Note: This report was originally drafted and substantially completed on December 16th 2025, prior to Heico’s earnings release on December 18, 2025. The analysis reflects information available as of that date and is intended to assess the company’s long-term business quality and economics rather than near-term earnings outcomes.

Heico is one of the most successful companies of the first quarter of the century, and it’s possible you’ve never heard of it. Though not generally mentioned with other unicorns, HEI has quietly returned over 100,000% for shareholders since its IPO in 1986, against the Dow Jones’ average of just under 3,200%.

That’s an exceptional annual return of 19% per year over nearly forty years, versus less than 10% for the Dow. As we’ll explore, that performance has been driven by outstanding fundamentals, with sales and earnings growing an average 16% and 18% per year since current management took over around 1990.

The company isn’t pushing the boundaries of computing or reinventing the electric car; it maintains a portfolio of companies in highly technical niches, supplying parts and maintenance services to electronic, aviation, and defense industries.

Heico’s valuation is now stratospheric, and we will explore what makes it such a solid, safe company with a bright growth outlook. We will also grapple with the assumptions that underlie such a steep valuation, and ultimately conclude that a great company is not always worth the sticker price.

History and Business Description

Heico’s History

The Mendelson Effect

Founded in 1957, Heinecke Instruments specialized in medical equipment, one of several niches that Heico still occupies. Heico’s relevant journey begins with the Mendelson family’s aggressive, drama-filled takeover of Heinecke Instruments around 1990. Through a proxy fight, they managed to take control of the relatively small, struggling company and grow it into a powerful force over the following decades.

At the time of acquisition, Heinicke also had a very small presence in aircraft part manufacturing. The Mendelsons steadily transformed it into a massive holding company (renamed Heico) with dozens of companies in its portfolio across both broad sectors (aircraft and electronic components and servicing).

The Mendelson family’s investment business, headed by patriarch Laurans Mendelson, was looking for cheap companies that could outperform. They wanted a significant moat, and freedom from the boom/bust business cycle that defined the father’s background in real estate.

His son Eric explained in an interview,

“As many people probably know with the cycles that used to occur back then, people would do very well in real estate through the cycle and then they tend to sort of go broke or give it back after the peak of the cycle… My dad, with his financial background, was determined not to do that.”

As a family business in the 1980s and early 1990s, they moved from real estate toward investing in smaller, undervalued public companies with strong moats and steady performance. Heinicke Instruments fit the bill.

The family saw their core investment thesis shine brightly from Heinicke financial statements and competitive position. What they loved about Heinicke was the consistency of the business model through different macroeconomic climates, as well as the industry’s natural barriers to competition.

From Heinecke to Heico

Laurans Mendelson and his sons, Eric and Victor, saw the protection from competition and massive human capital at Heinicke, and they built up a massive position. With Dad’s background in finance and real estate, father and sons had an intuition for capital allocation, scaling, and identifying successful investments rather than actively managing.

They’ve put that strategy to work. The holding company, since its inception, actively manages the portfolio but not the subsidiaries. It leaves companies alone, and bets on the performance of industries by expanding or reducing positions in certain segments.

The Mendelsons identified a number of attractive moats across Heinecke’s business segments. They saw Heinecke, and the massive holding company that Heico would become, as established in a diverse group of micro-industries. Those mini-industries, such as the manufacture of microwave medical tech, are protected by high regulatory barriers, fairly inelastic demand, and clients’ extremely high need for reliability and precision. That means strong, consistent profits and resilient growth.

The best reflection of these strengths is the manufacture of PMA (Parts Manufacturer Approval) parts, which has grown to become Heico’s biggest segment. Aftermarket parts, as opposed to OEM (Original Equipment Manufacturer), are significantly (about 40%) cheaper than those you get from the original manufacturer. You can think of Bosch (OEM) vs. Valeo (aftermarket) parts for a Mercedes sedan’s components. However, the margins, prices, and barriers to entry for replacement parts are a lot higher for a Boeing than a Benz.

The Mendelson family supercharged this area of the business, which was basically in its nascency shortly after their Heico takeover. At the time of the Mendelsons’ acquisition, the company made just one PMA-authorized part. Today, PMA manufacture and sales comprise the largest segment of the company’s over $4 billion in revenue.

Massive Growth, Organic or Otherwise

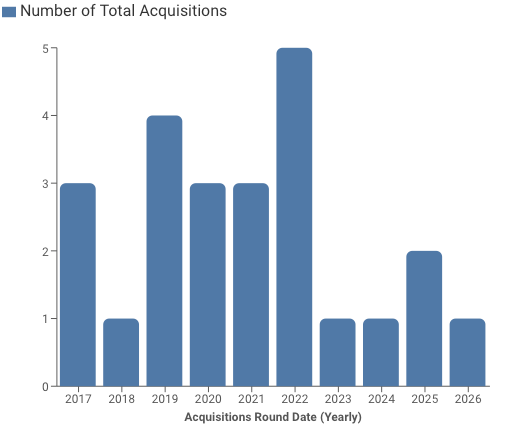

The company has grown organically and, central to its strategy, through acquisitions throughout its history. It has acquired roughly 100 companies since its conversion from Heinicke to Heico, almost always in the ballpark of $20 to $75 million. Those subsidiaries are anticompetitive (extremely low cannibalization) and maintain near-total autonomy from the larger holding company.

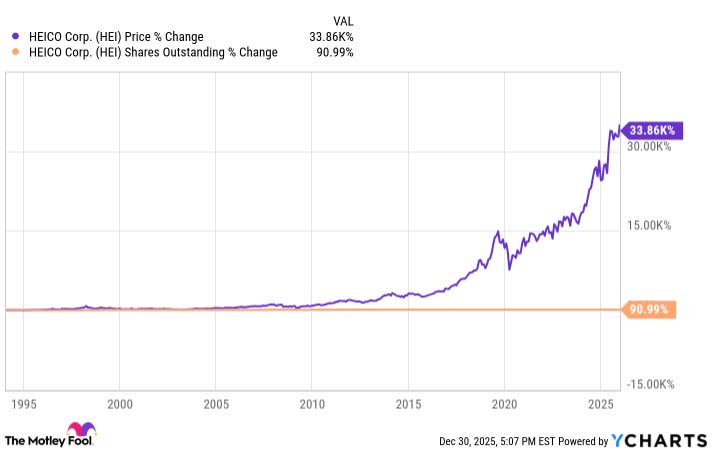

Since the Mendelsons took over in the 1990s, and especially over the past fifteen years, the company’s performance has been unicorn-level.

Powerful growth, low dilution

Source: Y-Charts

Since the New Millenium started, HEI has returned a%. Since 2015, the stock has returned nearly 1,000%. This massive growth has been achieved in large part through acquisitions, financed by accumulated earnings and manageable debt loads.

Business Description and Unique Qualities

More Berkshire than Boeing

HEICO is generally described as an “American aerospace and electronics company”, but a cursory review of its operations shows that it is more of a holding company, focused on acquiring subsidiaries in that space.

As CEO Eric Mendelson explained in a 2024 interview, “We’re not a 4 billion dollar company, we’re a hundred 40 million-dollar companies.”

Heico’s strategy is to invest in a number of companies, usually valued between $20 and $75 million at the time of acquisition, that show strong fundamentals in one of their preferred niches. Subsidiaries generally manufacture electronic equipment or provide maintenance, repair and overhaul services for vehicles and other complex tech. Their primary spaces are aerospace, defense, and medical technology.

As we discuss throughout this report, diversification is both a strength and a potential weakness. A 100-company portfolio provides many small bases to collectively grow from, and limits the impact of a bad quarter for any one subsidiary or even industry, but that diversification can also limit upside.

The company’s two largest acquisitions, both in 2023, are Exxelia and Wencor Group. Both epitomize the strategy of growth and market power through acquisition, as well as a focus on electronic equipment and aircraft. Exxelia is a French manufacturer of passive electronic components, and Wencor is a major producer of aircraft components. Notably, these deals broke from tradition in the targets’ size and the hefty $2 billion in new debt needed to finance them.

Source: Tracxn

Keeping Skin in the Game

Heico generally buys companies in their entirety, and leaves management/operations untouched. This can be a tricky combination, as the subsidiaries may lose their incentive structure for outperformance. It’s doubly tricky when the managers who remain are the company’s founders, and they were motivated from the beginning by their (now-sold) equity stake.

The company manages this balance through a couple of general practices. Former founders almost always retain a major leadership position, such as president or CEO. They keep full autonomy of operations and aren’t absorbed into a larger operational org chart. Importantly, each subsidiary keeps its existing chain structure, with the caveat that China is off-limits as a supplier.

Many founders prefer this relationship to the typical aerospace acquisition, where supply chains, decisionmaking, and/or branding are absorbed into the parent entity. It also minimizes disruption, making it easy for Heico to predict future contributions based on historical performance.

Acquired Leadership teams keep their incentive to outperform in the ways that you might expect. They either keep a small minority stake, or more often, they receive compensation based on the subsidiary’s performance. Near-total autonomy and the same direct incentives to perform can make it much easier for founders to remain as CEO.

A Nice, Wide Moat

In addition to deft capital allocation, Buffett would also be proud of Heico’s moat.

As discussed, PMA parts and services for aerospace now constitute the largest chunk of Heico’s sales. This is a notoriously difficult space to enter, as FAA certifications are brutal to acquire. Additionally, Major airlines, governments, and aircraft manufacturers (Boeing is by far Heico’s largest client) are more risk-sensitive than price-sensitive, which tends to keep them with the same supplier. Heico’s subsidiaries are known providers, while a new competitor could present the risk of component failure.

A similar dynamic works for the ETG space. The client base is largely medical technology and defense equipment, such as MRI equipment and laser-based technology for sensors and other applications. These are sticky, long-term contracts and reputation carries massive weight.

Heico is also, through a combination of foresight and fortune, positioned in some of the highest-growth industries in the economy today. The demand for medical technology, defense equipment, and aircraft parts are far outpacing broader industrial growth, due to some durable, systemic factors. Geopolitics and economic conditions will continue to drive demand from the aerospace and defense industries, while longer fleet lifespans and reluctance to invest massively in fleet replacement supports continued PMA growth.

Perhaps the most interesting and intelligent part of Heico’s acquisition strategy is the company’s target size: Heico is made up of nearly one hundred, mostly small companies in non-cannibalized niches. A portfolio of dozens of PMA manufacturers that do not compete has a smaller base to grow from than a single company of the same size. While the policy of non-cannibalization naturally boosts revenue and avoids friction between subsidiaries, it can also squeeze the number of available targets, as we’ll discuss later in the report.

But First, Consensus

A major factor that sets the company apart is that the core leadership team (namely Laurans, Eric, and Victor Mendelson) must unanimously agree on every major decision. These include large strategic pivots and all acquisitions.

The strategy might cause them to miss out on some profitable targets, but it greatly improves certainty in execution and probability that the company is picking safe targets. The result is that, according to the family, they have maintained a roughly 98% success rate on acquisitions.

The power-sharing and decision-making framework of the company, centered around a triangular arrangement between father and sons, is unique and clearly a driver of Heico’s success.

As we discuss in the Risks and Opportunities section, we are unsure of how the dynamic will evolve when the 87-year old Laurans Mendelson fully exits the equation.

Business Segments

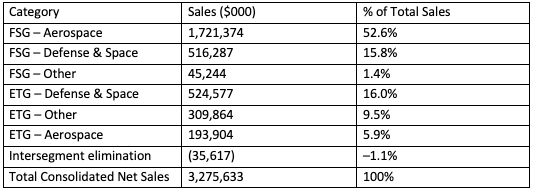

Heico has two main operating groups, which are further broken down into a few segments each: The Flight Support Group (FSG) and Electronic Technologies Group (ETG).

The following table breaks down the sales composition by broad segment:

Maybe to compensate for its rather opaque subsidiary-level performance, the company’s financial filings do a great job of describing and differentiating between the FSG and ETG, so I’ll lean on it in the following descriptions:

Flight Support Group (70% of Sales)

The Flight Support Group (FSG) comprises the lion’s share of company sales. HEICO describes the FSG as a broad aerospace platform built around replacement parts, repair services, and specialized components.

According to the 2024 10K, businesses in the FSG:

“primarily: design, manufacture, repair, overhaul and distribute FAA-approved parts for aircraft components and provide other services utilized primarily by commercial, regional, and general aviation aircraft, as well as military aircraft.”

The emphasis is mine, because the PMA authorization is a major barrier to entry for competitors. FSG is a large amalgam of little niche subsidiaries for different parts, as well as maintenance, repair and overhaul (MRO)services.

The 10-K emphasizes that FSG supplies a large and diverse range of products and services, including “[producing] jet engine and aircraft component replacement parts,” “specialized component parts,” and “repair and overhaul services for aircraft accessories and components, including hydraulics, pneumatics, avionics, structures and other flight-critical parts.”

Beyond PMA and MRO activities, the segment also includes manufacturing of composite materials, insulation, thermal components, and technical subassemblies. The group operates FAA-certificated repair stations and distributes “over 135,000” parts to airlines, MROs, OEMs, and militaries. The company describes FSG as a steadily expanding operation that “introduced approximately 500 new parts in fiscal 2024” and continues to grow both organically and through acquisitions.

The FSG has steadily gained ground as the bulk of Heico’s business, rising from roughly half to 70% of net sales over the past few years. Specifically, its PMA business is driving growth and seen as the most resilient of the FSG segments, as discussed above.

Electronic Technologies Group (ETG) (~30% of sales)

HEICO’s Electronic Technologies Group, which also serves the aerospace sector to some degree, is a collection of highly specialized electronics businesses serving defense, aerospace, healthcare and other mission-critical industries.

Per the 10k, The group’s subsidiaries “design, manufacture and sell mission-critical, high-reliability and innovative electro-optical, microwave, power, and other electronic products used in the aerospace, defense, space, medical, telecommunications, and electronics industries.”

ETG’s offerings also include “infrared simulation and test equipment,” “electronic connectors and interconnect assemblies,” “power conversion and distribution equipment,” “electro-optical devices,” “high-power microwave amplifiers,” “satellite and space components,” and “ultra-wideband receivers.”

HEICO stresses the mission-critical nature of these systems, noting that they are used in applications where “performance and reliability are essential. Like its FSG business, that level of precision and liability for failure leads to lots of risk-aversion and regulatory involvement, which helps raise the barriers to entry for businesses that compete with the ETG.

ETG also spans healthcare, industrial, and security markets, supplying X-ray imaging components, medical power supplies, and detection equipment. As with FSG, the company underscores ETG’s engineering intensity and product depth.

Even with the massive Exxelia acquisition, ETG has shrunk as a percentage of total sales over the years in favor of the Flight Support Group.

Domestic (~65%), International (~35%)

The United States is the main market for both groups, but international sales continue to grow as a percentage of the total. In 2024, international sales jumped from 34% to 37% of net sales. If that trend holds, the figure could be closer to 40% in 2025.

The company’s largest presence from a manufacturing and client standpoint is in Europe. Its 2023 acquisition of French company Exxilia (part of the ETG group) gave it a much stronger foothold in Europe for providing electronic components.

Heico has a much smaller PMA footprint overseas, due to a different regulatory map than America’s FAA. Basically, the same barrier to entry that protects the FSG at home makes it more difficult to expand into Europe and other regions. For this reason, while Heico works on Airbuses that fly in the US, Boeing is overwhelmingly FSG’s largest client.

Fundamental Analysis

Balance Sheet

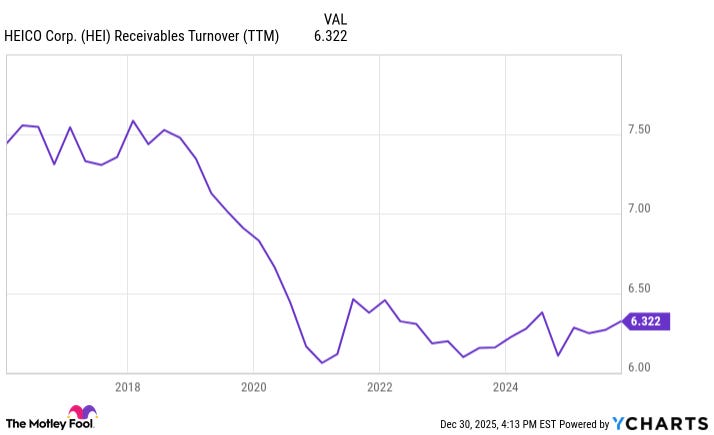

Receivables

Source: YCharts

The company maintains a strong receivable turnover, which makes sense given that its clients are mostly large corporations and public entities. However, its turnover fell to around 6.25x in 2019 after spending the previous decade around 7.5x. That’s a pretty significant change; receivables now take eight days longer on average to fully collect than in 2019. However, the shift took place over a year and stabilized after that, so it doesn’t seem like a significant concern.

One may guess that some massive acquisitions with longer turnover cycles drove the change, but the Wencor and Exxelia acquisitions were in 2023. Instead, fall in receivables is likely attributable to the company’s deeper moves into aerospace and defense, two industries with generally longer turnover periods, closer to net 45 days.

Further cause for optimism is that the company has reduced its allowance for doubtful accounts, in absolute terms, to an almost-negligible percentage of sales and income. Given its client mix, bad debt is basically a non-issue for the company, and its receivable turnover is healthy and predictable.

Liquidity

HEICO is a company that relies heavily on acquisition for growth, and finances much of those acquisitions through debt facilities. There are many advantages to that approach, as it helps to avoid dilution and consistently grow cashflow when targets are well-chosen. It also requires keeping a very sharp eye on the balance sheet and future financing channels.

Not only does HEICO have a strong cash position, its debt level and interest expense are far from limiting its strategic maneuverability.

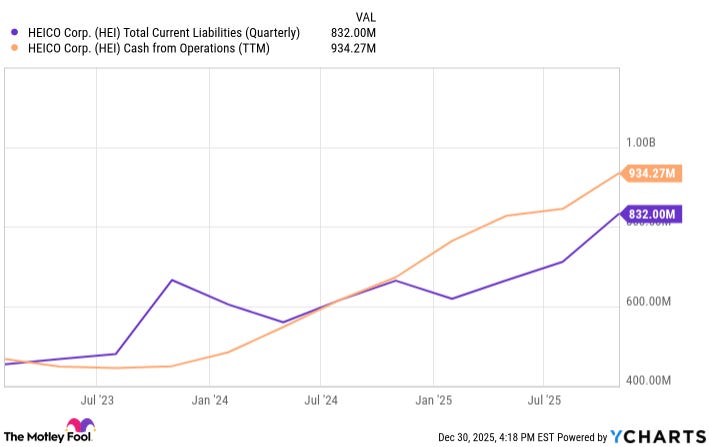

Liquidity Outlook: Smooth Sailing

Source: YCharts

Over the past three years, 12-month trailing operating cash flow has grown at an annualized CAGR of 21%, with the figure currently standing at $845 million. Current liabilities, including the current portion of its long-term debt, has in contrast grown at a CAGR of 16% and now stands at a manageable $711 million.

Income Statement

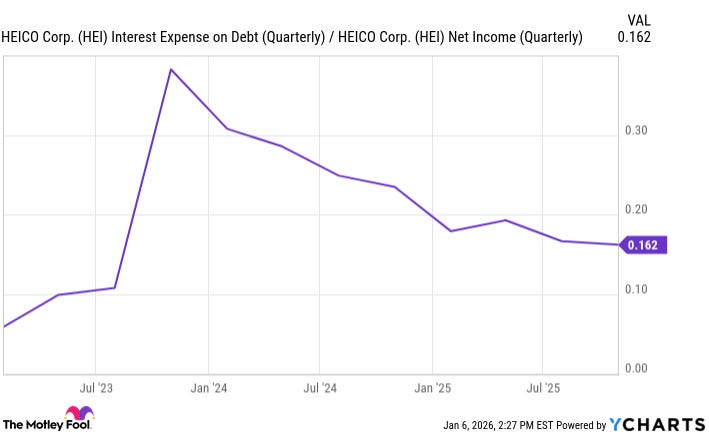

Source: YCharts

Interest expense is also at a manageable level. The aggregate interest rate on company debt has slowly fallen with prevailing interest rates, and is currently about 5.6%. While interest expense comprises a healthy 16% of net income, that figure has fallen from a high of nearly 34%.

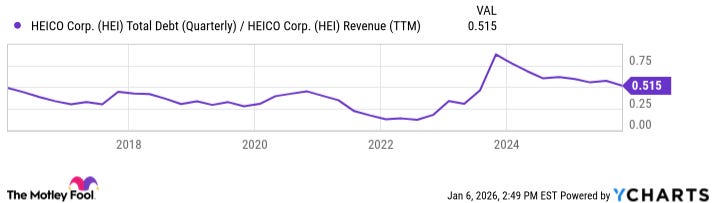

As we discuss below, the relationship between the company’s debt load, revenue growth, and interest expense does raise an eyebrow. More than solvency, we’re concerned about sustaining the current growth rate (and justifying today’s share price).

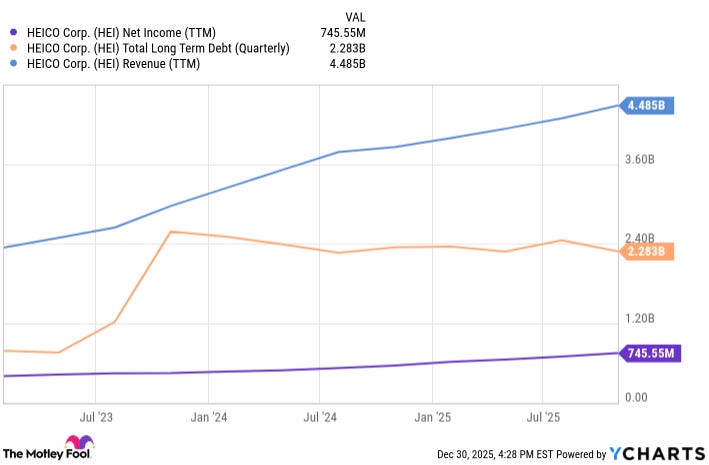

Future Scaling

As the chart below shows, the company’s total debt has floated around $2 billion since its two large-scale acquisitions in 2023. This figure is over half of trailing annual revenue and eclipses the last twelve months’ net income of roughly $700 million.

Source: YCharts

However, Heico has basically managed to keep debt stable since those major acquisitions, while enjoying significant growth in both revenue and earnings.

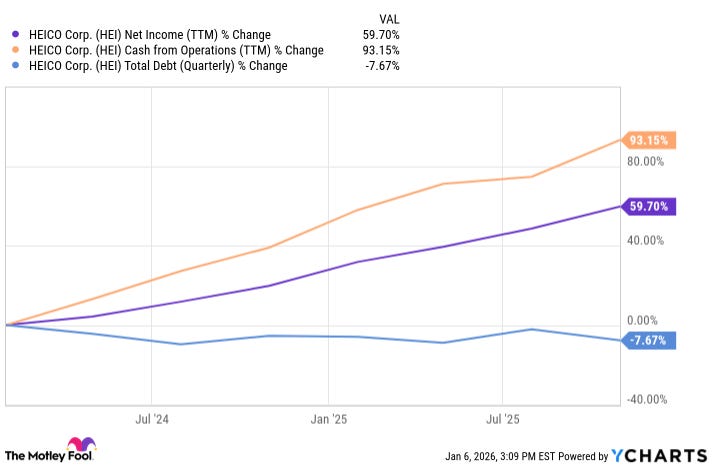

Source: YCharts

The chart above shows a more encouraging version of the same metric. While debt still dwarfs both net income and operating cashflow, the two “fun” figures are growing at an impressive CAGR, while total debt is (very) slowly shrinking.

It seems that the firm is content to slowly outgrow its debt over the medium term, keeping its powder dry for future acquisitions. That is encouraging; $2 billion will be a less scary figure as other operating metrics outpace it. On the other hand, while that’s sound financial stewardship, the strategy clouds the growth outlook as well.

One side effect of the current situation is that one of two things (or some combination of the two) are almost certainly necessary to maintain or exceed current growth rates:

Organic growth will have to account for more of the company’s future growth over the next three years than the previous three. Without multi-billion-dollar acquisitions, existing subsidiaries will need to pull more weight in achieving whole-company growth. HEICO has little control over this, since it makes a point of allocating capital rather than butting into the business of subsidiaries.

The company will have to dilute or take on more debt, bucking a trend since 2023 of growing assets through operations. Acquisition-driven growth, which has accounted for much of the company’s growth since 2023, requires either significant dilution or leverage, both of which could harm the company’s share price.

One of these scenarios warrants at least a healthy skepticism; if it relies primarily on organic growth through 2027, HEICO’s portfolio will have to outgrow its constituent sectors by double digits to outperform cheaper sector-wide ETFs.

The other scenario will likely make investors nervous, as another major jump in debt could raise concerns about the sustainability of the strategy. If financed through dilution rather than the historically preferred cash-on-hand and traditional debt, share price will of course be directly harmed.

These factors all combine to inform a hard, honest look at the current valuation.

Cash-Flows and Valuation

From a DCF perspective, we can assume the following:

A terminal growth rate of 4% after 10 years;

A discount rate of 10%, which is conservative given broader market performance and current interest rates;

A current share price of $310 per share, and current EPS and free cash flow per share of $4.56 and $5.56, respectively.

Tangible book value of roughly -$10 per share (a hefty goodwill account balance holds this figure down).

Working from those assumptions, we need growth to hold steady around 30% for EPS and 27% for free cashflow to have a fair valuation at $310. That’s a tall order, as the chart below shows:

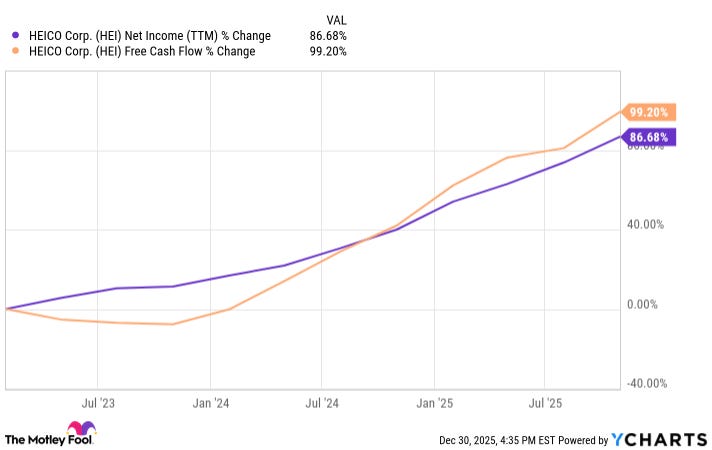

Operating growth figures hover around 20% per annum

Source: YCharts

Free cashflow and net income have both seen an annual CAGR of just over 20% over the past three years. The current price arguably projects a sustained 50% acceleration from this trend over the next decade. So far in 2025, we have seen the kind of earnings growth (~30%) that HEICO would need to justify this valuation, with some important caveats:

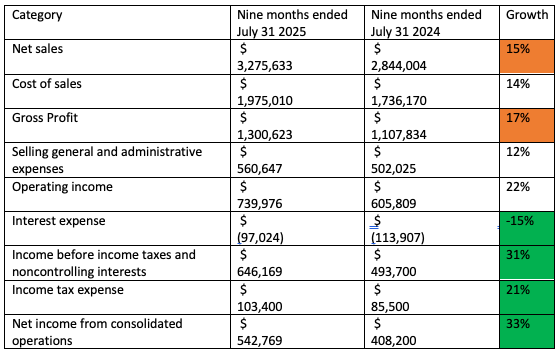

Source: Company Filings

The first 9 months of the year have seen accelerated growth, with net income breaking 30% growth YoY thus far. However, the composition of that growth warrants some concern about its sustainability. We’ve highlighted the table with some helpful color-coding (green good, orange not-so-good).

Profits grew in large part thanks to slow or negative growth in its bottom-line figures. Interest expense fell year-over-year as the company slowly shrinks its debt load, because its rate on variable-interest debt is falling with the prime rate.

Additionally, the tax rate on its net income was significantly lower YoY (17.3% vs. 16%), saving the company an implied $8.5 million and contributing nearly 3% of the 33% YoY growth. Most notably, SG&A expense was lower as a percentage of sales, giving profit margins a significant boost.

That is all great news of course, but none of these items (even the leaner SG&A) are sustainable means to long-term growth. Sustained growth can only be achieved through the top line, period.

Revenue: The Math Doesn’t Add Up

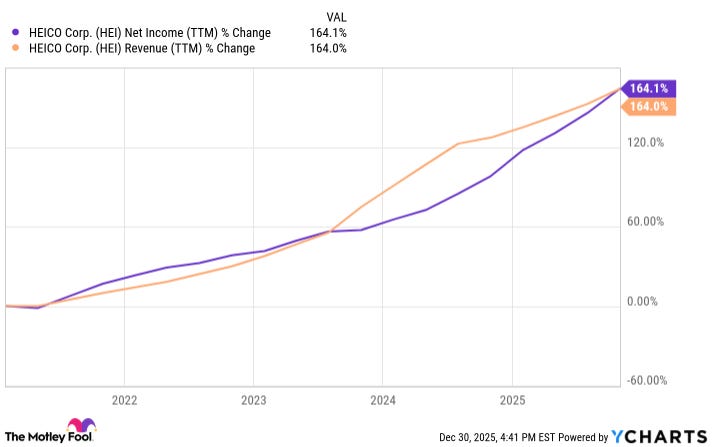

The real challenge for the stock price is the implicit revenue growth projection. Any sustained growth in profits will ultimately rely on a roughly equal sustained growth in revenue.

Source: YCharts

This chart probably isn’t necessary to convince you of an obvious relationship, but sooner or later, Heico’s (and every other company’s) earnings growth tracks revenue growth, and quite closely. There is a natural limit to the extent that bottom-line figures can persistently drive higher earnings growth.

A reduction in expenses helps margins, but it does not compound in the same way that revenue does. To illustrate with an extreme example, if Heico suddenly managed to reduce all expenses to zero, it would see a massive percentage jump in earnings in that year, and then earnings growth would be equal to topline growth for the rest of time, or lower if any expenses came back. It’s all about revenue.

On that front, we see less justification for the current valuation. Both sales and gross profit have so far grown less than the company’s 5-year CAGR of 20% in 2025, with revenue only growing 15% year over year.

Gross Margins to the Rescue?

You might be asking, “But what about improving gross margins?” Gross profit grew slightly faster than revenue, a slight deviation from a powerful trend of near-constant gross margins. Since 2019, gross margins have floated in a tight range of 41.6% to just under 43%. At 42.6%, this quarter’s gross profit was near the upper bound of that range.

To confirm intuition that the trend will hold, the company cited a very positive sales mix as driving an improved gross margin, with the cautionary note that this level likely won’t be sustained moving forward.

As CFO Carlos Macau said in the Heico’s most recent earnings call,

“I got to be candid with you, the margin that we posted this quarter exceeded my expectations. Is it sustainable? Look, I hope so. I still think that mix drove some of the growth in that margin”

That’s some refreshing honesty from a CFO! Of course, even without that warning, we know that gross margins can’t fall indefinitely. The issue is sales growth; so far this year, the company is underperforming its 20% 5-year CAGR. That confirms the intuition that an acquisition-driven firm will struggle to maintain a massive revenue and earnings CAGR without taking on significant debt, diluting, or eventually running out of attractive targets in its sector.

What about Flight Support?

Much of Heico’s platinum valuation comes from the powerful moat around PMA parts supporting Aerospace and Defense. The company offers a highly protected class of product at a lower price point than Original Equipment Manufacturers (OEMs). As secular demand for aircraft parts continues to heat up, so the logic goes, PMA sales volume will increase.

Not only that, surging demand will also give Heico subsidiaries some wiggle room to finally increase their margins, following OEMs upward as they hike their own prices. Sadly, there are some flaws in this logic, primarily the nature of Heico’s supply contracts and the extent to which PMA demand would have to outpace secular demand to justify current implied growth rates.

Prices: Fixed and Long-term

For its largest segment, Flight Support, we don’t see price increases meaningfully driving revenue growth. Neither does Heico itself. Price increases, either thanks to Heico’s PMA market power or following OEM pricing upward, will be limited by Heico’s deal structure.

A Macau helpfully explained,

“A lot of our large PMA relationships are done on long-term contracts. And we continue to commit to our customers anywhere from three to five years in these contracts. And more often than not, we will lock in pricing with either a CPI inflator or flat pricing… And that’s part of the reason why you start thinking about pricing our PMA business, many times we are locked in.

To your earlier question about, you know, the OEM prices rising at much faster rates, even if those prices go up, maybe our standard price list mirrors that growth, but our true net revenue or net sale is based off contractual relationships, which more often than not in the PMA space is going to have a fixed price component. It’s not really impacted by that type of movement in the market.”

(Emphasized by author)

Our takeaway from this: the largest growth driver and biggest factor in Heico’s current earnings multiple is unlikely to wield market power to raise prices for most of its clients over the next 18 months.

Secular Growth?

The alternative argument for massive revenue acceleration in the coming years is organic growth in demand, to the tune of 30%. The driver for this growth seems to center around surging PMA demand, as aircraft fleets are kept longer and defense spending increases around the world.

While I agree that PMA demand is likely to outperform comparable markets, I also find this thesis very hard to defend, because it undermines all other growth expectations for Heico’s sectors.

Most analysts are projecting the global aircraft parts market to grow at a CAGR of under 10% over the next five years. If you think that the PMA market will grow at twice that rate, that’s still well south of the revenue growth needed to drive Heico’s current multiples. PMA demand would have to outpace the market’s consensus growth rate by over three times to match Heico’s implied future growth.

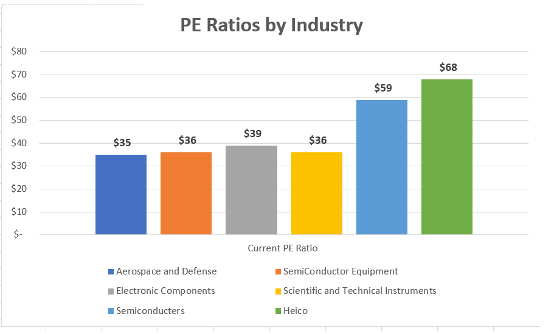

Heico’s operating sectors, primarily General Electrical Equipment and Aerospace and Defense have some of the highest multiples in the market, but they’re all well below Heico’s.

Data Source: FullRatio

The chart above shows the PE ratios for Heico’s main constituent sectors. While A&D, Electronic Components, and Scientific/Technical Instruments all enjoy above-market PE ratios of roughly $35, Heico dwarfs them all at nearly $70 (!). At roughly 80× earnings (an earnings yield of only ~1.25%), the market is essentially pricing HEICO as a near–sure thing. In other words, investors appear to assume flawless execution and extraordinary growth ahead – leaving virtually no margin for error if the company falters.

Heico even stands above today’s most famous industry for insane multiples: semiconductors. In case you think Heico is more analogous to semiconductor equipment than making the chips themselves, I added both to the chart. The takeaway: the market thinks Heico’s portfolio will vastly outpace both of those industries. It is truly challenging to imagine a universe where this happens organically.

Valuation

For these reasons, we see a median outlook for net income closer to 25%, perhaps a bit lower, with continued improvements in operational efficiency brushing against the realities of organic sales growth. That puts our price target closer to $220 per share, indicating a steep overvaluation.

To achieve 30% annual growth inorganically, HEICO will probably have to acquire aggressively. That would lead to stock dilution, more debt, and/or lower-quality targets, all of which would dampen investor outlook and share price.

We love Heico as a company, and are adding it to our watchlist, as with all reports, but we think its valuation made more sense in April than it does in December.

Capital Allocation

Naturally, a company that operates as a capital allocator warrants special attention to how effectively it does so. We like the company’s basic return-on-capital figures, and its ability to finance most of its growth and acquisitions internally makes its cost figures look strong as well.

Regarding the ratios we discuss, two factors that have dimmed the shine a bit are the immense market capitalization (of course, Heico can’t control this) and its recent assumption of $2 billion in debt in 2023, which it has slowly reduced/outgrown in the two years since.

Investment: WACC Vs. ROIC

While fundamentally a holding company, Heico’s subsidiaries are in physical, industrial spaces, with the significant capital investments that you would expect to be necessary. Beyond internal investments in PP&E, the company maintains robust acquisition operations.

To cut to the chase, the company generates a return that justifies investment, and maintains responsible leverage.

WACC

The company’s WACC (Weighted Average Cost of Capital) looks strong. WACC is the size-weighted average cost of the company’s debt (the average interest rates against its financial debt) with the cost of equity (essentially the opportunity cost of investing in Heico rather than the market).

10% is a common estimated figure for the cost of equity (risk-free rate plus a 5-6% equity premium), but we argue for 9%. As an umbrella for many profitable subsidiaries across different markets, Heico is comparably more diversified than the average firm. It also operates in safer spaces that are less sensitive to economic shocks. This justifies lowering the risk premium a bit.

As discussed, Heico’s effective interest rate on its aggregate debt currently stands at around 5.6%. Since the interest expense is tax deductible, we can discount this further by the company’s effective tax rate of ~17%, arriving at an effective cost of debt of around 4.6%. Thanks to its massive market capitalization, the company’s WACC figure overwhelmingly leans toward the cost of equity, since debt only comprises 5% of the market value and equity the other 95%.

We estimate the WACC to be about 8.5%.

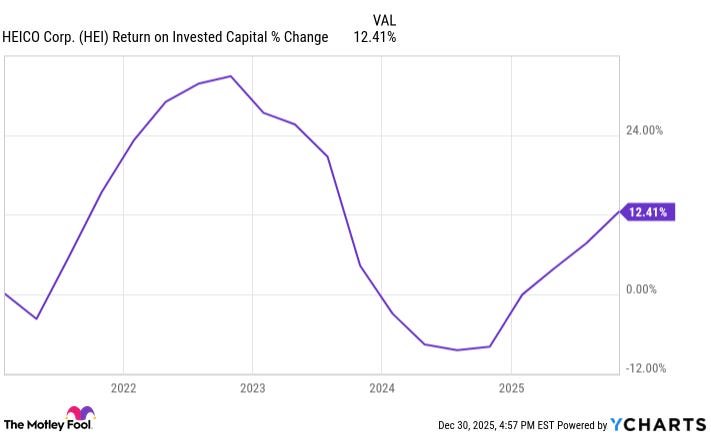

ROIC

The company consistently maintains a strong return on invested capital (ROIC). ROIC is the after-tax profits divided by total equity, debt and preferred stock. Essentially, for every dollar the company has acquired from outside means, how many cents does it generate as profit?

As the chart below shows, Heico has a healthy ROIC of 10.5%. ROIC has taken a hit since 2023 as a result of its $2 billion debt position, falling from a high of 12.5%. However, the returns on the Exxelia and Wencor acquisitions have gradually made up for the initial capital investment, and ROIC is up from a 2024-low of roughly 9%.

ROIC: Strong and Improving

Source: YCharts

ROIC Justifies WACC

Heico’s return on invested capital is comfortably higher than its WACC. This is to say that the company’s returns justify the capital that investors provide, even when accounting for the opportunity cost of those funds.

We expect this to remain the case, while recognizing that the cost of equity, market capitalization and risk-free rate can have a significant impact on the figure moving forward.

Financing Mix

As discussed, the company mostly finances its growth internally. It supplements this with some debt and equity fundraising, neither of which dominate the balance sheet or dilute shares.

To illustrate, shares outstanding have increased by 6% since 2015. The Debt to Assets ratio, currently at 28%, has remained below 35% for the company’s relevant history.

Especially since the cost of current equity is so much higher than the cost of debt, and because the company loves to grow through acquisition, we might call Heico underleveraged.

We believe, especially given its valuation, that Heico is wise to approach new dilution and debt cautiously. We reiterate that new debt or dilution would likely be necessary to achieve the market’s growth expectations, so Heico’s beautiful balance sheet gives it that strategic latitude.

Dividend

Since its IPO in 1994, the company’s dividend policy has essentially been “No”, choosing to reward shareholders through value creation and using its cash for acquisitions and reinvestment. Its meteoric growth affirms the decision.

The company has increased its dividend lately, most recently providing a $0.12 dividend in July. The dividend yield remains negligible (nearly 0%), with about $0.25 paid over the past year (the company trades above $300).

Compensation and Ownership Structure

Stock-Based Compensation

Stock-based compensation at HEICO is material, but conservative in its structure and the philosophy behind it. It is clearly framed as a retention and alignment mechanism rather than a vehicle for aggressive equity dilution. The company prefers to award subsidiaries’ performance directly, which means that those awards are reflected in the Income Statement as direct payments rather than diluting equity.

The company grants equity awards primarily in the form of stock options, restricted stock, and restricted stock units to selected executives, key managers, and employees. These awards are generally long-dated and vest over time, reinforcing HEICO’s emphasis on continuity and long-term value creation.

To put stock-based compensation in perspective, Heico’s SBC expense in 2024 was $68 million, which translates to 1.8% and and 13% of the year’s revenue and income, respectively.

Ownership Structure

HEICO has a long-standing dual-class ownership structure that concentrates voting control while maintaining broad public equity participation. The company has two classes of common stock: Class A common stock and Class B common stock. Both classes are economically equivalent, receiving the same dividends and having identical claims on earnings and assets, but they differ significantly in voting rights. In the public market, the two classes trade separately (HEI and HEI.A), even though the economic rights are the same. Any price spread between them is typically driven by voting demand and liquidity rather than fundamentals. When a meaningful spread opens up, it can matter for investors who care about the cash flows more than control.

Each share of Class A common stock is entitled to one vote, while each share of Class B common stock is entitled to ten votes. As a result, holders of Class B stock exercise effective voting control over the company, despite owning a minority of the total outstanding shares. The Class B shares are primarily held by members of the Mendelson family and related trusts, which keeps HEICO a family-controlled enterprise.

This structure allows management to pursue a long-term, acquisition-driven strategy without undue pressure from the market, and it has remained unchanged for decades.

Class B shares are convertible into Class A shares on a one-for-one basis, but not vice versa, which gradually reduces concentrated control over time as insiders reduce their position.

Ownership Mix

Insiders (overwhelmingly the Mendelson family) own about 15% of the company shares. Institutional investors own about three quarters of the float, with retail holding the other 11%.

The Mendelson brothers have recently been winding down their concentrated holdings in Heico, perhaps in order to diversify and perhaps because they share our assessment of the share price’s current overvaluation.

Risks and Opportunities

Key-Man Risk

When it comes to potential Key-Man risk, Heico is in a similar position to Interactive Brokers; its core leadership team has been around for years, but always with its visionary founding CEO at the helm. While Laurans Mendelson may have shared more decision-making and strategic power with his sons than IBKR’s Thomas Peterffy did with anyone else, they both have been instrumental to their companies’ multi-decade journey, and they are both at a very advanced age.

Laurans Mendelson transitioned from CEO to Board Chairman in 2025, with his sons now serving as co-CEOs. The eventual complete departure of the father may prove whether the historically three-legged stool will be as strong without him. Two brothers sharing an executive role, without their father to temper a natural competitive streak, could make consensus more difficult to find.

While we are less concerned than for other companies, given the brothers’ deep involvement in company strategy for over three decades, it is an unknown variable whether the secret sauce will be as strong when the head chef fully exits.

Supply Chain Risks

It’s one of the biggest risks facing manufacturers of vehicle parts and electronic components: deep uncertainty regarding supply chains. Boeing and GM are both grappling with geopolitical risks and gradual segmentation of globalized supply chains. Shortages of key components and materials are likely to crop up sporadically, as they have in greater numbers since the pandemic.

Heico makes a point of stressing its lower exposure to supply chain risks because it’s been de-risking for years. To quote Eric Mendelson:

“We do not have any manufacturing operations in China. Full stop… There are too many other opportunities for us to take that risk.”

The company emphasized that since their subsidiaries are all independent actors, rather than a fully integrated, siloed supply chain, they have some built-in supply chain diversification. While no subsidiary sources from China, they are not all sourcing from the same place.

We agree that dozens of small, nimble companies may be able to dodge supply chain shocks more effectively than Boeing or GM, both of which have famously struggled this year, but significant risks remain for all players in the space.

Speaking of diversification, the company’s unique structure carries both added safety and muffled upside.

The Diversification Paradox: Lower Risk, Overstated Upside?

HEICO’s greatest strength also tempers my optimism about its ability to drastically outperform its sector: it is essentially a very specific ETF, actively managing a portfolio across a few industries but not managing any constituent subsidiaries.

CEO Eric Mendelson said last year that the greatest point of pride for the company is that they “don’t mess things up”. As we’ve discussed, they identify companies that they think will outperform, and they bet heavily on those companies by taking a massive stake (usually 80-100%). They don’t move in and try to “fix” anything, and the extent of their value-added for the new subsidiary’s performance is capital access and (minimal) access to their network.

In this sense, they are much more like Berkshire today, or an actively managed sector-specific ETF, and much less like Boeing or some other individual company in their sector. This isn’t news to anyone, but we’ve harped on this essential difference throughout the deep dive because it makes us question whether the company can achieve the future growth implicit in such a high multiple.

Constantly keeping this fact in mind helps to explain why Heico’s income statements are relatively tame. Gross profit margin barely moves from year to year, because it’s the aggregated figure across roughly 100 companies, rather than the more volatile performance of a single company. Growth, costs, and all other metrics are well-diversified, reflecting a consistent average rather than a volatile line-item.

Heico benefits from diversification across many subsidiaries through lower volatility than most companies on the market. Compared to a typical single company doing over $4 billion per year in sales, it is able to achieve stronger, stabler growth through many small constituents at a steeper part of their growth journey. These factors make its above-market growth cheaper in terms of risk, but they also dampen a realistic projection of that growth.

The flipside of diversification is a relatively lower ceiling on the upside, which goes against the market’s current consensus. Taking a position in Adobe or IBKR is a riskier bet than, for example, a passive tech or financial sector ETF, but it also has a higher potential ceiling. Apple is a single company that can (and almost certainly will) either outperform or fall short of average tech sector returns. The lower volatility and consistent growth in Heico’s financial statements come at the quiet cost of a moderated upside.

If we think of Heico as a portfolio of PMA and electronic equipment manufacturers, buying at an exorbitant share price seems to open two unique risks:

1) This portfolio would eventually regress closer to mean sector performance (primarily electronic equipment and A&D) in terms of both returns and volatility.

2) If it continues to outperform the market so dramatically, such a portfolio may see its moat undermined as other funders try to copy the acquisition strategy, or well-funded actors natively develop PMA firms.

Additionally, the company (wisely) goes to great lengths to avoid cannibalization. There is extremely low overlap between the product offerings of different constituent companies. Heico has a significant market share of several of its segments, including PMA and MRO services. This combination (high market share and anti-cannibalization policy) eventually puts a ceiling on the breadth of available targets moving forward, unless Heico strays far outside its usual wheelhouse.

Macroeconomic Environment

HEICO is well-positioned in different economic climates, though different areas of its businesses would be relatively hindered or helped. To summarize, a lower rate environment would make acquisitions cheaper, since HEICO leans heavily on debt to drive its acquisitions. On the other hand, higher rates could relatively boost its Flight Support Group business, particularly for commercial airliners.

Due to the very strict regulatory environment and immense liability, fleet maintenance, repair and overhaul is quite inelastic. Governments, airlines, and other firms need their air fleet to be safe and compliant, regardless of economic conditions. In fact, demand for these services and parts can increase during leaner economic times as firms forgo or delay fleet replacements. The company’s niche within its Electronic Technologies Group is largely centered around Aerospace and Defense and Healthcare, also limiting its exposure to changing aggregate demand.

In short, both of the company’s main business groups should be resilient to economic downturn. Higher interest rates would likely correlate with higher inflation, which would allow Heico to make modest price increases for its CPI-linked contracts.

We find Heico’s revenue outlook to be safer from interest rate risk, inflation, and macroeconomic temperature than most companies. However, interest rates definitely have a pronounced impact on acquisitions.

Monetary Policy, Acquisition Costs

Companies that live and die on acquisitions tend to thrive when debt is cheaper. As we’ve covered extensively, Heico will need to keep acquiring aggressively to meet the market’s growth expectations. In addition to making debt less expensive, lower interest rates would boost the company’s market cap, making it easier to borrow against and making dilution hurt a little less.

On the other hand, low interest rates work both ways. Valuations tend to soar during times of easy money, which would force Heico to pay higher multiples for high-quality companies. The extent to which these factors balance out is difficult to say, and with a Debt-to-Sales ratio of 0.57, the company is still more leveraged than its historical average following its Exxelia and Wencor acquisitions in 2023. The chart below shows the impact of those acquisitions on Heico’s leverage position.

The chart also illustrates that Heico generally leaned more on its own war chest to finance acquisitions. With strong cashflow and a negligible dividend, the company has plenty of capital to go after smaller fish, but could raise eyebrows if it tacked on another $2 billion of debt in a single year.

While financing costs and a fairly heavy debt load could hinder Heico’s buying power, we feel good about the firm’s ability to navigate changing valuations and debt costs. We are also confident that they would live within their means as an acquisition-focused company.

This is not an existential risk, but another risk to the meteoric growth that its current share price demands.

Secular Demand: A&D is Here to Stay

While it has proven an excellent corporate administrator and capital operator, most of the market’s giddiness about Heico comes down to its tailwinds. Heico’s largest segments revolve around aerospace, and government contracts comprise an increasing share of its client base. These are excellent, sticky spaces to operate in.

We live in a time of increasing geopolitical tensions, and demand for military equipment continues to soar around the world. Heico’s main operating regions and clients, the US and Europe, will demand increasing volumes of military equipment, maintenance and repair. This will likely be true even if the US trims its footprint overseas, as it tries to maintain parity with state-level actors in terms of hard assets like ships and aircraft.

Not only are they massive buyers in themselves, but American and European governments export massive amounts of military material, which Heico is certified to work on and provide parts for. Private aerospace is also very exciting for its strong demand tailwinds and Heico’s strong moat around PMA products and services.

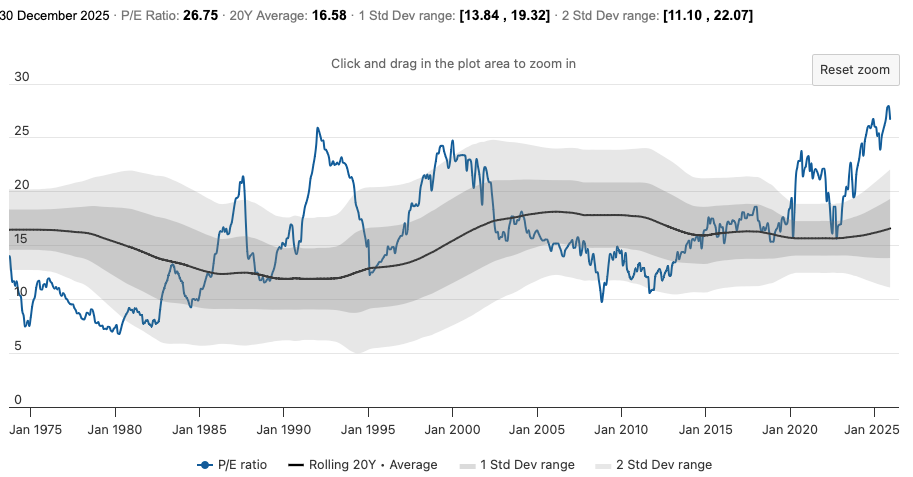

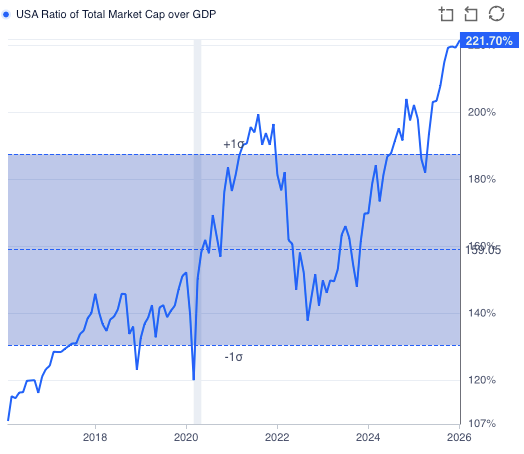

Heico’s Place in an Overvalued Stock Market

We’ve tried to make a disciplined argument that Heico’s fundamentals do not justify its current valuation. A fair rebuttal is, “So what? Everything is overvalued.”

This is true. PE ratios are stratospheric across virtually all sectors, including Electronic Components and A&D. As the chart below shows, the current PE ratio (December 15) across the US stock market is nearly 28. That’s $8 above the average over the past ten years, or roughly 2 and a half standard deviations.

Source: World PE Ratio

Source: GuruFocus

The ratio of the market cap to GDP, which is a simplified version of the Buffett Indicator and something like the stock market’s total PS ratio, is 223%. That’s also more than two standard deviations higher than the ten-year average of 158%. These are scary figures and flashing red lights for a correction a la DotCom Bubble.

On the other hand, there’s an argument for both high PE ratios and Heico’s ability to weather a storm. AI-driven gains and America’s evolving monetary/fiscal position are bullish for the stock market and inflation, respectively. Additionally, HEICO may not suffer as much as other companies in an economic downturn.

There’s a (somewhat) reasonable argument that in a more bearish market, HEICO’s fundamental performance would suffer less than many companies. We accept that a Ben Graham approach to valuing companies is difficult in an age of everything-bubbles, a weakening dollar and unpredictable automation.

HEICO is an all-weather company that benefits both from a significant moat and a portfolio of high-quality firms that don’t directly compete.

However, the important caveat is that Heico is overvalued relative to all those overvalued sectors, as we discussed earlier in the report (Secular Growth?). The company’s extreme PE’s leave it virtually no margin for error, even when everything else is highly valued as well.

Regulatory Risks: Evolving Standards, Foreign Barriers to Entry

Heico’s most interesting moat is its insulation from competitors because of the expertise, precision, and certifications needed to operate in its industries. However, these same strengths can also potentially work against the company when it comes to organic expansion of its product line or geographic market.

We can see this in the fact that virtually all of Heico’s Flight Support Group sales, and especially its PMA segment, are based domestically. Additionally, Boeing is far and away Heico’s biggest industrial client. The company has steadily cornered the market for MRO and PMA services for domestic aerospace and defense clients, an effort that took years of steadily building up acquisitions and reputational capital.

This is difficult to replicate in new markets. For example, to the (unknown) extent that it has tried, Heico has been unable to replicate its business model with European Airbus. It does not have the regulatory privileges with Europe’s aviation safety authority (EASA) that it does with the FAA. This means that to boost growth overseas, Heico will have to either invest heavily in natively building the reputation and certification needed to replicate its domestic business model, or (more likely) would have to acquire companies that have that capital already.

Conclusion: A Powerful Company at Too High a Price

We love Heico for its disciplined approach to acquisitions, hands-off subsidiary management, and elite identification of an enduring, powerful moat. The company continues to perform well, and TTM earnings growth would actually justify its steep valuation if it continued indefinitely. Its fiscal situation is strong and healthy, providing the latitude to pursue acquisitions on its own timing and terms.

Our issue with Heico has nothing to do with its fundamentals. It’s a safe, strong company that will very likely continue growing earnings beyond the market average. To repeat a frequent refrain in today’s market, the issue lies with its current share price. With one of the highest PE-ratios for a firm of its size, industry and maturity, we cannot endorse opening a position.

In an overvalued market, it is wise not to buy at PE’s well above the prevailing rate, which is already near record highs. If you hold Heico, consider selling covered calls or starting to take profits incrementally at this price point. If you do not, then perhaps wait for the market to settle down, or the fundamental picture to meaningfully change, to open a position.

We appreciate your time in reading our Heico Deep Dive. We will continue tracking its performance and strategic evolution through periodic updates and implication reports available to subscribers.

Disclosures and Disclaimers

This report is for informational and educational purposes only and does not constitute investment advice, a recommendation, or a solicitation to buy or sell any securities. All opinions expressed reflect the author’s judgment as of the publication date and are subject to change without notice.

The author does not currently hold shares of Heico Corp. (HEI) but may initiate a position in the future without further notice.

For the full disclaimer, click here.

Copyright © 2025 Business Deep Dives. All rights reserved.

Business Deep Dives is an independent research publication operating on a pre-incorporation basis. All content is protected under applicable international copyright principles.