Interactive Brokers is a Wall Street Darling for a reason. With operating margins in the mid-80s, consistent 25% income growth over the past five years, and a massive war chest to weather any storm, it deserves the love. It owes this enviable position to a culture, driven by founder Thomas Peterffy since inception, of aggressive innovation across all workflow processes. First with Timber Hill and later with Interactive Brokers, Peterffy has transformed finance through computerization and a scientific approach, leaving the industry to catch up.

A more interesting question than “Is Interactive Brokers a great company?”, to which the answer is a confident “yes”, would be: “Is IBKR a buy at its current valuation?” This deep dive will seek to answer the more interesting question. While we love Interactive Brokers for many reasons, all of which we discuss and many of which point to the singular genius of its founder, we also see reasons that its pricey valuation could carry some underperformance risk in the near term. While bullish up to this point in 2025, and well rewarded for the thesis, we now think it’s wiser to hold, with an eye on what we expect to be an important leading indicator over the near term: interest rates.

Before diving into its risks, let’s give the company its flowers, and discuss a case study in fundamental performance.

Peterffy’s Obsession: Optimization through Automation

Interactive Brokers has some of the best operating margins, not only in the industry but in the entire stock market. Elite margins are never by accident; in this case, it’s the result of an obsessive focus on operating efficiency, from its inception into today. More than a passion for financial markets or capital allocation, it seems that using computers to optimize business processes is what drove the founder’s focus and the company’s meteoric rise.

When it comes to the American Dream, Thomas Peterffy, a Hungarian immigrant who started in America with no English and $100 to his name, is the exception that proves the rule. Before moving into finance, Peterffy taught himself computer programming, since machine and software code were easier languages to learn than English. In the style of other great business minds like Henry Ford and Frederick Taylor, Peterffy was laser-focused on maximizing yield on capital and labor. You may not have heard of Frederick Taylor, but based on how Peterffy describes his business journey, I’d be willing to bet that he has.

Thomas Peterffy, Founder/Chairman of IBKR

Image Source: Forbes

Taylor coined the field of scientific management. His philosophy for business optimization, for achieving the zenith of effective management, was centered around four principles. He described the ultimate manager as such:

1) “They develop a science for each element of a man’s work, which replaces the old rule- of-thumb method.

2) They scientifically select and then train, teach, and develop the workman, whereas in the past he chose his own work and trained himself as best he could.

3) They heartily cooperate with the men so as to insure all of the work being done in accordance with the principles of the science which has been developed.

4) There is an almost equal division of the work and responsibility between the management and the workmen. The management takes over all work for which they are better fitted than the workmen, while in the past almost all of the work and the greater part of the responsibility were thrown upon the men.”

The writing is a bit dated; 1910 was a long time ago, and treating “workmen” as faceless widgets in the production function hasn’t aged well. That being said, Peterffy is an exemplar of these core principles at work, and IBKR’s performance over the past thirty years is proof of that.

Rule #1: Develop a Science…

For one, there isn’t an aspect of financial markets, first as a market maker with his company Timber Hill and later as the head of Interactive brokers, that Peterffy didn’t transform through process optimization. His first independent project in finance was founding TImber Hill, a market-making company, in 1977. Not surprisingly, he applied his knowledge of computer programming and algorithms to the business of finance, something no major firm was really doing at the time.

Market makers essentially try to find the equilibrium price between buyers and sellers in order to “make a market” for them, pocketing the “spread” or difference between the buy and sell price. It can be a lucrative business, but the market maker’s risk (and upside) can increase during times of volatility. It’s a business where utilizing data and rigorous, disciplined systems are going to provide an advantage.

Two years after Timber Hill’s founding, it became the first market maker to use fair value pricing sheets on the stock exchanges floor. Today, it is surprising that a rational, methodical approach to valuing stocks and options would have taken so long for the trading floor to adopt, but it revolutionized the profitability and risk profile of making a market. While other traders essentially relied on emotion and instinct, Timber Hill’s traders referenced a simple formula, similar to a Black-Scholes Model, to determine fair prices and safe spreads for options, stocks, and other assets.

As he explained in a 2022 interview with Motley Fool, describing his process for pricing options in the 1970s:

“I decided the best thing for me would be to computerize the process. I started to put down computer screens on the floors that would continuously state these fair prices. Bids that were slightly under the fair price offers. Slightly over the fair price. And I told my people to buy as much as they can underbid and sell as much as they can on the offer and the time of difference in between was our profits. That worked well.”

To reiterate, this was in the 1970s and was light-years ahead of its time for the securities market. This story presents a metaphor for Peterffy’s instinct to boil the opaque, personality-driven world of financial markets into its key components, reducing costs and risks to the minimum possible. In 1983, Timber Hill created the first handheld computers used for trading on the floor of a stock exchange. These computers, while of course clunky, helped to quickly calculate the fair value formulas that had provided an edge.

On the Chicago Options Exchange, his handheld computers could calculate a fair options price as the real-time price, and other technical data, of the underlying asset changed. They provided such an advantage that the CBOE banned “analytical devices” on the trading floor for some time in the 80’s. While rarely described in company with Steve Jobs and Elon Musk, Peterffy was a true visionary, the first to see how computers could optimize financial markets by instantaneously incorporating new information into pricing models.

In 1987, he built the first algorithmic trading system, writing and implementing the code for the program himself. Again, in 1987! That is about two decades before algorithmic and automated trading would become mainstream tools. Once again, securities exchanges briefly banned algorithmic trading, which Peterffy successfully lobbied to reverse.

In 1993, Peterffy founded Interactive Brokers as a broker-dealer to handle Timber Hill’s order flow and offer brokerage services to other institutional customers. While no longer taboo or totally new, Interactive Brokers continued to expand over the years through algorithmic, computerized trading solutions.

Hearty Cooperation, Active Management

Revisiting Taylor’s other principle of scientific management:

“They heartily cooperate with the men so as to insure all of the work being done in accordance with the principles of science… The management takes over all work for which they are better fitted.”

Frederick Taylor would approve: Peterffy certainly “heartily cooperated” with his team, from its earliest days as a market maker and brokerage. He chose and developed his team with such success that much of the executive office in 2025 joined the company in the Timber Hill days.

Many of the company’s leaders, like Peterffy, are scientists before financiers, with backgrounds in physics and software development.

Backed by a likeminded and well-trained team, he developed a science for market-making at a time when intuition and social connections were way too central to the trader’s toolkit. Rather than delegating work that he could do better, he wrote and implemented the algorithmic trading systems that would herald the future of automated trading.

Steve Sanders, an early team member, lauds Peterffy in a recent interview:

“He encourages you to include just the relevant people to make a decision… and he has a rule that any analysis (we provide) must have an actual action on it.”

Sanders goes on to explain that “He’s always doing what’s ethical, what the fair thing is to do.” In the at-times predatory world of high finance, that’s a rare quality in a leader, and helps to explain the exceptional longevity of his core team. It has been a source of Interactive Brokers’ success since the early years of Timber Hill and its eventual spinoff of the trading platform.

Over the years, Peterffy has proven the wisdom of the system. Timber Hill and later Interactive Brokers are built on a culture of engineering and optimization. As a market maker, the company obsessed over reducing risk and latency to maximize the alpha of arbitrage. As a brokerage, it has automated its processes and reduced bureaucracy to the minimum extent possible, with a hyper-focus on investing in capability and functionality over needlessly complex org charts or marketing frills.

First to the Future

To recap, here some of Peterffy’s pioneering achievements in finance:

First market maker to use fair value pricing sheets on the stock exchange floor (1979).

First to computerize the valuation process in options trading, using screens to continuously display fair prices.

Created the first handheld computers used for trading on the floor of a stock exchange in 1983.

Built the first algorithmic trading system in 1987, implementing the code for automated trading well before it became mainstream.

Founded Interactive Brokers as a broker-dealer to handle order flow and offer brokerage services, which emphasized algorithmic and computerized trading solutions.

Providing this backstory, covering decades of accomplishments and lauding quotes from Peterffy’s employees, isn’t to introduce a puff piece about the 81-year old founder, who still essentially controls Interactive Brokers. There are plenty of those, and his respect is due, but we’re trying to convey something else.

In assessing Interactive Brokers, we need to convey the unique innovative success of Peterffy’s company, the longevity of his executive team (which we’ll discuss later), and IBKR’s current market dominance as a product of his genius and the culture he created. His approach to business, to operational efficiency, to finance, and to leadership have defined IBKR’s journey from its inception. That inspires confidence for the company’s continued leadership, and it flags potential risks that could come with his departure. As we discuss below, the proof of Peterffy’s genius is in the pudding.

Fundamental Analysis: Solid as a Rock, Pricey as a Diamond

We’ve covered Peterffy’s Hero’s Journey, and you’re likely convinced that the man brought us the future before most, or any, financial executives were even ready to accept it. It’s time to crack open the financials and see how Interactive Brokers looks in 2025.

In taking a look at Interactive Brokers’ fundamental performance, we’ll focus on the following key points:

Growth and margins remain strong. True to company roots, automation throughout all workflow processes make IBKR one of the most efficient brokerages (and companies) in the world.

We’ll break down and describe IBKR’s business model, its main revenue segments, and their contributions to top and bottom-line performance.

We then take a look at some balance sheet metrics. Spoiler alert: the company looks great from a solvency and liquidity standpoint. Virtually all historical growth has been profit-driven, with little equity or debt financing to speak of.

As Peterffy would advise, we apply some basic fair pricing models to IBKR’s growth in cashflow and earnings to attempt a rational assessment of its current valuation. We conclude that while the company’s a diamond, it’s also priced like one.

Growth, Margins Remain Remarkable

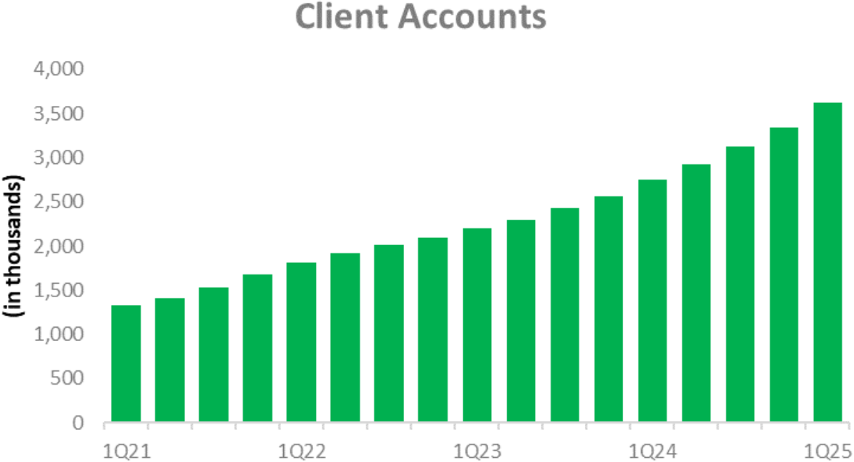

Interactive Brokers has some of the best margins not only in the financial services industry, but the stock market at large. The company’s operating margin has remained steady around 85%, and it continues to attract new users at a strong clip. Trade volume and equity held on the platform continue to increase, and it continues to establish relationships with new brokers, particularly overseas brokers seeking advanced access to US equity markets. It continues to grow quickly, expanding its product offering and adding new brokerages to its order flow. It is the dominant player in terms of performance, efficiency, and growth.

Source: Company Presentation

Per the company’s Q2 earnings call,

“This quarter we added 250,000 net new accounts, bringing our year-to-date total to over 528,000 – more than we added in all of 2023. Our application processing is highly automated and continually becoming even more so, allowing us to handle surges in new accounts efficiently, without adding significantly to our headcount or cost base.”

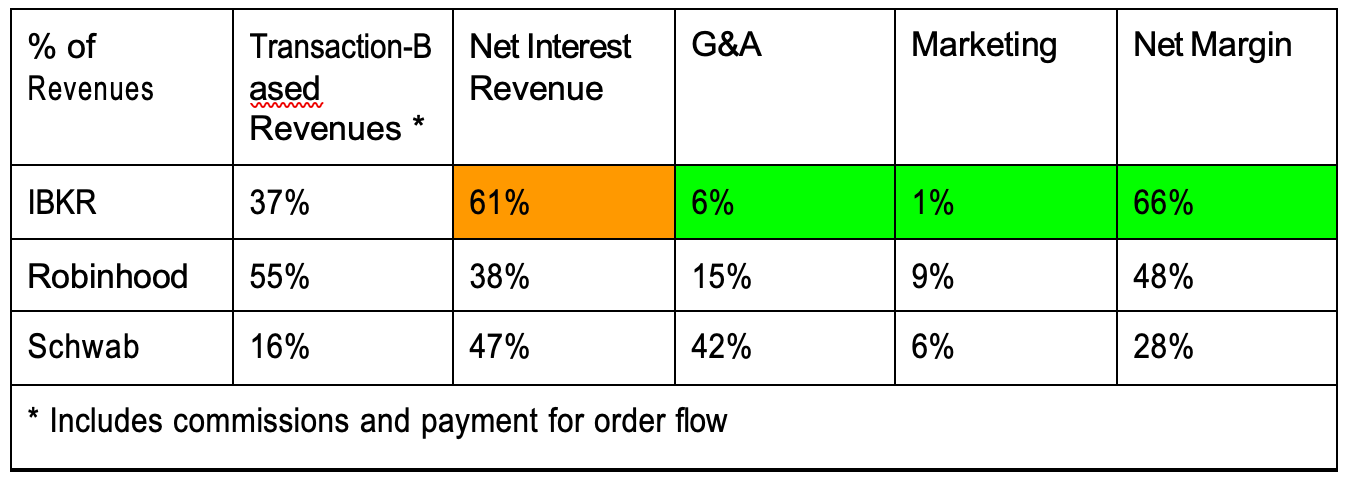

The well-worded comment highlighted the two factors that make Interactive Brokers one of the most highly coveted stocks on the market. Its growth appears unstoppable, and it continues to be one of the most efficient brokerages in the arena. It blows Schwab, Robinhood, and any relevant competition out of the water when it comes to operating efficiency, from gross margins to revenue per employee.

The table above shows how Interactive Brokers stacks up against major competitors Schwab and Robinhood, in terms of its revenue mix and operating efficiency. As you can see, Interactive Brokers runs an incredibly lean operation, spending a tiny fraction of its competitors’ budgets on marketing and general expenses. We’ve highlighted the numbers we like in green, while net interest revenue is highlighted in orange to convey its potential overexposure.

While Schwab, a behemoth whose income statement is more tilted toward its management and advising business, spends 42% of revenue on G&A, Interactive Brokers spends just 6% on general and administrative costs. That is an incredible number. Similarly, while Robinhood’s revenue and account growth is owed to spending 10% of revenue on marketing, IBKR is able to achieve similar growth while spending just 1%.

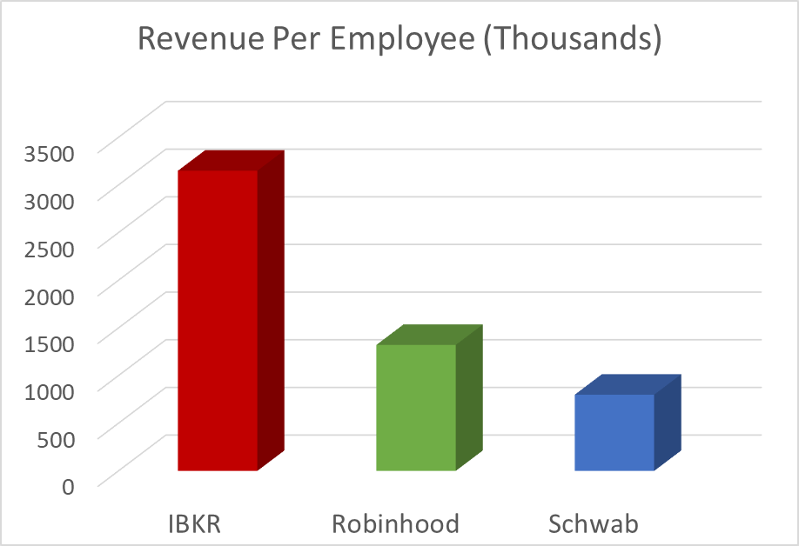

Source: Company Filings

Unsurprisingly, given its elite yield on SG&A, Interactive Brokers enjoys massive revenue per employee of roughly $3 million. That is nearly six times better than Schwab, and nearly three times better than Robinhood. As he often confirms in interviews, Peterffy has long obsessed over how to achieve the best possible product with the fewest possible people. He loathes bureaucratic bloat, and that has stayed evident in the balance sheet even as IBKR grew to blue-chip size.

These figures obviously bode well for the company, but they remind us that IBKR doesn’t have much further to go in terms of operating efficiency. Administrative blobs like Schwab may gain more from automating customer service, accounting, and other internal operations than a mean, lean machine like IBKR.

Business Model and Segment Performance

Core Business Model

Interactive Brokers (IBKR) is a global, multi-asset, electronic broker-dealer whose model combines trading & clearing services with interest income, securities lending, and ancillary fees. The firm serves professional, institutional, and active retail clients around the world. IBKR is unusual in how its revenues are diversified, and how much of its topline performance is powered by its balance sheet and client asset base, rather than commissions alone.

Product Offerings & Client Segments

IBKR provides a broad set of product offerings across many asset classes and services. Key services and differentiators include:

Trading & Execution / Clearing: Equities, options, futures, bonds, currencies, funds/ETFs.

Global access: clients can access 150+ markets / exchanges globally. This is a major differentiator, giving IBKR a strong presence in

Clearing services for institutional/professional clients (i.e. post-trade processing).

Data- IBKR has a robust analytics-as-a-service segment, which provides both data analysis tools and raw data to sophisticated institutions and traders. (While a meaningful differentiator and loyalty driver, these solutions directly comprise a very small percentage of company revenue.)

Account Types / Pricing Tiers:

IBKR Pro: for frequent, professional and active traders.

The Pro tier has more pricing structure complexity, lower commissions and more favorable interest, both for margin loans (lower rates) and account balances (higher earnings). While traders pay a commission per trade, the pricing structure for Pro rewards higher volume, larger trades.

IBKR Pro’s main differentiators are the efficiency of trade execution and the ability to use APIs for trading. The Pro feature enables SmartRouting, which searches multiple markets for the best possible price. It also allows trading from 4am to 8pm Eastern time, while Lite users can start trading at 7am.

Additionally, the Pro tier offers API support, which is a must-have for algorithmic traders. IBKR sets itself apart on its automated trading support (unsurprising since Peterffy was the first person to do it), so this is a must-have for institutional and active traders.

IBKR Lite: commission-free on U.S. stocks/ETFs; more simplified offering.

This meets demand from most retail clients, burying commissions in the spread and order flow revenue, and rewarding smaller trades. It is also generally the best fit for financial advisors and wealth managers, since they tend to make relatively few trades based on fundamental analysis.

Other Platforms & Tools (GlobalTrader, etc) : targeted at more amateur / mobile / international users.

GlobalTrader is gradually becoming a significant revenue and growth driver as IBKR continues to consolidate its presence in the European and Asian markets.

Revenue Generators

Interactive Brokers’ core sources of revenue can be broken down into two broad categories: transaction revenue and earnings on custodized assets.

Earnings on custodized assets mostly take the form of interest revenue, and any other earnings that IBKR gets from taking (prudent) risks with the assets that customers hold in their account, such as equities and cash. Transaction revenue is the money that Interactive Brokers earns for making trades on behalf of clients, in the form of commissions and payment for order flow.

As we discuss in detail during this deep dive, net interest income is the largest single revenue component. Net interest comprised 61% of the company’s revenue in 2024, up from 54% in 2022. Most of the growth in interest income is driven by larger client equity on the platform, but some of it is due to higher interest rates.

Commissions remain meaningful, especially with increased volumes (equities, options, etc.). Commission growth in recent quarters has been strong—IBKR reported commission revenue of about $516 million in Q2 2025, up ~27% YoY.

Other fees and “other services” make up smaller, but non-trivial, slices of revenue; these include market data, FX, clearing/execution fees, etc.

Commissions and Order Flow Revenue (~40% of Revenue)

Like any brokerage, even those with “commission-free” models, IBKR makes money when clients make trades on their platform. Contrary to what one may expect, IBKR charges commissions on its high-end users’ trades, while offering most retail investors a commission-free fee structure.

Since big fish make big (and frequent) trades, they are okay with paying a flat fee structure for their activity. Smaller retail investors, on the other hand, are more drawn to the “commission-free” model, as evidenced by the definite industry shift toward that pricing model over the 5-10 years. Individual stock prices for IBKR-Lite users have wider spread between bid and ask, effectively hiding the commission and indeed making it a better deal for small trades, such as spending $2,000 across three different stocks.

Ultimately, the retail investors pay a higher percentage by losing more of the “spread” to IBKR, while Pro clients pay a small transaction fee, but pay a lower spread between the bid and ask prices. As a percentage of total trade volume, Pro is certainly worth it for big fish, and offers one of the best fee structures in the industry for active and institutional traders.

The company earns about 40% of its revenue from transactions made on the platform. The figure varies slightly, with higher volatility generating more transaction revenue as investors adjust their positions to hedge or speculate. The consistent trend, especially since 2022, has been for net interest income to grow as a percentage of company revenue.

Margin Lending & Interest-Earning Assets (~60% of Revenue)

More than commissions and order flow revenue, this has been IBKR’s main revenue driver since the most recent round of quantitative tightening began in 2022. IBKR charges interest on customer margin loans, as well as customer cash balances.

Money that clients leave idle (or cash collateral) is an asset that IBKR can invest or place in interest-earning vehicles. Income from segregated cash + interest on cash collateral are important sources of revenue. As client accounts and client equity grow, so does IBKR’s net interest income.

Net interest income is the company’s main revenue driver, as we’ll discuss in detail in the Risks section.

Securities Lending / Stock Yield Enhancement:

When clients hold fully paid shares, IBKR can lend these shares to short sellers or other counterparties. The client typically gets a rebate on the cash collateral; IBKR earns interest spread on the collateral and demand-driven lending “premium.”

There are also securities borrowed / securities loaned programs connected with customer margin / short positions.

Other Fees, Services & Ancillaries:

Market data fees: clients who want real-time or premium data pay subscription or access fees. This typically meets demand from professional traders and institutional clients.

Execution, clearing, and regulatory / exchange / routing fees. Some “other services” line items that include miscellaneous fees.

Foreign exchange (FX) – since IBKR supports trading in many currencies, there is revenue from currency conversion, spreads, etc.

Crypto & prediction contracts: newer product offerings (binary/event trading) and crypto in certain jurisdictions.

Key Drivers of IBKR’s Financial performance:

Client Equity / Account Growth: More accounts, more equity balances, more idle cash → higher interest income, higher potential for commissions.

Interest Rate Environment: Very important for NII—when interest rates are higher, the spread between what IBKR can earn on customer funds / loaned cash / margin vs what it pays to depositors etc. is wider. Conversely, low rates compress margins. IBKR’s NIM (Net Interest Margin) has moved meaningfully over time.

Trading Volume & Market Activity: More trading leads to more commission revenue, more activity in derivatives and futures, more FX conversion, etc. Volatility often increases trading volume.

Automation & Cost Structure: IBKR has invested heavily in technology & automation. That means incremental revenue from trading / new accounts scales with relatively less incremental operating expense. This gives operating leverage.

Relative Segment Performance:

Commissions Versus Interest

Net interest income has gradually come to eclipse commissions over the past few years. This is partially due to an industrywide “race to the bottom” on trade efficiency and fee minimization, as well as the bump to interest revenue that came with quantitative tightening.

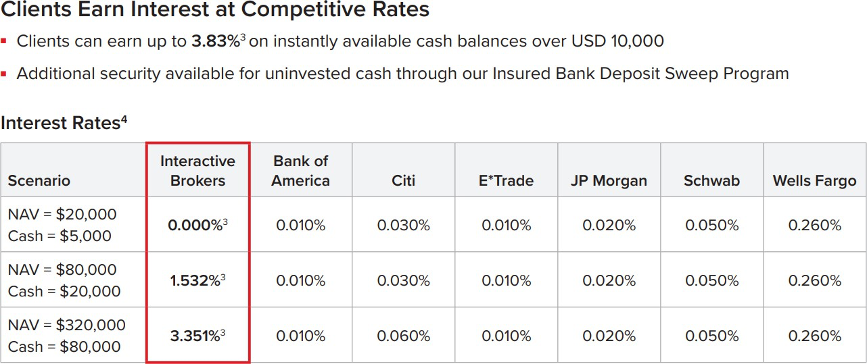

To keep capital on the platform, IBKR rewards investors with some of the best interest rates for cash and stock lending, which leads to ever-expanding client equity.

As the company reports, IBKR offers some of the most attractive incentives for keeping capital, including idle cash, on the platform. It also offers some of the most advanced features and lowest costs for large and frequent trades. Attractive rates for large balances and low costs combine to attract big fish.

While we fret about the potential for near-term interest rates to dampen relative earnings and stock price performance, most of IBKR’s success on the interest rate front is due to its massive stash of client equity. The company has the largest client equity (and therefore revenue) per client account of any brokerage that we reviewed, including Robinhood and Schwab’s brokerage service.

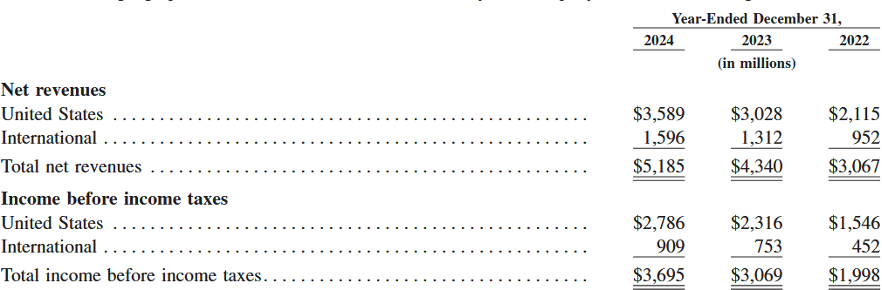

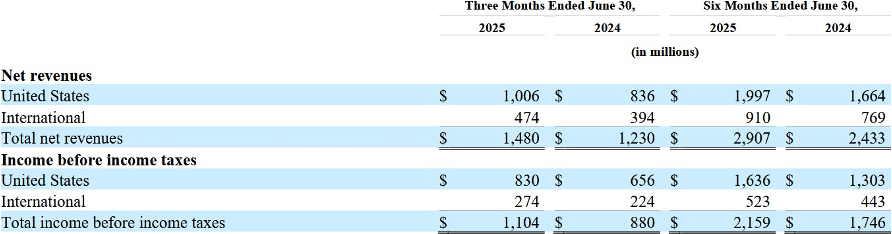

International Revenue

Source: 2024 10-K

Interactive Brokers established itself as an international broker early on. International revenue slightly outpaced US revenue in 2024, growing 20% versus 18%. While IBKR does not often publish a precise regional breakdown, it has long focused on Europe as a location for expansion, given Peterffy’s Hungarian roots and European financial markets’ early adoption of computerized trading solutions.

Asia and Europe will continue to be the main drivers for IBKR’s foreign performance. They provide the company with a strong hedge against both the highly competitive American brokerage market, and the highly volatile American dollar.

One of the most attractive features that IBKR’s platform offers is access to a massive portfolio of foreign equities. According to the company, through IBKR GlobalTrader:

“Customers can deposit in their local currency and trade stocks at 90+ exchanges and options at 30+ market centers around the world. Customers can also trade select U.S. ETFs around the clock, plus cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum and Litecoin, all from their mobile device.”

We expect its global presence to continue to be a major differentiator for IBKR compared to other US brokerages, particularly in Europe.

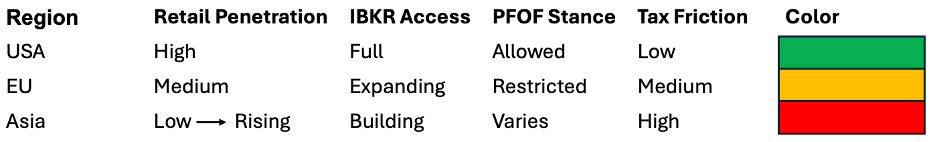

International TAM & Regulatory Overlay

*Green/Amber/Red = Relative Ease of Growth

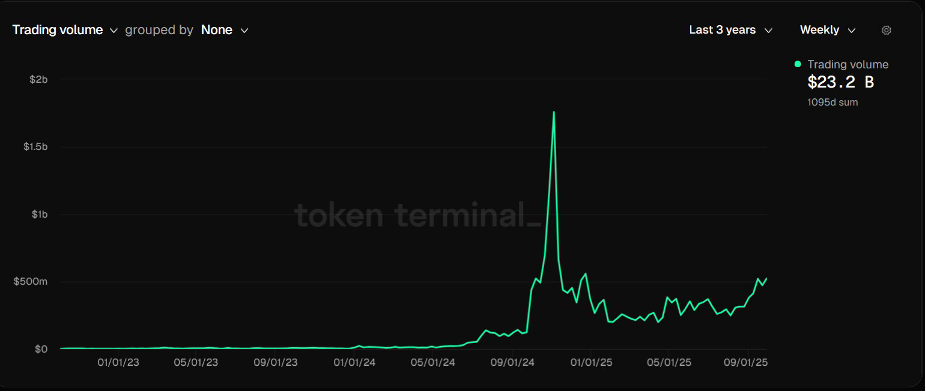

Emerging Segments: Crypto and Prediction Markets

Though not the leader in either space, IBKR is rolling out solutions for cryptocurrency exposure and for participating in prediction markets.

As we discuss in the Risks and Opportunities section, IBKR will likely have to tap into these nascent markets to maintain its impressive account growth. Younger investors, and increasingly institutional players, lean on cryptocurrency and prediction markets not only as important signals for the performance of other assets, but as viable sources of alpha.

While just entering both spaces, and keenly aware of the regulatory and execution risks (cryptocurrency is mentioned about 60 times in the “Risks” section of a recent filing), IBKR will benefit greatly if it can find leadership in either asset class.

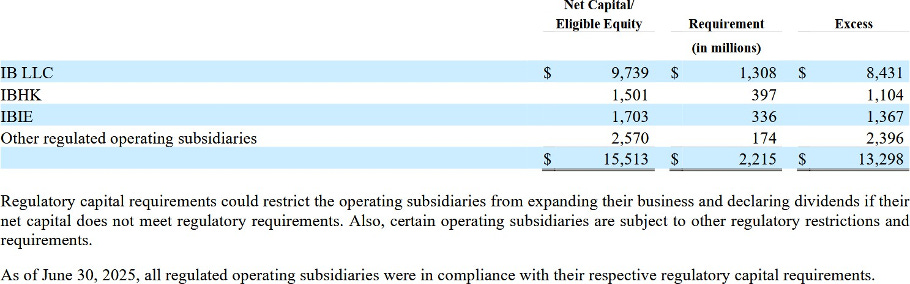

Balance Sheet: Safe, Strong, and Impressive

Interactive Brokers has a beautiful balance sheet, though it might confuse people who aren’t accustomed to brokerages’ financial statements. As we also discuss in the next section, it can be difficult to apply more conventional financial ratios to financial firms like IBKR, since so much of their balance sheet consists of assets and liabilities that they hold for customers.

For example, Interactive Brokers’ total assets is more of a measure of its client equity than of assets that it really owns. The company holds about $4.7 billion in “real” cash that it can use freely, with the other $180 billion of financial assets on its balance sheet either owned by customers or segregated for regulatory purposes. This is 30% more such cash than it held at the beginning of the year.

Things like quick ratios are less informative as well, since a large component of company “payables” simply describe its duty as a steward of customer assets, like deposits in a bank. As its massive operating margin would suggest, the vast majority of its payable and receivables are respectively due to and from customers, with securities and cash serving as collateral for both sides of the ledger. Payables for actual expenses comprised less than $700 million at mid-year, which cash on hand could easily cover.

As long as the company manages its capital responsibly, this is a very safe situation. Happily, it does, in excess of regulatory requirements.

Source: Q3 2025 Filings

As an FDIC and Basel-compliant company, Interactive Brokers is subject to capital reserve requirements. The chart above shows that IBKR’s capital reserves are well in excess of requirements.

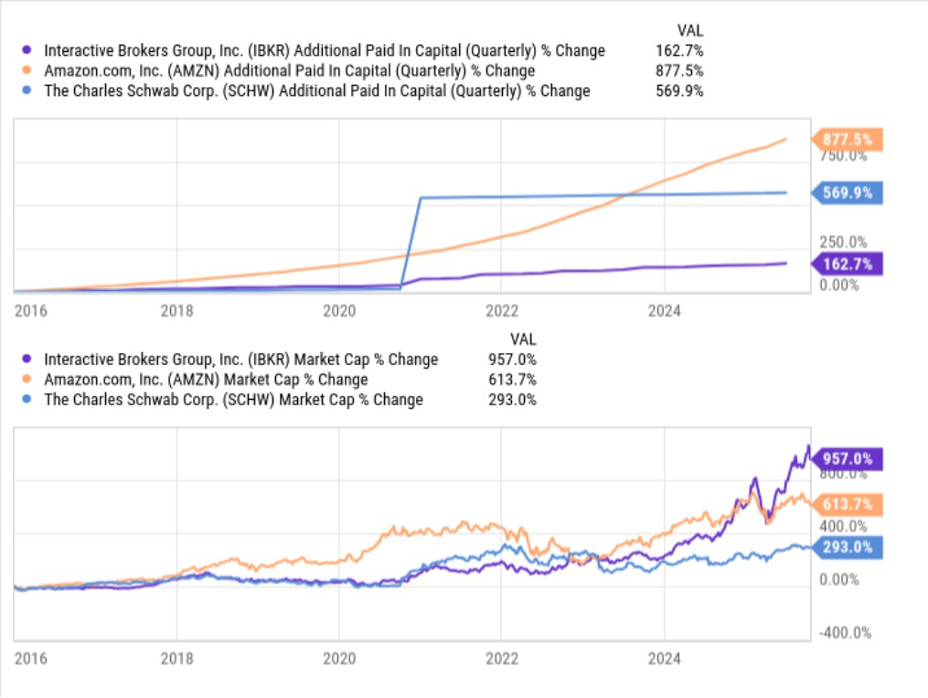

Over the past ten years, IBKR has managed to grow its market capitalization by nearly 1,000%, while growing its fundraising base by 162%. In other words, it only raised about $1 billion over the last ten years from investors, while generating some of the best stock price returns of any company on the market.

The chart above compares three successful companies from the past ten years. The key difference between them is that while Amazon needed to hit up investors on a near-constant basis to finance its massive growth, raising over $100 billion since 2016, IBKR has achieved better share price returns while only raising about one billion from shareholders.

Frankly, it is remarkable to see a company grow so exponentially while maintaining such a conservative approach to financing. Virtually all of the company’s growth and investment have been financed by retained earnings. As the company states in its filings:

“Historically, our consolidated equity has consisted primarily of accumulated retained earnings, which to date have been sufficient to fund our operations and growth.”

These retained earnings are not being invested in luxury offices or other fixed capital expenditures. In fact, Another item that is conspicuously absent (or negligibly small) on the balance sheet is “Other Assets” the sum of all assets that are not cash or financial instruments. This figure was $1.3 billion in Q2, compared to total financial assets of roughly $180 billion.

However, even that overstates capital expenditures, as much of this figure includes speculative investment and R&D compensation for its software development team.

IBKR is able to do with its own profits what almost every other industry leader, from Facebook to Amazon to Google, needed massive debt and/or equity financing to achieve. It has virtually no debt, and equity fundraising is less likely to dilute the stock than most other competing firms, since it grows at the speed that retained earnings allow.

As a result, the balance sheet is rather boring, as there is no compelling solvency or liquidity risk to deeply explore. Its liabilities are composed almost completely of payables to customers (stocks and cash that customers hold in IBKR accounts), rather than outside debtors. Short term borrowing constitutes a rounding error on the balance sheet, and it has no long-term debt.

As is true of any industry in 2025, particularly one that relies on digital solutions, whether it keeps this dominant position in the near and medium term is not guaranteed, to say nothing about long-term leadership. One reason for concern regarding price performance is just how amenable the current competitive and macroeconomic environment has been for the company, whose stock price has returned roughly 40% this year.

DCF Valuation

Financial firms like Interactive Brokers can be a bit challenging to value by conventional means. In the case of Interactive Brokers, is it very important to note that public shareholders only own about a quarter of the company, so all valuation analysis needs to take this into account. We’ll discuss that more below, but first, let’s focus on the perils of cash flow analysis.

If we value Interactive Brokers based on free cash flow, the company looks like even more of a money-printing machine than it is. For example, the company’s price-to-free cash flow currently sits at 0.4, while free cash-flow was $33 billion over the past 12 months. Taking those numbers at face value, it would be a crime not to put every egg in the IBKR basket.

Of course, given the company’s business model, cash flow is more a measure of client account growth than cash generation. IBKR’s unrestricted cash, meaning cash that isn’t tied up in client accounts and truly belongs to the company, is around $3.6 billion and doesn’t change very much from year to year. For example, at the end of 2022, cash and equivalents was $3.2 billion. Solid cash management, but not a good reflection of the company’s performance.

A better metric for valuing the company is its earnings growth. Growth in earnings over the past three years has been fairly stable around 25%, which roughly mirrors account growth.

While pretax margins of ~70% are hard to beat, we expect margins to slightly improve, given the company’s recent success adding new accounts with little additional spend, which has boosted net margins in every year of the 2020s.

(All figures in thousands)

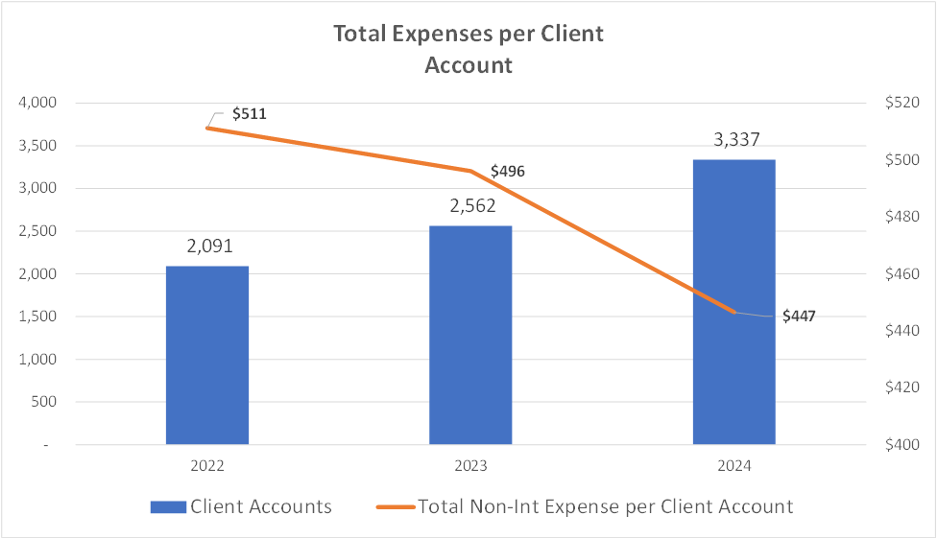

Thanks to possibly the slimmest SG&A spend in the industry, the company’s non-interest expenses per client account continues to fall at an accelerating rate. We won’t attempt to predict the level at which it stabilizes, but it seems safe to assume that the figure will continue to fall for at least another year or two.

This makes it easier for us to price in 30% average growth in earnings per share, which accounts for increased net income per client account to offset a potential future slowing in account growth. With that figure, we add the following assumption:

A 6-year time horizon of on-average 30% growth in earnings;

A terminal growth stage (10 years) of 4% annual growth;

A discount rate of 9%;

A current book value of $11 per share, comprised mostly of retained earnings.

When we plug these figures in, we find a fair value of $65, implying a slight market overvaluation of roughly $5. We are inclined to agree with that assessment, and it’s worth noting that IBKR has gained $24 (52%) since the beginning of the year. It is reasonable to call a great company a hold after the price has gone up so dramatically.

Flying in the Goldilocks Zone

The company has had a fantastic year by any metric, and its stock appreciation reflects that. However, it is worth noting that broad macroeconomic conditions for the company have been near-optimal as well.

Since 2023, interest rates have been high while the stock market has generally soared, a boon for companies whose revenue and capital bases are largely driven by interest rates and equity valuations. Increasingly, IBKR is that kind of company. Interactive Brokers now derives more than half of its revenues from net interest income, thanks in large part to quantitative tightening. That makes it deeply sensitive not only to prevailing interest rates, but investors’ appetite for margin.

Ownership and Compensation Structure

Level of Insider Ownership: Yes

If insider ownership is a green flag, IBKR certainly makes the cut. Founder and Board Chairman Thomas Peterffy still owns most of the company (roughly 68%) and remains deeply involved in strategy and operations.

When the company went public, the vast majority of its equity remained privately held, primarily among founders and early employees. The company spun off a public entity that owns a 26% stake in Interactive Brokers (Interactive Brokers Group, Inc.). The remaining 74 % of IBG LLC is owned by IBG Holdings LLC (“Holdings”), a private firm that houses most of the insider holdings, nearly all of which still belongs to Peterffy.

Holdings allocated to the public entity are categorized as Class A common stock (publicly traded, ticker IBKR), providing one vote per share. The private entity’s (IBG Holdings) shares (91% of which are still owned by Peterffy) are allocated as Class B common stock (not publicly traded). Each Class B share carries voting power proportional to Holdings’ 74 % economic interest in IBG LLC.

In other words, it remains Thomas Peterffy’s world and we’re all just investing in it. This is a testament to his belief, personal stake, and continued involvement in one of the most successful companies of the past thirty years. It also presents some potential “key man” risks for the octogenarian.

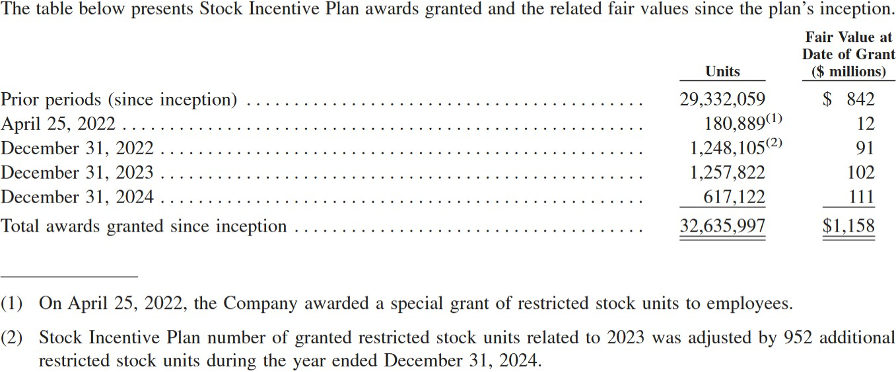

Stock-Based Compensation

The following excerpt is from the 2024 10K:

In 2024, for example, the company rewarded about $111 million worth of equity and/or options to employees through its stock-based compensation scheme. This is a fairly tame figure compared to its 9-figure revenue and income statement figures. However, the seemingly innocuous figure warrants extra attention, given how the unique ownership structure of the company.

Source: Company’s 10-K

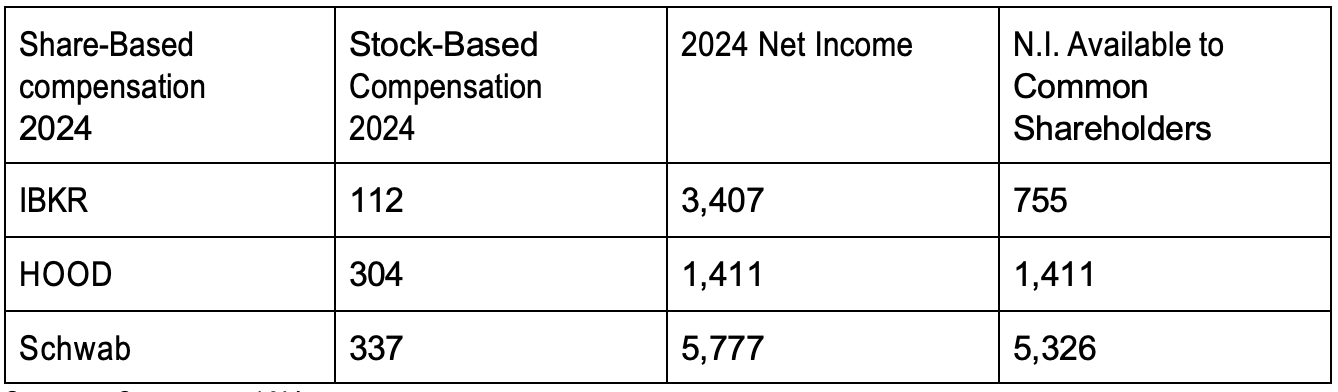

At a glance, Interactive Brokers compares favorably to Schwab and Robinhood in its stock-based compensation as a percentage of net income. IBKR, Robinhood, and Schwab paid out 3%, 21%, and 6% of 2024’s net income in stock compensation to its employees, respectively.

The issue is that the vast majority of income generated by Robinhood and Schwab is available to its shareholders, and the dilutive effect of awarding stock is also shared across the company’s total equity. Interactive Brokers, on the other hand, is still primarily held by Peterffy and other insiders through its Holdings company. Any dilutive action, such as employee stock compensation, stock splits, or new issuances, is drawn exclusively from the 26% public stock.

Its unique ownership structure means that only 26% of IBKR’s income is available to common stockholders. It also means that all stock-based compensation only dilutes the 26% of company equity that is held by the public. This looks rough for shareholders when compared to Robinhood, whose shares are 100% held by the public entity, which means every dollar of net income is available to common shareholders. The same is nearly true for Schwab, for which the figure is 92%.

Translation: for every dollar that Robinhood and Interactive Brokers dole out as employee compensation, the dilutive effect on total public stock is roughly four times higher for Interactive Brokers.

It is important to keep in mind IBKR’s unique organizational structure for a number of reasons. Company stock has a much higher exposure to dilution than companies of similar size, since public shareholders bear roughly four times the dilutive effect of a company which is entirely owned by its public entity. Additionally, as we’ll discuss below, voting rights are entirely held by the private Holdings LLC, which in turn is owned entirely by one man: Thomas Peterffy.

Assessing Risks and Opportunities

In assessing risks that IBKR faces, we’ve broken down some structural and near-term risks. The largest structural risk that we see is the inevitable departure of the company’s main brain from all company decision-making. We are also aware of the changing nature of the industry, which could put new competitive pressures on the firm in the face of automation, falling commissions, and competition for order flow.

We’ll devote particular attention to the company’s Key Man risk, and as we consider it the most relevant to relative stock price performance in the near term, to interest rate risk as well.

Strategic Risk (and Opportunity): Blockchain, Prediction Markets, and Everything Else

Peterffy’s departure comes as huge changes approach the world of finance. Interactive Brokers has made major pivots over its history, leaning on digital solutions and other human-less systems to reduce risk and increase efficiency. It pivoted from market-making and price discovery to a central focus on its brokerage and analytics platforms. In 2019 it pivoted again from a commission-based fee structure to interest revenue and payment for order flow, after the industry consolidated a move toward zero-fee trading.

The massive automation of the market, as well as the ascendance of new technologies, including decentralized financial tools like cryptocurrency, other blockchain-based instruments like stablecoins, and predictive betting markets which bring their own implementation opportunities and challenges, could be tailwinds or headwinds for IBKR. To varying extents, the company has rolled out solutions to accommodate those instruments on its platform, but it still has to leap the competitive and regulatory hurdles that each emerging market will present.

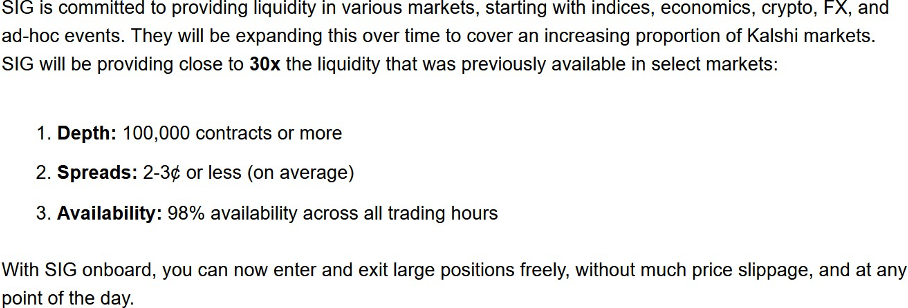

Blockchain and prediction markets present IBKR with massive potential upside. Prediction markets offer some very attractive spreads; betting market Kalshi, for example, reports spreads of 2-3 cents (essentially 2-3% or 200 to 300 basis points) on its most liquid contracts. This is huge compared to the relatively tiny spreads that market makers receive for traditional financial instruments like stocks, and much higher than spreads in highly liquid options markets as well.

This excerpt shows Kalshi lauding its 2-3% spreads on its most highly liquid binary-outcome contracts (this would include massive, highly capitalized events like federal reserve rate changes or federal elections). It is easy to imagine a well-capitalized, highly optimized platform like IBKR disrupting this nascent market. However, as predictive markets grow, and IBKR’s position remains minor, it is also feasible that another major platform could draw institutional and retail investors away from an abundant new source of market-making and interest revenue.

International Opportunity

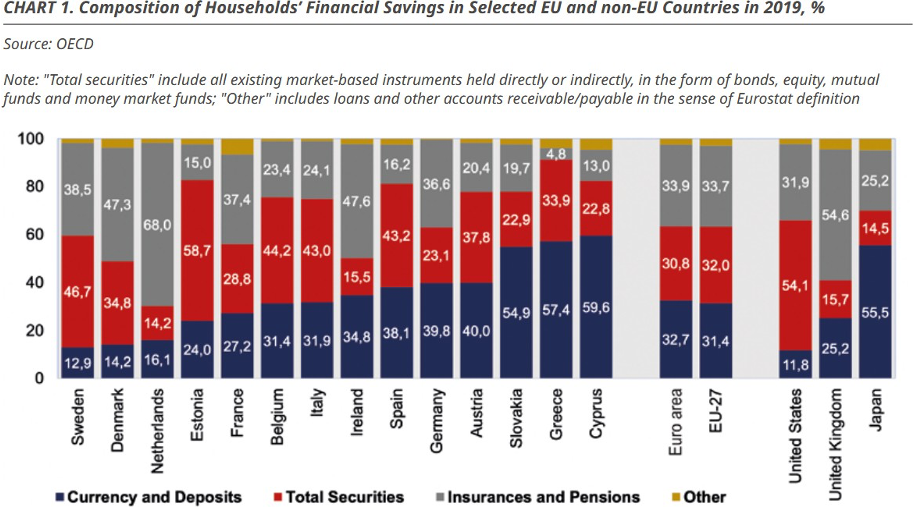

Brokerages have a much higher penetration rate among US households than in Europe and Asia. As IBKR moves to make international securities, particularly US securities, available to a global market, Asia, Europe and the Middle East represent a more nascent market.

Source: EuroFi

As the chart above shows, only about 32% of European households own equities or other market-based instruments, with large variation between individual countries. Pensions and cash see a much higher representation in Europeans’ savings accounts. Part of the reason for this is that Europeans are more likely to enjoy a structured pension and other robust safety nets, rather than relying on their investments for income as they enter retirement.

This is a much more structurally embedded tendency than, for example, the penetration level of ecommerce or mobile banking. That makes it difficult to predict the extent to which IBKR or any other brokerage can move the needle. However, Interactive Brokers may have the wind at its back in attempting to woo European and Asian households.

As defense spending increases, many European countries will likely see increased pressure towards austerity and reduced social spending. Several think tanks and journals note that to some extent, defense spending will need to come out of social welfare budgets, which will likely include pensions. That may incentivize Europeans and some Asian states to more aggressively pursue returns on their savings in the form of equity investing.

Source: IBKR Q3 10Q

To date, IBKR’s international revenue growth has mostly tracked its US operations. For example, international revenue growth by 18% YoY in the first half of 2025, versus 20% for the US. However, margins are consistently stronger in the United States, even before accounting for international markets’ generally higher tax rates.

While international markets represent an exciting opportunity, and sustained growth is encouraging, the company’s main geographic driver is likely to remain the United States for the foreseeable future.

Competitive Risk: Unequal Market Share, Efficiency Gains

There is a natural risk that directly competing companies like Schwab, Fidelity and Robinhood could outperform Interactive Brokers, in terms of market share and particularly improving margins.

Losing market share to platforms like Schwab and Robinhood is also a risk. Schwab’s recent acquisition of ThinkorSwim gives it some of the analytic bona fides that TD Ameritrade had, although IBKR likely continues to lead reputationally in terms of analytics features. Given its high-end niche and continued leadership in technology like APIs, data analytics and efficient trade execution, losing its high-value customers to the likes of Robinhood or even Schwab seems like a lesser competitive risk.

Beyond the risk of peeling away market share, we should also consider the probability that IBKR’s competitors outperform in terms of margin improvements, stock price return and growing dividend yield. When a company like IBKR is already operating at such remarkable efficiency metrics, and user growth remains so robust, it is difficult to surprise analysts on the upside.

Robinhood and particularly Schwab simply have further to go in terms of optimizing the customer service experience and automating their administrative systems. A bureaucratic giant like Schwab is likely to see massive improvements in SG&A costs as it switches more of its administrative work toward increasingly capable bots. In terms of beating investor consensus, the fact that competitors simply have more fat to cut could give them an advantage when they finally start trimming in earnest.

Key-Man Risk

As we’ve discussed extensively throughout this deep-dive, Thomas Peterffy isn’t just any founder. He is a highly charismatic, intelligent, and mentally disciplined leader. Through massive disruptions, he has kept Interactive Brokers’ eyes on the prize: using technology and a disciplined systems approach to reduce market inefficiencies and manage risk.

He is not going to run the show forever. At age 81, his time as the company’s leading visionary (albeit from the board rather than the C-suite in 2025) will eventually come to an end. He has built a culture that reflects his priorities: engineers over marketing or financial orthodoxy.

Several leaders of the company, including CEO Milan Galik, have a background in software development, and other more technical elements of the industry.

Key Leadership Roles

CEO Milan Galik : MS in electrical engineering, recruited directly by Founder/Chairman Peterffy in 1990 as a software developer. He helped to build the technology behind the firm’s electronic brokerage segment, which would come to define the business.

CFO Paul J. Brody: Joined in 1987, essentially running the back office ever since. Formerly Vice Chairman of the Options Clearing Corporation.

Vice President Thomas A. Frank: Joined in 1985, helped to develop the company’s early market-making systems. Chief Information Officer from 2006-2024. PhD in physics from MIT

These are not outside hires or industry plants. They are not “finance bros”, MBA’s or marketing specialists. They are highly talented, scientifically-minded people like Peterffy, who respected him and believed in the company enough to spend decades building IBKR alongside him. As evidenced by their longevity, the feeling was mutual. The culture of Interactive Brokers, one of endless optimization, risk management and maximizing added value, is likely to continue under a team that has been on board virtually since its inception.

IBKR’s financial statements dutifully address the key-man risk, including the centrality of Peterffy’s control over the board of directors, executive leadership etc. However, with so much success and such consistent leadership, it is hard to stress too much about Peterffy’s concentrated control.

What is far more interesting than Peterffy’s centrality, or even the company’s leadership after he retires from direct control or passes away (which is unlikely to change dramatically), is what happens to all that power in the long run. Essentially, one man has had plenary power over the Board of Directors and executive office. This can only happen for “controlled companies”, in which one person or entity has enough voting rights to run the show, exempting IBKR from NASDAQ’s requirements that the board be partially composed of independent directors.

Much like a popular autocrat, companies can struggle after the departure of a highly centralized, highly gifted leader. Peterffy will certainly leave massive shoes to fill, and importantly, massive control over company leadership and grand strategy, to the person(s) who inherit his power.

From cursory research, it appears that Peterffy’s heirs will receive his stake (and voting rights) upon his death or inability to exercise control. Should his estate retain those shares indefinitely, it will enjoy 100% voting rights in the company. If their holdings fall below 50%, all shares in the Holdings company would gain voting rights.

This is a rather unusual situation, and a pretty big key-man problem when he has made every strategic, thousand-yard decision for the firm since the company’s inception. Statistically speaking, his estate is unlikely to collectively possess the same gifts that he has. Under the current plan, the captain’s family and estate managers will eventually take the wheel of a spaceship, or at least be charged with hiring its crew, as it flies onward into the unknown.

The firm’s design — low cost, extreme automation, and minimal bureaucracy — has worked brilliantly under a founder who is both a systems engineer and a highly involved autocrat. But his skills, unlike his voting rights, are not fully transferable. Over decades, Peterffy, in concert with a team that largely remains in the C-Suite, made major strategic pivots.

We cannot say with certainty how well the team will weather tomorrow’s storms without him, nor how that team will be chosen over the long term.

Currency Risk

Any company with IBKR’s cash holdings and global reach is subject to some level of currency risk.

IBKR’s equity is 25% forex-denominated, and they maintain a diversified cash portfolio (called GLOBAL in its financial statements) which is designed to help reduce concentration in the dollar and diversify exposure to a basket of ten currencies. Notably, the dollar has lost some weight in the fund since last year.

The chart below shows that the GLOBAL does a decent job of hedging against the dollar:

It is of course wise for a company with massive cash holdings and an international operating presence to diversify its dollar holdings. However, we think GLOBAL is essentially minimal prevention for a minimal problem, similar to a cheap seatbelt on a merry-go-round. Roughly three quarters of GLOBAL’s portfolio remains dollar-denominated, and the Euro and the dollar combine for 86%. Ultimately, it is very likely that any harm to the dollar will be offset by equity gains, as equities have proven extremely sensitive to inflation expectations and perceived weakness of the dollar.

Given that IBKR’s performance is still largely dollar-denominated, and dependent on interest rates, equity valuations and volatility for its core performance, we find currency risk to be mostly offset by inversely correlated upside risks.

Market Risk

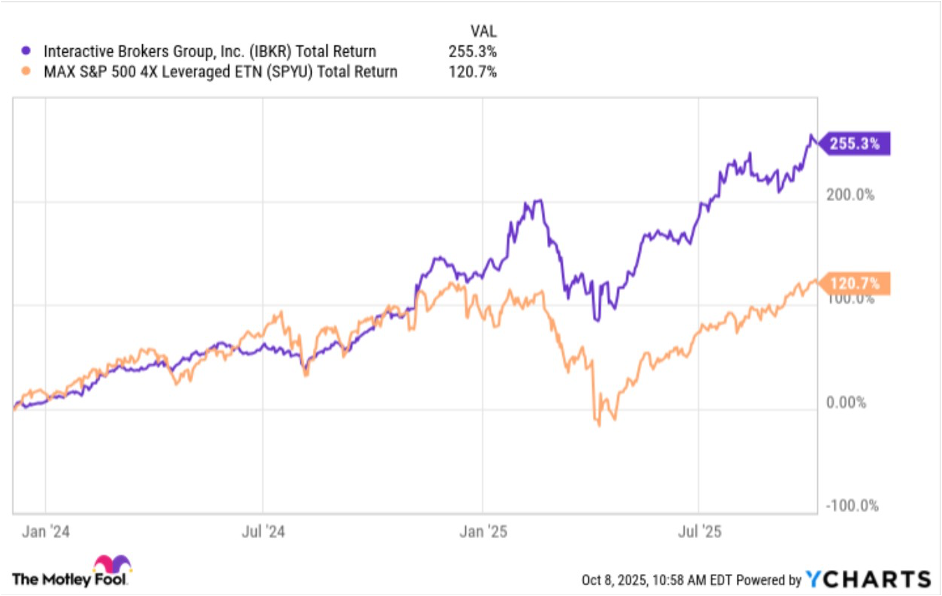

Market risk is another interesting issue for Interactive Brokers. IBKR is clearly very highly correlated with the broader market, both as a high-growth tech stock and as a company whose balance sheet literally moves with it.

The chart above shows that IBKR’s stock performance does correlate tightly with the market. Since January of 2024, it has quite closely followed a leveraged ETN that tracks the S&P500. In a vacuum, a market crash would be bad for IBKR.

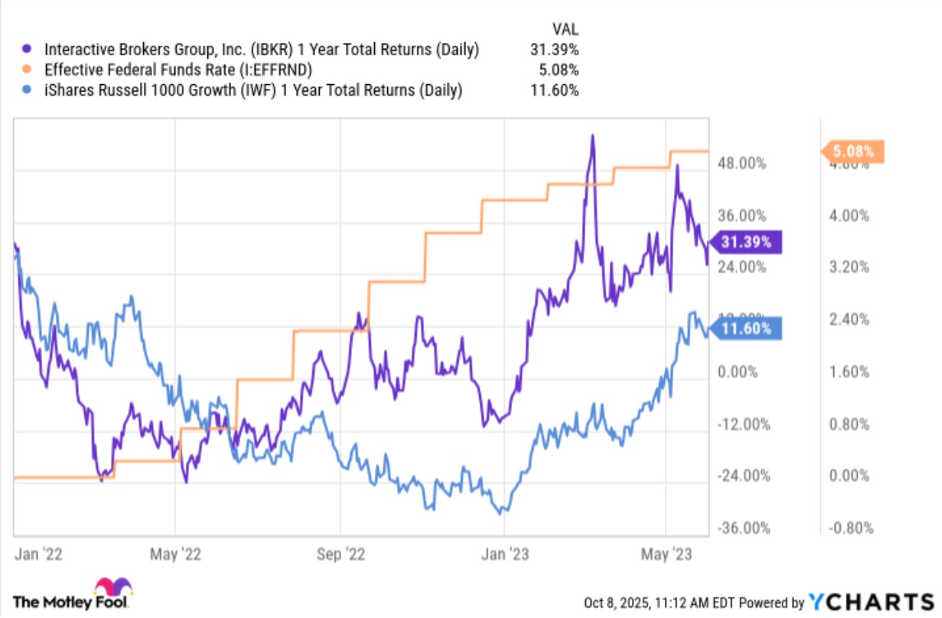

That being said, volatility is not terrible for the company, as it leads to higher trading volume. Additionally, as the chart below shows, the last market correction led IBKR to outperform, thanks partially to strong growth in new accounts and trading volume, and mostly to higher interest rates:

IBKR outperformed the high-Beta market (represented above by the Russell 1000) during the last sustained correction in 2022. That correction was driven largely by the pandemic’s demand hangover and quantitative tightening. Interest rates helped to buoy IBKR, which outperformed the Russell 1000 by 2,000 basis points (20%) from January ’22 through June of 2023.

From a macroeconomic perspective, a perfect storm for IBKR would be quantitative easing in a bearish environment, similar to what we saw in the immediate aftermath of the Great Recession. Over the near-term, interest rates are likely to be the dominant macroeconomic factor for IBKR; falling interest rates could cause it to underperform other growth stocks in the near-to-medium term.

Interest Rate Risk: Biggest Near-Term Red Flag

Our biggest warning light over the next year or two for IBKR is the prospect of falling interest rates. As we explain below, rising equities (which correlate with falling rates, especially in an inflationary environment like we have) may not be enough to save IBKR’s topline performance, which has been supported to a large extent by net interest income. Additionally, the rising tide of quantitative easing is likely to lift the general market more than IBKR, since most participants do not depend to the same extent on interest as a revenue source.

A Company of Interest Since 2022

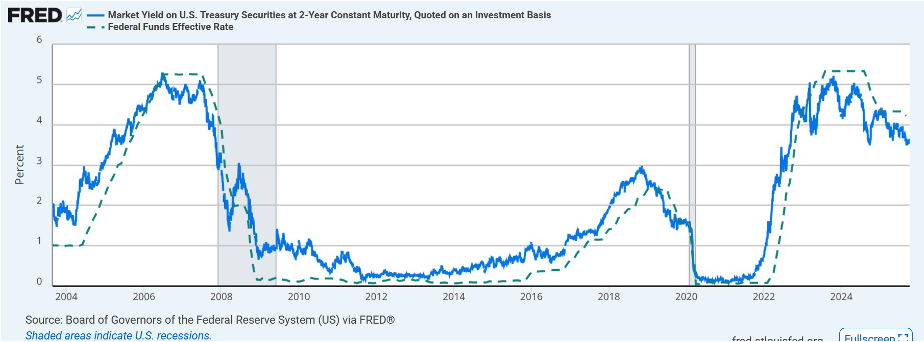

There’s an old saying on Wall Street that the Federal Reserve’s real mandate is to chase the 2-Year Treasury rate around. When you look at a graph of the two figures over time, you can see where the saying comes from; the federal funds rate tends to follow the 2-year very closely. At a glance, it would seem that Interactive Broker’s income statement chases both figures around as well.

Source: FRED

More than half of Interactive Brokers’ revenue is now derived from interest income. The contribution of interest revenue has historically moved dramatically with interest rates for the company, a relationship that makes intuitive sense. Interest income as a percentage of total revenues neared their current record highs in 2019, just before interest rates started easing and were brought to zero as a response to the pandemic.

A potential issue, and perhaps one that isn’t being fully considered when pricing the company, is the vulnerability of its topline to interest rates.

It would be paranoid to the point of tinfoil-hattery to claim that a company so well positioned, so efficient, and with such healthy growth will live or die by the winds of monetary policy.

However, when trading at current stratospheric valuations, any deviation from earnings consensus could cause the stock price to underperform the market, even if the price doesn’t fall.

At the very least, its deepened reliance on interest revenue risks dampening future growth, even if account growth and commission revenue stay strong. If interest income remains flat (for example if account growth struggles to offset lower interest rates), IBKR could still underperform the broader market, which is eager to soar on any signal of quantitative easing. This market-inverse risk is true of any company that derives most of its income from interest.

Of course, IBKR benefits from a looser environment as well, as we’ve discussed. Investors are willing to take on more margin risk when rates are lower and optimism is higher; account growth tends to increase in bullish environments; and clients’ aggregate equity balance naturally grows with the market.

The question is whether those effects would cancel out the near-certain hit to interest revenue in a lower rate environment.

Margin Debt to the Rescue?

Margin debt is an interesting metric, especially when trying to relate it to IBKR’s historical performance. Curated by FINRA, it’s the national aggregate balance of (mostly retail) investors’ margin accounts. The metric is a useful measure of investor optimism, particularly on Main Street, and it sits near an all-time high today of just over a trillion dollars.

It also tracks the total market capitalization of the stock market quite closely, just like the average mortgage outstanding correlates closely to the average home price. In short, margin debt is positively correlated with optimism and total market capitalization, while negatively correlated with interest rates. That means that when interest rates fall, fatter margin accounts could feasibly make up for lower interest rates.

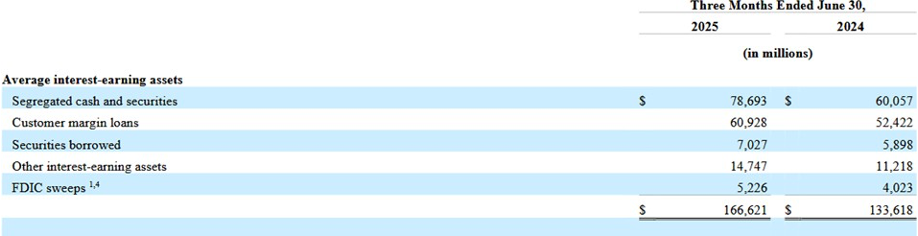

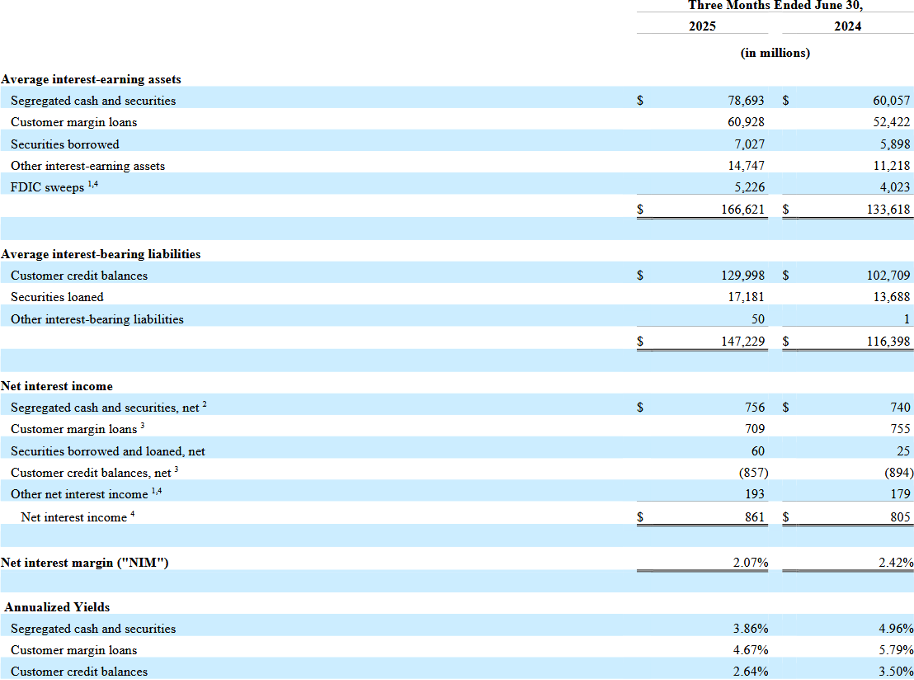

A full canceling out is unlikely for a number of reasons. The first is that margin loans only account for roughly 36% of IBKR’s interest-generating assets, as the table below shows:

Source: Company Filings

Furthermore, margin loans actually comprised a higher percentage of IBKR’s income-generating portfolio in Q2 of 2024, when interest rates were about 100 basis points higher than they are today. Despite management’s attempts to minimize the issue (discussed below), total net interest margin falls when rates are lower.

Management: Recognize and Minimize

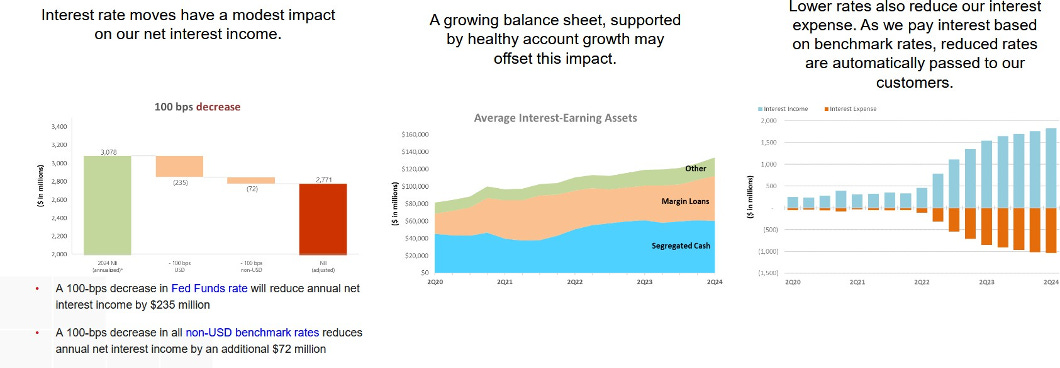

Interactive Brokers is run by some of the most brilliant minds in finance and technology, so it is no surprise that they have anticipated investor concerns over interest rates. For example, as part of their Q2 presentation in 2024, they provided these slides to assure investors:

Source: IBKR Q2 Presentation, 2024

The company assures that interest rate fluctuations have opposite impacts on both sides of the income statement; in other words, if rates fall, both revenue and expenses should decrease.

This is true, and to be fair, we’ve only been looking at the obvious connection between interest revenue and the federal funds rate. If the revenue and expense effects of interest rate changes nearly cancel each other out, there is indeed no need for concern. Unfortunately, we can say with high confidence that this is not the case.

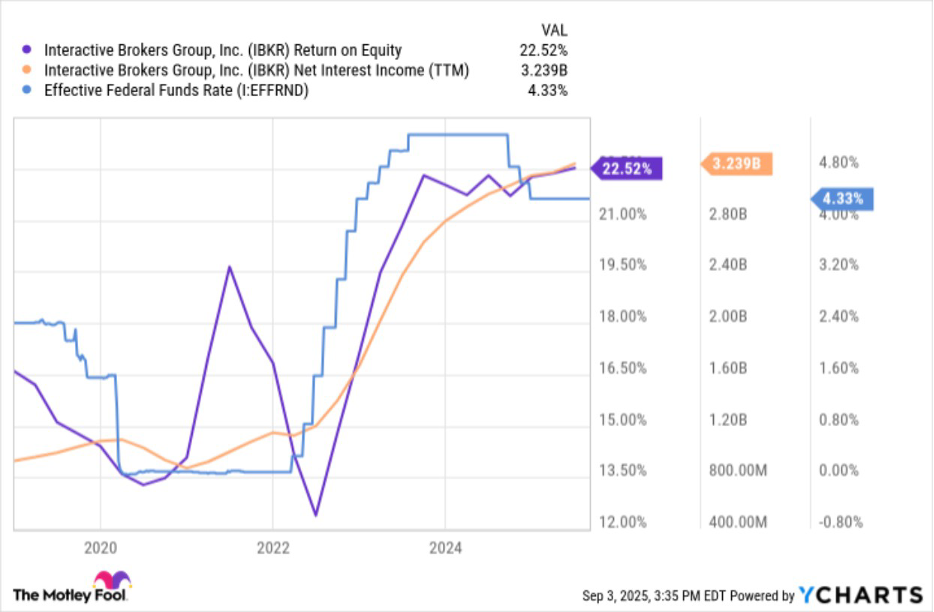

This chart shows a powerful relationship between three data points: the Fed’s interest rate, the company net interest income (meaning the difference between interest revenue and interest expense), and the company’s Return on Equity (ROE). As you can see, quantitative tightening has come with a profound increase in both interest income and, apparently, return on equity.

We added ROE to the chart in anticipation of the following argument: “Couldn’t interest income just be growing as client accounts and total assets grow, which happened to coincide with the Federal Reserve hiking interest rates since 2022?” Not only is net interest income about 4 times higher than during pandemic-era QE, but it has driven a return on company equity from roughly 13% to 22.5%. This profound effect, in our opinion, is understated in the company’s analysis.

If you’re still not convinced that interest rates drive the company’s current profit performance, take a look at the expanded chart below, pulled from the company’s Q2 2025 financial statements.

The company’s net interest margin, or the return on all interest-subject assets and liabilities, is strongly correlated with interest rates. It was forty basis points higher in Q2 of last year (2.4%), when the federal funds rate was about 100 basis points higher (5.33%), and it was just 1.1% in Q1 of 2022, when the federal rate was near zero.

To put this another way, the company grew its interest-earning assets by about 25%, while its net interest income grew by just 7%, thanks to falling interest rates.

The bottom line is that more than half of the company’s operating profit comes from a segment that is anchored to the fluctuations of monetary policy. This is not to understate the company’s fantastic fundamentals, real growth in accounts, trading activity and client equity; those are real, and they’re impressive. The problem is that the company’s current valuation may not fully appreciate its near-term interest rate risk. This risk does not threaten to derail the company nor is it likely to shrink revenue, but it could certainly dampen growth beyond market consensus.

Raising the Stakes

To maintain its current valuation, that puts significant pressure on Interactive Brokers to continue doing what it has done remarkably well so far: high-quality, efficient, accelerating growth. It is deeply impressive to see a company grow at this rate in a highly segmented, capitalized and reasonably mature (if evolving) market.

It will likely need to do so with ever-stiffer competition to contend with. It is plausible that given IBKR’s current efficiency, which may have the highest revenue per employee of any major player in the industry, competitors like Schwab may gain relatively more from automating some of their workforce.

The company is clearly well-run and provides significant value for clients at exceptional margins. However, if interest rates fall, as the White House is doing everything to accelerate, it will need to rely solely on its active business segments to drive profitability and revenue growth, while automation will help less efficient companies drive down expenses and potentially put downward pressure on commission rates.

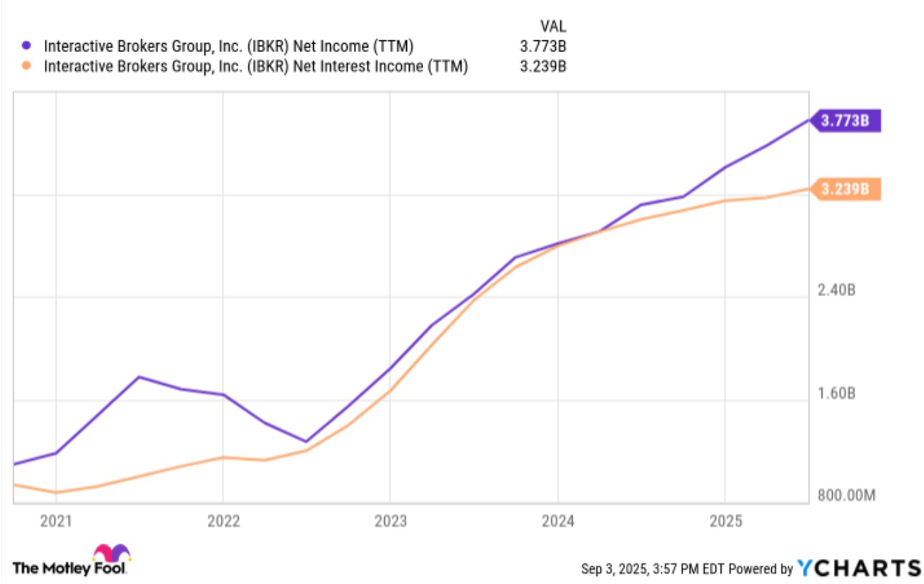

The final chart we’ll show, and why we have to put a Hold rating on a company we love, captures our concern. Interest revenue has been a pivotal part of IBKR’s growth journey since 2022, growing at virtually the same rate as total net income. We are happy to see total net income starting to pull away, but we worry that it may not be enough to staunch lost revenue in a lower-rate environment.

If net interest income not only stops growing but falls, it is virtually impossible for the company to maintain its current growth in revenue and profitability without exceptional acceleration in its active segments.

It’s not that we don’t believe in the company, but we see too much of its current valuation tied up in a very real near-term risk. For that reason, we advise to hold, or wait to see if IBKR can maintain its outperformance in a different monetary climate.

Conclusion: A Valuable, Expensive Company

It is often tempting to call a company a bargain or a lemon. After massive stock price appreciation this year, and after yet another strong quarter in Q3, Interactive Brokers is hard to call expensive and certainly hard to call cheap. It is one of the strongest companies on the stock market, and it’s valued as such.

We are happy to purchase IBKR, although not at this price. Investors have been well rewarded for our core investment thesis over the years. The stock not only represents a growing market, but it is a bet on the man who, perhaps more than any other figure, drove the digitization of securities markets. It is a bet that his philosophy of optimizing financial platforms, of removing human error and bureaucratic bloat wherever possible, will continue as the company’s central ethos for decades to come.

IBKR’s balance sheet management is prudent to the point of perfection. As a general rule, it does not dilute or borrow to achieve growth. Like the industrial giants of yesteryear, its meteoric growth has been almost entirely driven by reinvesting real profits. It lives within its means; its accelerating growth is the product of accelerating profits.

When a company has performed nearly perfectly for the entirety of the Digital Age, there are obvious risks to its valuation. Its current price and growth trajectory make it a pricey investment by any DCF valuation. Its competitors may gain more in the near term from automating than IBKR, since it is already such a lean operation. A fall in interest rates may hit it harder than competing companies, since it receives more of its revenue from interest than they do, and has historically shown a sensitivity to interest rates.

We see enough risk to think twice about adding to our IBKR position as its price floats in the high $60s. However, we are happy to keep watching and believe that the company’s fundamentals remain solid. Keep a close eye on top line growth and competitor performance if you plan to open a position, and prepare for IBKR to underperform growth stocks in the near term if interest rates come down significantly.

We appreciate your time in reading our Interactive Brokers Deep Dive. We will continue tracking IBKR’s performance and strategic evolution through periodic updates and implication reports available to subscribers.

Disclaimer

This report is for informational and educational purposes only and does not constitute investment advice, a recommendation, or a solicitation to buy or sell any securities. All opinions expressed reflect the author’s judgment as of the publication date and are subject to change without notice.

The author does not currently hold shares of Interactive Brokers (IBKR) but may initiate a position in the future without further notice.

For the full disclaimer, click here.

Copyright © 2025 Business Deep Dives. All rights reserved.

Business Deep Dives is an independent research publication operating on a pre-incorporation basis. All content is protected under applicable international copyright principles.