Eastern Europe are catching up as reimbursement improves. We anticipate steady growth as more countries fund CGM for Type 2s and as companies introduce cost-reduced models suited for broad use.