MercadoLibre (MELI): The Latin American Platform Powerhouse Transforming Commerce and Finance

A Comprehensive Analysis Of MercadoLibre's E-Commerce, Fintech, Credit Expansion, And Macroeconomic Exposure.

If you follow tech stocks or have spent time in Latin America, you’ve probably already heard of the company. It’s not only the largest tech company focused on the Latin American market, but the largest LatAm firm listed on Wall Street. Since its inception, MercadoLibre (MELI) has followed the ecommerce playbook with the precision and vision of other regional giants like AliBABA, Amazon, and its strategic mentor, eBay.

Since its founding at the turn of the millennium, and especially since its American IPO in 2007, Mercadolibre has richly rewarded investors. It’s achieved an annualized total return of 27% over the past eighteen years. That journey has been defined by eye-watering growth in a brand-new market, prudent resource management, and the aggressive integration of payment solutions that have become its flagship offering.

We like MELI, and so does the market. The company enjoys a very steep valuation of roughly 50 times earnings. That’s after shaving 10% off its price after reporting earnings at the end of October, which we’ll discuss in this article. In a pricey market, and especially with this 10% discount on a still-solid earnings report, we recommend initiating or incrementally growing a stake in the company. We see Mercadolibre as an unusual triple threat: a blue-chip company, a strong growth play, and an unusually low correlation with American tech or consumer stocks.

We will cover the following facets of the company in this article:

MercadoLibre’s history, including historical performance, major strategic partnerships and pivots. Current position within the Latin American market.

The firm’s main operating segments and its relative market share within them.

An analysis of MELI’s financial statements, and a basic DCF valuation of the company under different growth scenarios.

The company’s ownership, leadership and compensation structures

A thorough assessment of MercadoLibre’s unique risks and opportunities.

Let’s dive into MELI’s story, and how it became both the Amazon and Paypal of the major Latin American markets.

Founding Vision: Homegrown Disruption

Any investor with an eye on the Latin American tech market knows MercadoLibre. Founded in 1999 as the brainchild of Argentinian Stanford grad Marcos Galperin, the company has become the preeminent e-commerce and payment platform in major Latin American economies, most notably Argentina, Brazil, and Mexico.

The company was founded by Argentinian Marcos Galperin in 1999, then a grad student at Stanford University. He recruited his cousin as Chief Technology Officer, and the two got to work in Buenos Aires before his graduation.

As a Stanford University case study notes, “While many U.S.-based e-commerce companies were beginning to think about international expansion at the time, Marcos felt strongly that a homegrown company built from the ground up to serve Latin America would have an advantage against the foreign transplants.”

In 2025, and even as tech markets continue to consolidate, this early intuition has borne out across different geographies and cultures. Take a look at the chart below:

With the exception of Amazon’s deep presence in the European market, every major e-commerce market has a natively founded company dominating the space. This might be surprising; one could expect a large, well-capitalized tech giant to easily enter a new market and take over. That strategy has worked pretty well for Amazon in Europe, but much less so in the East and Global South.

Latin America and Southeast Asia are just too different in terms of consumer tastes, local infrastructure, and regulatory environment for a foreign e-commerce platform to move in and take the throne.

This homefield advantage for natively grown tech companies is even more powerful when it comes to payment solutions. Foreign companies have to navigate a web of new regulatory barriers, authentication challenges and consumer preferences when it comes to curating a digital wallet or P2P payments.

It may seem simple now, but imagine the difficulties that Paypal encountered just to allow two Colombians to send each other pesos. A web of international regulations, technical challenges, and compliance risks came with P2P transactions in Colombia, from money laundering concerns to outright theft -- the juice wasn’t worth the squeeze. Paypal gave up on the effort, leaving Colombia for years; in the meantime MercadoPago and (Colombian company) Rappi helped to fill the void.

MercadoLibre’s advantage from its earliest days has been its founders’ intimate understanding of, and ability to navigate, LatAm’s challenging landscape for e-commerce. The problems that MELI helped to solve in Latin America in the early 2000s, from negligible e-commerce awareness to massive unbanked populations, have paved the way for itself and new entrants to finally seize a massive, maturing market.

To Galperin, the fundamental problem for Latin America was the lack of native e-commerce solutions, from trust systems to payment solutions.

MercadoLibre’s Homepage in 2000

Source: Internet Archive

In each new market, Galperin hired a local sales and development office. As anyone who has done business, lived, or even traveled though Latin America knows, the infrastructure, commercial environment and consumer preferences vary widely. Galperin correctly decided that the best way to ensure dominance in each new country was to localize marketing, customer service, and management. From Argentina, they quickly moved into the massive Brazilian market next door. The two countries formed the cornerstone of MercadoLibre’s growth in the 2000s.

While gaining early traction, Galperin had to contend with a major problem for establishing the e-commerce market: extremely low regional penetration rates for internet use. In 2005, only 17% of people in Latin America were online, according to the World Bank. That figure was even lower when MercadoLibre launched in 1999.

MELI’s steady scaling in the 2000s, followed by an accelerating takeoff in the 2010s and 2020s, has coincided closely with two major drivers that MELI itself helped to create. One is the steady democratization of internet access; Today, Latin internet access is nearly on par with the West, especially in MercadoLibre’s biggest markets. The other is the provision of financial solutions that allow unbanked Latinos to buy online.

From Storefront to Full-Service Finance

Like any e-commerce platform worth its salt, MercadoLibre rolled out its own financial solutions as it scaled and gained market share. Though MercadoPago, its payments platform, was launched in 2004, its full financial suite was refined and gained traction in the mid to late 2010s.

Today, the company’s fintech solutions generate more user engagement and revenue in some markets than the e-commerce platform. That vision and execution may be thanks to its strategic partner in the early years.

Ebay-Won Kenobi

MercadoPago’s launch was followed by a strategic alliance between MercadoLibre and E-bay. Inked in 2001 just two years after launch, the partnership focused on equity investment, business development and information exchange. EBay’s influence is evident in MELI’s early days as more of an auction site, while today most products have fixed prices in the spirit of other leading e-commerce platforms.

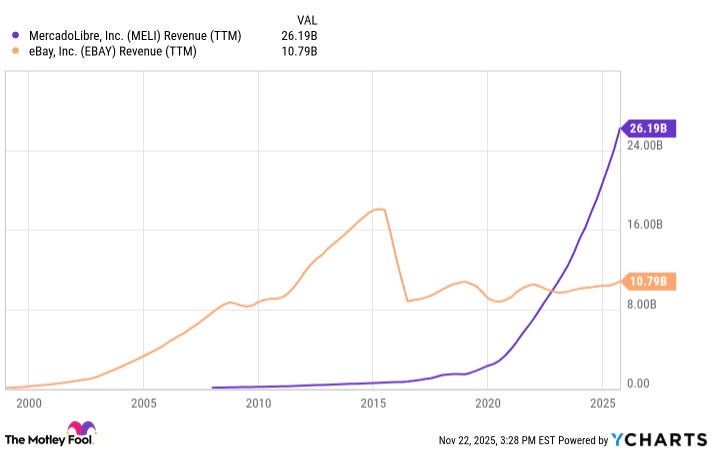

Through some combination of coincidence and counsel, MercadoLibre’s integration of its financial platform, and its eventual predominance in the company’s identity and financial statements, mirrors E-bay’s journey with Paypal. Both companies acquired or developed a financial services platform to augment their e-commerce offering, and to eventually expand those solutions throughout the digital and physical payment ecosystem.

They both largely achieved this goal, but in eBay’s case, it spun off a platform in 2015 that would eventually eclipse it.

Paypal: Takeoff after Spinoff

Source: Ycharts

The chart above illustrates the tremendous growth potential of fintech solutions compared to standalone e-commerce, and provides a cautionary tale that MercadoLibre certainly noted from its old strategic partner. While Ebay’s core operations and Paypal segment were roughly equal in terms of revenue at the time of spinoff, Paypal now boasts a top line figure of triple its old parent company.

Of course, part of this comes down to company management and how well each platform held market share (unlike E-Bay, Paypal didn’t have to directly battle with Amazon for customers), but the fact remains. MELI’s takeaway, based on interviews with Galperin and decisions made, reflects that it puts tremendous value on its fintech platform.

Fintech solutions not only represent roughly half of MELI’s revenue, they’re central to the company’s vision for its place in the region.

Digital Democratization

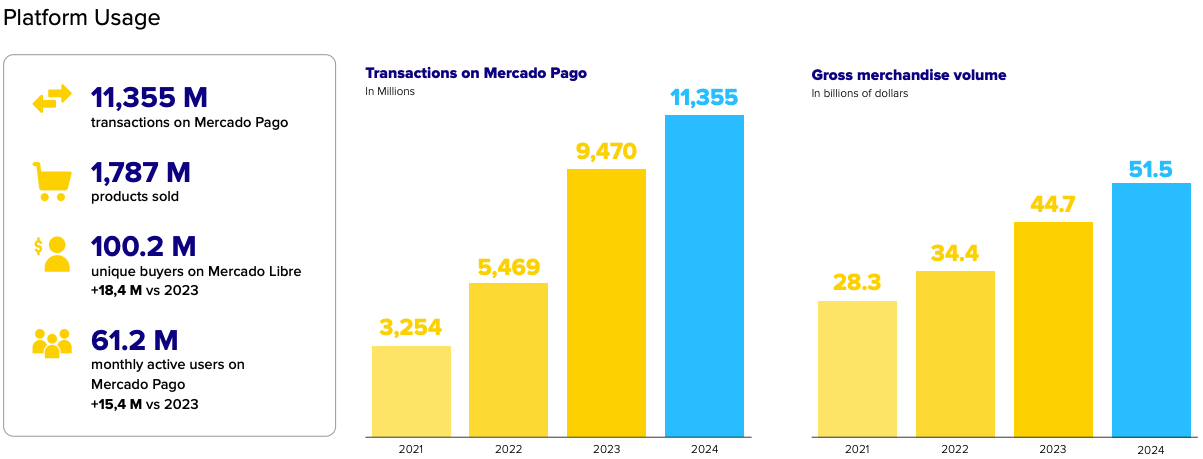

The very first page of a recent investor relations deck lays out the scope and focus of the company’s vision:

“MercadoLibre’s purpose is to democratize access to commerce and financial services in Latin America.”

The company is highly aware that the greatest value it can add (and the highest growth it can achieve) will be in penetrating the unbanked market across the region. What makes MercadoLibre an exciting investment, and what arguably drives its growth premium, is this massive untapped market. Since roughly 2018, MercadoLibre has had great success in bringing banked and unbanked customers into its ecosystem, and there’s a lot of gold left in those hills.

Source: MercadoLibre

E-commerce is sticky, but as the diverging growth of eBay and PayPal prove, financial solutions are stickier and far more scalable. Not everyone wants to buy a toaster online, but everyone has to pay for stuff. Providing a means to transact anywhere, access a line of credit, and a simple way to grow savings will drive Mercado Libre’s future success.

This is doubly true in a market with hundreds of millions of people who have a smartphone but not a bank account. The percentage of the unbanked population varies by country, but is high in most of the region. In Mexico alone, a major market for MercadoLibre, roughly half the population (66 million people) lack a traditional bank account, making it hard or impossible to transact digitally, obtain microcredit to make ends meet, or larger credit solutions for things like business investment.

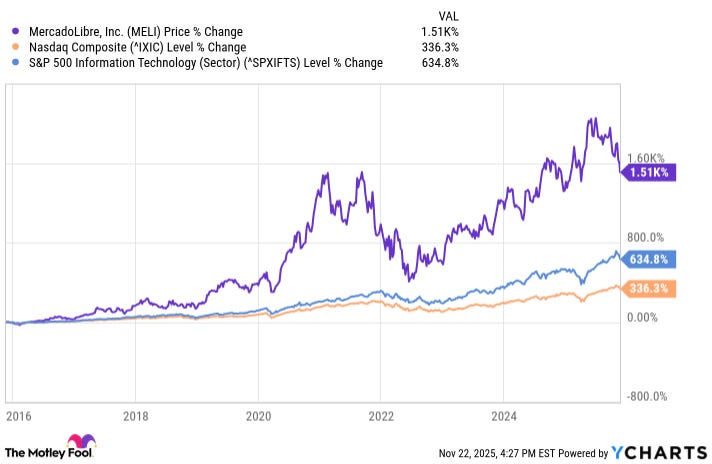

Elite Price Performance

MELI’s 10-YearBreakout

Source: YCharts

Since its IPO, which was a first for a Latin American tech firm, Mercadolibre has richly rewarded investors. Over the past ten years, it outperformed the NASDAQ and the S&P 500 Tech Sector by factors of roughly six and three, respectively. Its market cap has swelled from $4.5 billion to $120 billion over that time, a growth journey that vastly accelerated during and after the pandemic.

Business Model

Business Segments

MercadoLibre has two broad categories: commerce, which encompasses revenue derived from its ecommerce platform, and fintech, which encompasses all of the financial services it provides, such as its payment platform, digital wallet and credit solutions.

1) Commerce (~60% of Total Sales)

Source: Company Presentations

The Commerce segment represents the set of services and revenues around MELI’s core e-commerce platform, MercadoLibre.

In Q3, the segment accounted for roughly 60% of total consolidated net revenues. Although this mix fluctuates quarter to quarter, Commerce remains MELI’s original and still-core business, even as Fintech continues to outpace it in growth.

This includes:

E-commerce Services Revenues (52% of Total Revenue): This is revenue that MELI gets from third parties for providing the platform, and includes:

Marketplace fees: commissions from sales of new and used goods across categories.

Advertising services: mainly Mercado Ads, which lets sellers promote listings and products on the platform.

Shipping and logistics: MELI’s Mercado Envíos logistics arm, which earns fulfillment and shipping fees.

Other services: classified listings, loyalty programs, and ancillary merchant services.

Direct Sales (8% of Total Revenue, Highest-Growth Commerce Segment):

Increasingly, e-commerce revenue and purchase volume are driven by growth in MercadoLibre’s direct sale of products on the platform, similar to Amazon-branded store offerings.

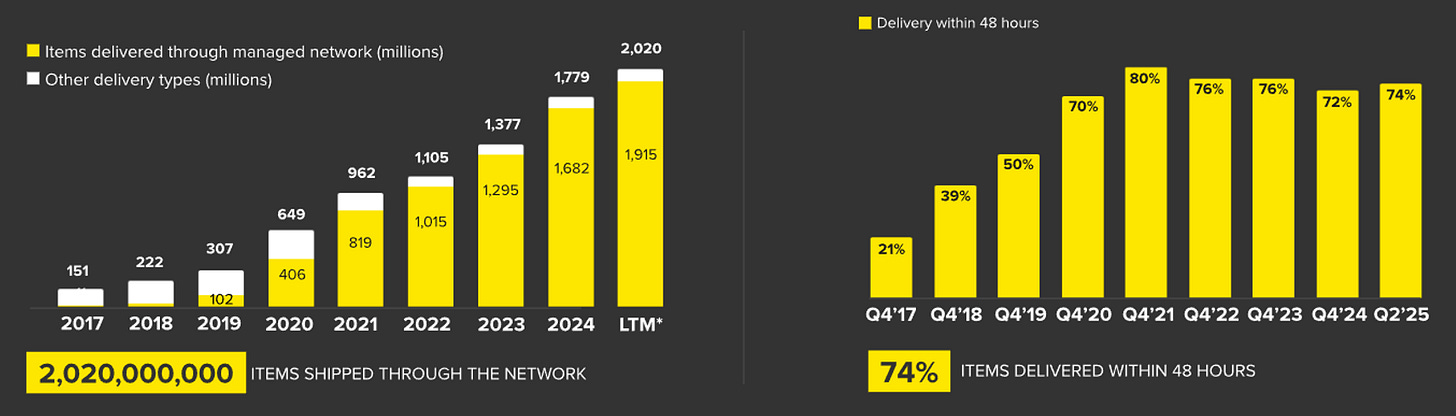

Marketplace revenue is still the largest single line within Commerce, but growth is being driven more by advertising and shipping. Mercado Ads, for instance, now contributes a mid-single-digit share of total revenue and has become a key profitability driver. Mercado Envíos, meanwhile, supports higher conversion rates and user retention, extending MELI’s control deeper into fulfillment and last-mile delivery.

Over the past few years, the company has moved aggressively toward end-to-end logistics coverage — over 90% of items sold on MELI in its core markets now ship through Envíos, with same-day or next-day delivery options becoming standard in major cities. This vertical integration increases take rates but also adds fixed cost intensity, which MELI offsets through scale and automation.

Advertising also plays a strategic role similar to Amazon’s ad business: it monetizes merchant demand for visibility while improving overall margin mix. The company leverages proprietary data from its marketplace and payments ecosystem to target ads efficiently, driving revenue growth well above that of GMV.

Overall, Commerce revenue growth in 2024 slowed modestly compared to prior years (after pandemic-era surges), but remained healthy — supported by GMV expansion, higher take rates, and growing monetization from ads and logistics.

2) Fintech (~40% of Total Sales)

The Fintech segment, built around Mercado Pago, represents roughly 40% of total consolidated revenues, but increasingly constitutes higher transaction volumes than the original ecommerce offering. This side of the business has evolved from a checkout tool for marketplace sellers into a full financial ecosystem.

Major components include:

Payments processing (both on-platform and off-platform).

Digital wallets for consumers and small businesses.

Credit operations: consumer, merchant, and card lending.

Investment products, insurance, and other financial services.

Within Fintech, the off-platform payments business has become the largest subsegment. It includes QR code payments, mobile point-of-sale (mPOS) terminals, and integrations with third-party merchants. MELI has positioned Mercado Pago as an all-purpose payments infrastructure in Latin America, comparable to a blend of PayPal, Square, and Alipay.

Credit operations are a fast-growing revenue and profit contributor. MELI extends consumer and merchant loans using proprietary data drawn from marketplace activity and payments history. The company’s credit card portfolio, particularly in Brazil, has been expanding rapidly, supported by high user engagement and cross-sell potential. The 2024 10-K notes a strong increase in interest income, reflecting higher portfolio yields. Effective annualized rates vary by product but generally fall in the 40–70% range typical for unsecured Latin American lending — though MELI manages risk through conservative underwriting and AI-driven scoring models.

Interest and fees from these credit products represent a rising share of Fintech revenue, alongside payment transaction take rates. MELI also monetizes float and investment income from balances held in digital wallets and merchant accounts, a meaningful source of high-margin income given regional interest rate levels.

Finally, the Mercado Crédito and Mercado Fondo arms deepen user engagement: consumers can save, borrow, and transact entirely within MELI’s ecosystem, blurring the line between commerce and finance.

In sum, Fintech is the group’s growth engine — outpacing Commerce both in transaction volume and revenue expansion. It also provides strategic insulation: as competition intensifies in e-commerce, MELI’s financial services create lock-in and margin diversity.

Geographic Segments

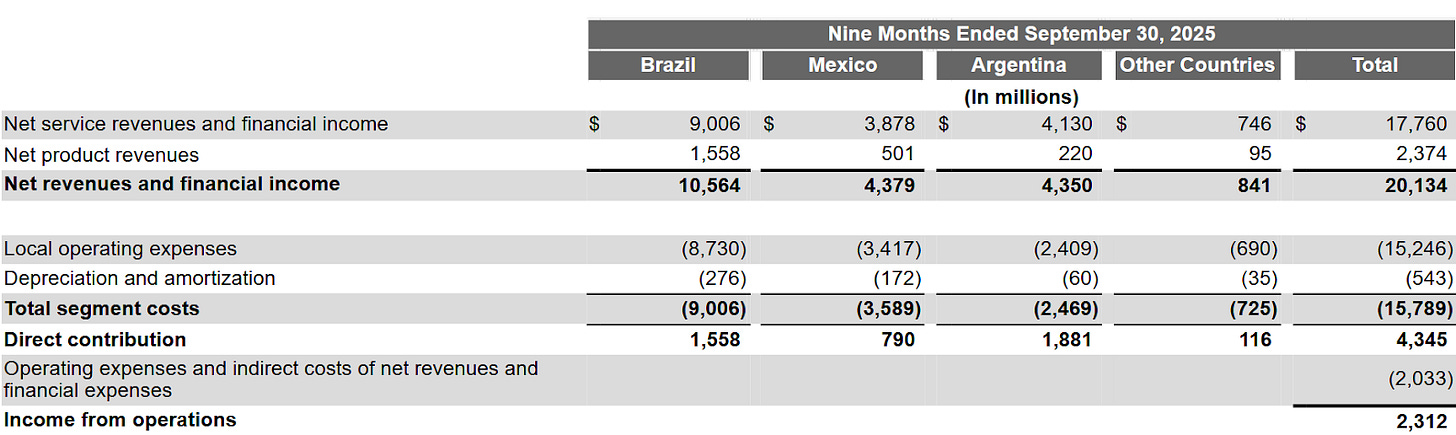

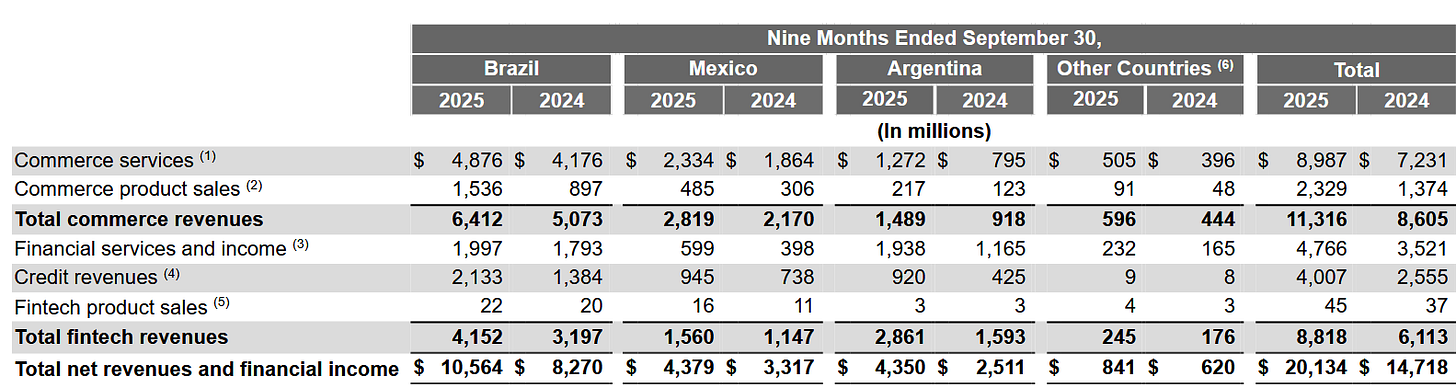

MercadoLibre reports revenues by country of origin rather than just segment type, highlighting concentration in a few key markets. The graph below shows a breakdown of MELI’s three main segments, as well as its other Latin American operations:

Source: Company Filings

As we’ll discuss below, Brazil is the main revenue driver, followed by Argentina and Mexico (highest-growth).

Brazil

Brazil is MELI’s largest and most mature market, contributing roughly 55–60% of total net revenues in 2024.

The country is the testing ground for most of MELI’s innovations: same-day delivery, credit cards, and integrated payments all scale first here before rolling out elsewhere.

The Brazilian market is defined by:

High penetration of Mercado Pago in both online and offline payments.

Continued expansion of credit products, with the largest share of total AUM.

Significant scale in logistics infrastructure — including fulfillment centers, last-mile delivery partners, and cross-docking hubs.

Brazil’s powerful consumer base and relatively developed infrastructure make it not only a bedrock of today’s operations, but a proving ground for MELI’s ability to integrate all of its offerings across an ecosystem. Its powerful inroads in fintech, most notably credit products, have bolstered the multi-platform use case and made its leadership in the country stickier.

Brazil’s economic volatility (especially interest rates and inflation) directly affects MELI’s profitability mix, as a large share of its Fintech income comes from interest-linked products. Nonetheless, MELI has managed to grow active users and maintain operating margins through strong local brand equity and ecosystem integration.

Argentina

Though Brazil became its biggest market less than a year after launching, Argentina is where it all began for Mercadolibre. While economic headwinds have stifled performance in recent years, the macroeconomic picture is improving and growth has stayed positive even through the country’s toughest years.

Argentina accounts for about 20% of total revenue, but a higher proportion of GMV and user activity, since local pricing and inflation distort nominal figures.

As MELI’s country of origin and corporate headquarters, Argentina remains strategically important, though exposure to currency devaluation and capital controls limit the repatriation of profits.

Despite macroeconomic headwinds, MELI’s platform enjoys near-monopoly scale domestically. It continues to process a growing share of offline payments and has one of the country’s largest credit card portfolios. Inflation also drives users toward Mercado Pago balances as a partial store of value, boosting float income in nominal terms.

Mexico

Mexico has become MELI’s fastest-growing market, contributing roughly 15–18% of total revenue in 2024.

The company has invested heavily in logistics — fulfillment centers around Mexico City, Monterrey, and Guadalajara — and has rolled out credit cards, merchant loans, and a growing QR payments network.

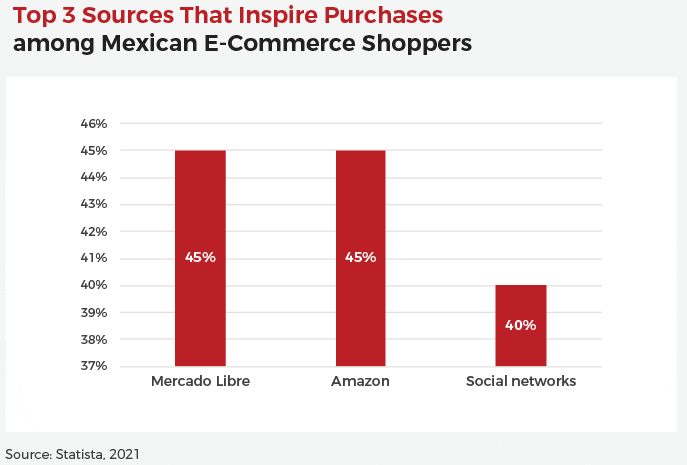

Mexico’s E-Ecommerce Pipeline

Source: Americas Market Intelligence

Mexico’s competitive landscape (with Amazon and local fintechs) is tighter than Brazil’s; MELI enjoys about 15% of e-commerce market share, roughly even with Amazon and WalMart. But MELI’s integrated approach (combining marketplace, payments, and logistics) and Latin identity gives it a structural and branding edge. Its Fintech operations here are expanding at over 40% annually, making Mexico central to MELI’s medium-term growth strategy.

Other countries (Chile, Colombia, and the rest of Latin America)

The remaining markets only contribute roughly 7–10% of total revenue combined, mostly from Colombia and Chile, though they offer upside potential as MELI scales fulfillment and financial services. In these regions, MELI focuses on localizing logistics and regulatory compliance while leveraging technology developed in Brazil and Mexico.

Payments adoption is particularly strong in Colombia and Chile, while e-commerce penetration is rising from a low base. While exciting potential markets for their robust consumer base, Colombia and Chile also have competing offerings like Rappi in Colombia and Tenpo in Chile.

FinTech and Credit Will Drive Future Earnings Growth

Source: Company Filings

There’s an item in the financial statement that makes Argentina a more exciting market than its relatively small revenue contribution would suggest. The Argentinian segment’s direct profitability is a whopping 43%, compared to 11.5% across all regions.

The reason is primarily thanks to much higher contributions from the fintech segment in Argentina. While 43% of all company revenue came from the fintech segment in the first three quarters of 2025, fintech comprised 65% of sales in Argentina. Fintech, as we noted in our Interactive Brokers deep dive, allows for much higher margins, efficiency gains, and network effects. This is doubly true when it comes to credit products.

Credit is perhaps the most exciting segment in MercadoLibre’s current portfolio. Its credit assets are exploding as it expands credit card and other consumer offerings. Q3’s Year-over-Year growth in credit revenue was 68%; revenue from credit accounts have soared to 20% of revenue from negligible levels a few years ago.

The Thesis

Though most of its valuation reflects expectations for future performance, MELI already has some strong fundamentals. Let’s dive into some hard numbers behind the hype.

First, we’ll take a look at the income statement, balance sheet, and cash position. After assessing the company’s cash and growth position, we’ll consider what MELI should theoretically be valued under different growth scenarios.

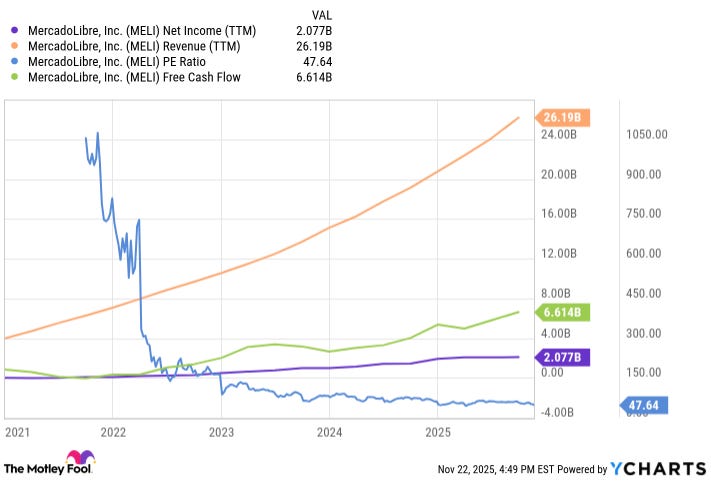

Income Statement Figures

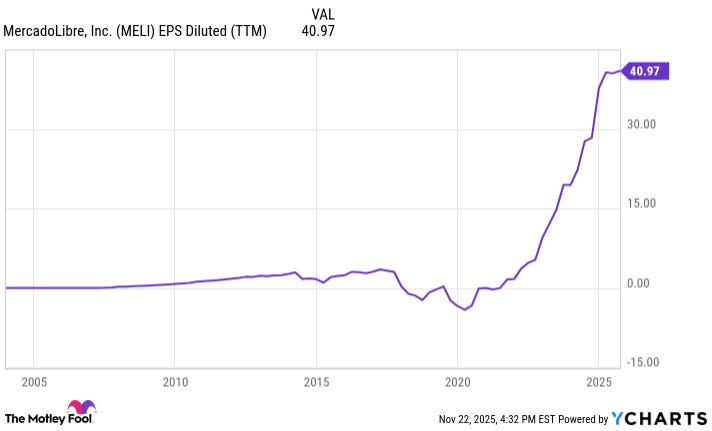

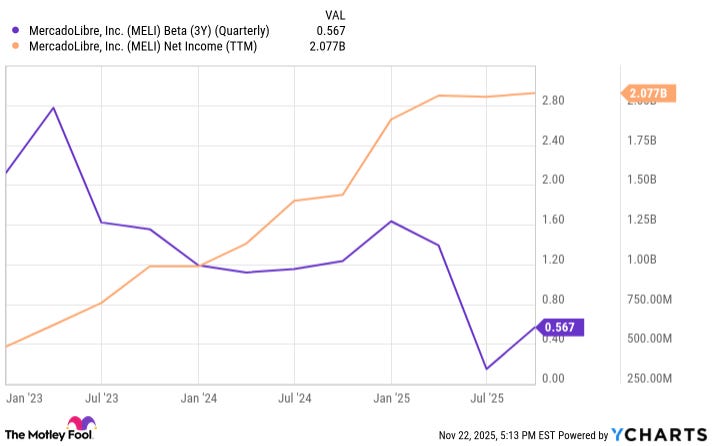

Since breaking even in early 2022, its annual net income has reached $2 billion and operating cash flow was $6.8 billion over the past 12 months. The company continues to grow at a steady geometric rate, driven by strong growth across segments.

Earnings: Post-Pandemic Takeoff

Source: YCharts

The pandemic marked an inflection point in which MELI began to generate significant income from operations. As we discuss in the Risks and Opportunities section, this is also when the market began to really distinguish MELI from other risky growth stocks. Its 12-month net income has doubled since the beginning of 2024 to $2 billion.

As we discuss below, while its administrative efficiency continues to improve and revenues are still growing at a healthy clip, net income and operating margins have flagged in 2025 due to growth investments.

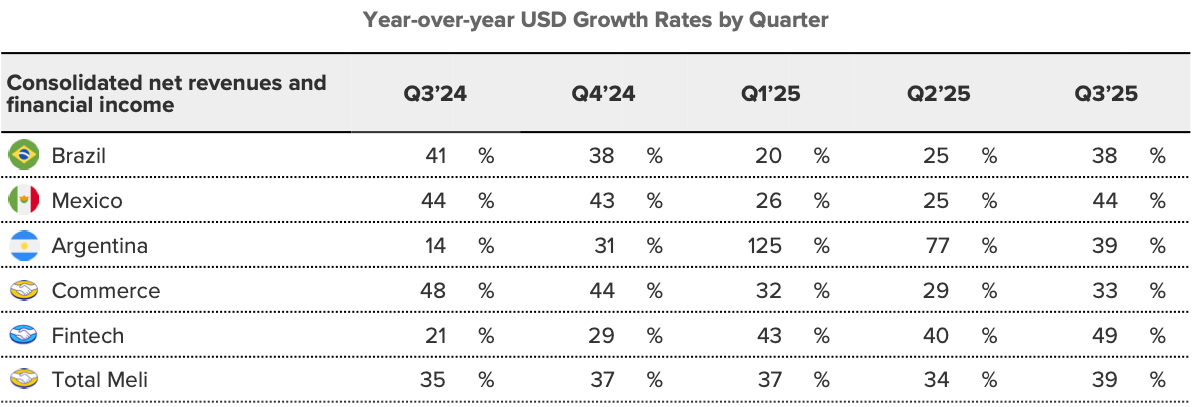

Source: Q3 Letter to Shareholders

The company is achieving strong revenue growth across all major markets. Year-over-Year revenue growth has been at least 35% in every quarter since Q3 ‘24. Mexico has maintained consistent growth, while Argentina has rebounded strongly since flagging growth in 2024.

Q3 was the best year for growth, and MercadoCredito is a major contributor. The company’s loan portfolio has ballooned in the past few quarters, and interest income now contributes 20% of revenue, up from a negligible figure just three years ago.

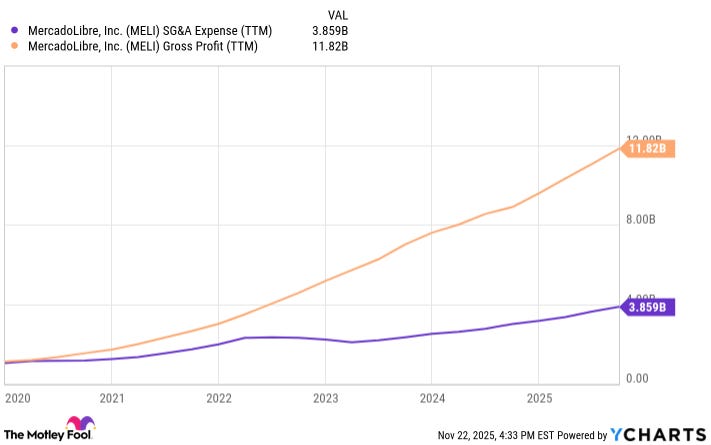

As Profits Soar, SG&A Stays on the Ground

Source: YCharts

MELI is living up to the promise of efficient management, with SG&A comprising a shrinking percentage of revenue. When you subtract marketing expenses, general and administrative expenses were less than 4% of revenue in the first three quarters of 2025, compared to over 5% in 2024. More impressively, while gross profit grew roughly 40% YoY in Q3, G&A expense actually fell by 12%.

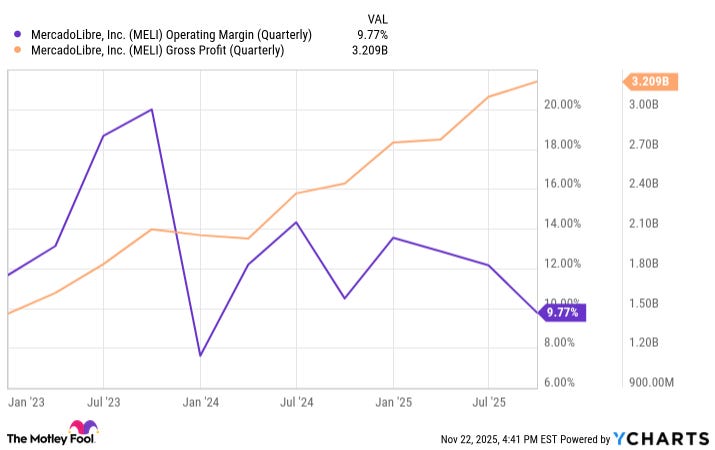

Growth Strategy Pressures Margins

Source: YCharts

Given its improving efficiency in terms of administrative costs, it might be puzzling to see operating margins actually fall in 2025. The two main reasons are increased expenses related to logistical investment and Mercado Credito.

MercadoLibre has made aggressive drives into growing its credit profile (with great success), and achieving greater efficiency and lower consumer costs for shipping. In Q3, we saw higher COGS (which includes shipping costs), marketing expense, and allowance for doubtful accounts as a percentage of total revenue.

The company has stated that it intends to prioritize growing its credit portfolio and lowering delivery costs as well as shipping timeframes, even if it puts near-term pressure on margins. This is a company that is dedicated to growth and has the financial cushion to absorb some margin pressure while still generating cash.

Balance Sheet and Cashflows

MELI manages a strong balance sheet. This is no surprise given its high growth and strong metrics.

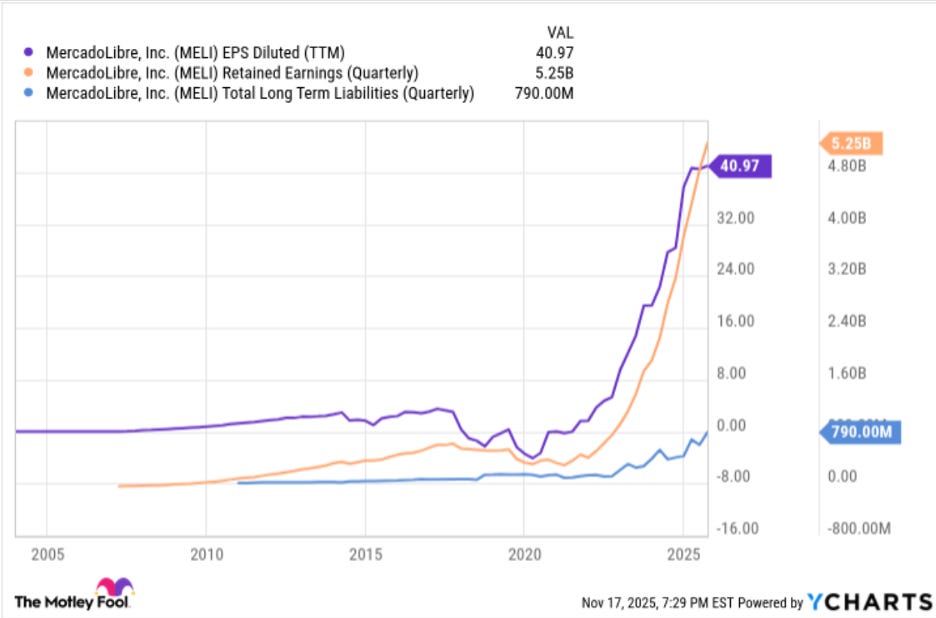

MELI Builds a War Chest

Source: YCharts

As the chart above shows, MELI enjoys Retained Earnings of $5.25 billion against long-term liabilities of 800 million. Its cash position is sufficient to meet near-term needs, and even before the company was generating roughly $1 billion in operating cashflow, it showed little need to dilute to take on excessive leverage to meet its financial obligations.

Traditional ratios, such as the quick ratio, become less informative as MELI grows its Fintech portfolio, since much of its growing cash base actually belongs to the customers. To address this, MELI now releases an “adjusted free cashflow” figure with its earnings reports, which help to cut through the effect of growing client cash accounts.

The figure is simply free cashflow (operating cashflow minus capital expenditures), minus growth in restricted cash that MELI holds for customers and can’t use for operations. As MercadoPago and other digital services grow, and restricted cash becomes a massive item on the balance sheet, this is a much more informative figure.

The company’s adjusted free cashflow, which excludes restricted cash that MELI basically holds for customers, was roughly $1.2 billion in FY 2024, a very healthy figure. Its adjusted free cashflow was over $200 million, reflecting an annualized contraction as the company invests in growing its credit profile and logistics network, particularly in Brazil.

Ratings agencies are seeing the same thing that we are. Fitch recently upgraded both MELI’s loans receivable profile and its $1 billion in outstanding unsecured loans, due in tranches over the next five years. It cited robust cashflow generation and financial services as a future growth driver, both of which bode well for its ability to meet future obligations.

Valuation

Though most of its valuation reflects expectations for future performance, it already has some strong fundamentals. Since breaking even in early 2022, its annual net income has reached $2 billion and operating cash flow was $6.8 billion over the past 12 months.

A DCF analysis of free cash flow, if we conservatively assume a 10-year average growth of 20%, a terminal growth rate of 4%, and a discount rate of 10%, indicates that the company is still undervalued by about 30%. However, that figure is highly distorted by the growth in financial service accounts, which are restricted to protect clients’ cash balances.

MELI: In the Black, Growing Fast

Source: Ycharts

If we look at earnings rather than cash flow, and apply the same conservative terminal growth and discount figures, a reverse DCF implies that the current share price roughly projects 28% annual earnings growth over the next 10 years. That’s in contrast to roughly 40% growth over the past year, which is of course biased by its recent move into profitability. Ultimately, though generally not the main thesis for most MELI investors, the company’s current performance and fundamentals arguably warrant its steep multiples.

A leading e-commerce and fintech platform with $24 billion in annual revenues may seem quaint when compared to Amazon’s $670 billion in TTM sales, and MELI commands a fairly high earnings premium of 57x, even considering its meteoric growth. However, that premium recognizes, as it has for years, the fertile market that MELI leads in.

Its dominance in a nascent, growing market that US companies have been slow to penetrate makes it not only a powerful growth play, but a useful hedge against highly correlated US tech firms and even the American economy. This article explores whether the company’s growth, leadership and novel market exposure is worth that premium, with the cautious recommendation to keep piling into a LatAm darling.

Ownership and Compensation Structure

Institution-Led Investor Base

Institutional investors own the vast majority of MELI’s shares. According to Simply Wall St, about 80–82% of the company is held by institutions. According to TickerGate, the split is ~81.83% institutional, ~7.28% insiders, and ~10.89% retail. Among the top institutional holders are Baillie Gifford (~8–9%), Capital Research & Management, Morgan Stanley, and others.

In my opinion, this heavy institutional ownership is both a vote of confidence from professional investors, and a sign that the company’s key executive structure will be supported by market analysts.

Insider / Management Ownership

According to BusinessQuant, insiders (directly) hold ~6.75% of outstanding shares (roughly 3.42 million shares, based on ~50.70 million shares outstanding). However, “individual insiders” (i.e., in their personal capacity) own a very small fraction.

The vast majority of this insider ownership is through Marcos Galperin’s Galperin Trust, holding ~7.0%. Other concentrated ownership is mainly held by early institutional investors like Baillie Gifford. These entities appear to maintain an active role in steering MELI toward what they feel is sound policy.

In contrast to IBKR which we covered here, it seems like MELI’s operational success has been more of a team effort. While Galperin is the founder, current CEO and still deeply involved, it seems that institutional investors have provided heavy input to applying best practices to achieve healthy growth and a solid fiscal position. This likely explains the relatively small insider holdings.

It makes intuitive sense that a recent Stanford graduate, building this company with other very young colleagues, would lean on major industry players for early capital and guidance, such as the early strategic partnership with E-Bay.

Risks and Opportunities

Mercadolibre is a unique company, which is why we like it. Its market, and position within that market, are both highly unusual for a large-cap, US listed stock. This is especially true when you exclude China from the list.

The most exciting thing about MELI is also where much of its risk comes from: it leads an emerging market. While Latin America, particularly some of MELI’s main markets, have a special history of economic volatility, it also projects massive growth in MELI’s two main segments.

Strategic Risk

MELI’s net margins are comfortably over 10% and it manages a comfortable liquidity situation. Even when adjusting for It also has access to a deep bench of institutional investors to weather any fiscal storms.

However, any company that is fighting in a lucrative, competitive market faces risks of losing market share. The challenge for MercadoLibre from a price performance standpoint is that the implied growth rate basically assumes that the company will be able to continue to dominate and consolidate its role in major markets (Brazil, Mexico, Argentina).

This is a space ripe for disruption, and it’s worth noting that eBay’s market cap was basically neck-and-neck with Amazon from 1999 to 2007. While MELI has a dominant presence, it is not operating alone in any of the three markets. Amazon is aggressively competing in Mexico for example, and fintech is especially vulnerable to new entrants in all three markets.

Political, Economic Stability

Mercadolibre’s three largest markets, Argentina, Mexico, and Brazil, are all subject to some level of political and economic uncertainty. This added risk is the price of doing business in the developing world, and Mercadolibre is no exception. In general, these risks can be broken down into political stability and macroeconomic outlook and currency performance, since virtually all of Mercadolibre’s operations take place in Latin currencies, which are then translated to dollars on its financial statements.

While they share many risks in common, let’s break down Mercadolibre’s three biggest markets’ unique risk profiles.

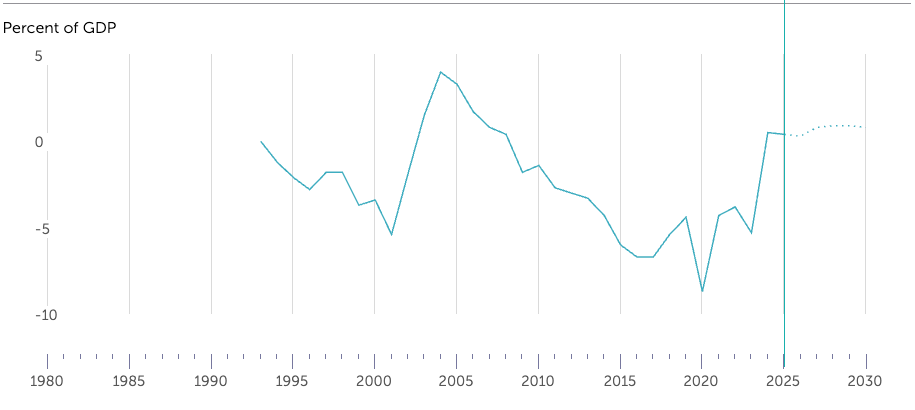

Argentina – Significant Risk (Improving)

Argentina has long had a reputation as Latin America’s (second) most poorly managed economy. Despite some excellent fundamentals, such as the highest GDP per capita among large Latin countries and a well-educated population, the country has struggled for decades with periodic fiscal crises and resulting economic stagnation. Historically, the government has found it virtually impossible not to spend beyond its means.

Argentina Government Net Borrowing (% of GDP)

Source: International Monetary Fund

That has been changing since Milei came into power. The Trumpian figure and former economist has taken an aggressive, austerity-driven approach to government spending. The result is that, after years of hyperinflation and runaway deficits, Argentina is now entering a budget surplus for the first time since the 1990s.

There are still significant risks to Argentina’s monetary performance, but with the US backing the economy for now, and real improvements to its fundamental picture, Argentina’s economic outlook looks much better than it did two years ago.

Brazil – Moderate Risk

Brazil is MELI’s largest and most strategically important market, but it carries a well-known set of macro and policy vulnerabilities. The country combines strong structural fundamentals—a large consumer base, diversified economy, and comparatively mature financial system—with chronic fiscal pressures and governance frictions. As Argentina gets its house in order, it may now be the riskiest of MELI’s three major markets from a currency standpoint.

Public spending has a tendency to outpace revenue growth, and efforts to implement durable fiscal reforms frequently stall in Congress. While Brazil’s institutions are considerably stronger than those of many regional peers, the policy process is slow, fragmented, and vulnerable to reversals. These dynamics contribute to periodic bouts of currency volatility and high real interest rates, both of which weigh on consumer demand, credit formation, and MELI’s USD-translated results.

Mexico – Moderate Risk

Mexico offers strong long-term fundamentals—proximity to the United States, a large working-age population, and a rapidly expanding digital economy—but faces structural weaknesses that create ongoing uncertainty.

Public finances are comparatively disciplined by regional standards, yet institutional fragility, uneven rule-of-law enforcement, and pervasive security challenges undermine confidence and increase the cost of doing business. Regulatory unpredictability has risen in recent years, particularly around energy policy, tax enforcement, and cross-border commerce. While Mexico has not experienced the severe macro dislocations common in some Latin American economies, its governance and security issues act as steady drags on productivity and private investment. These constraints translate into a more cautious risk profile for operators like MELI, whose core businesses rely heavily on stable commerce infrastructure, consumer confidence, and predictable regulatory oversight.

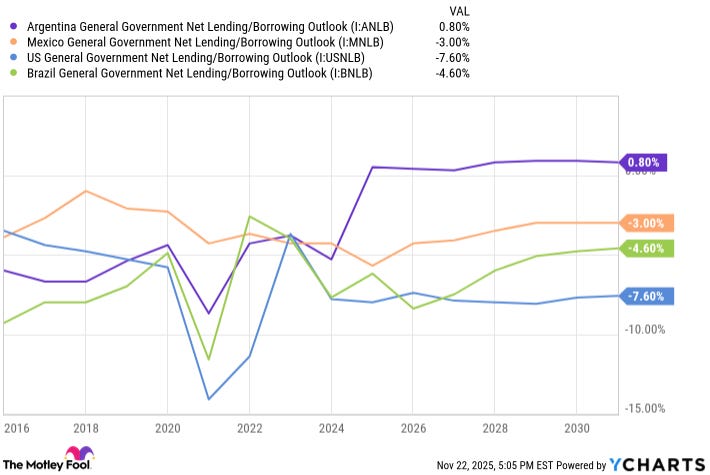

Currency, Growth and the American Hedge

Excluding Chinese giants, which are subject to greater geopolitical risk for US investors, Mercado Libre is virtually the only blue chip tech stock on the NYSE with income derived almost entirely from foreign markets. This is not strictly a buy signal on its own, but it does offer a level of uncorrelated performance compared to comparable stocks.

One of the more interesting questions in September of 2025 is who will win and lose on falling interest rates. Of course, the rising tide of QE tends to lift all boats, and the market writ large is probably a relatively safe (and fun) place to be when interest rates fall. Of course, active investing is about finding alpha, the investments that will outperform in risk and inflation-adjusted terms. As we discussed with IBKR[9] , a stock can still rise and potentially underperform peers, particularly in a dizzying QE environment.

MercadoLibre’s unique fundamentals (massive growth, safe financial position, foreign operations) provide an interesting edge when we look into the near-to-medium term. The US dollar outlook remains negative, with Latin American currencies performing particularly well since the beginning of the year. Even Argentina, the poster-child for fiscal mismanagement and runaway inflation, is making strides to stabilize its economy, with positive results and American support to show for it.

MELI’s Biggest Markets Have Better Deficit-GDP Ratios than USA

Source: Ycharts

As the US frets over the overlapping perils of flagging GDP growth, stubborn inflation and a massive debt burden, MercadoLibre presents a solid, high-growth company with lower exposure to an unpredictable American economy. Of course, Latin American economies are deeply integrated with the US; both inflation and recessions are quite contagious between American neighbors. They also have their own unpredictability, as the Argentinians know all too well.

That said, they are driven by unique own demographic and economic tailwinds, and MercadoLibre’s core value proposition is about more than offering discretionary consumer goods to Latinos; it is about driving the digitization of Latin American finance. It is hard to imagine that a flagging US economy would somehow stop the gradual digitization of Latino spending, or the need for new financial solutions, even if fewer goods are purchased through the ecommerce platform.

If the coming fiscal and monetary shifts in the US prove to be structural and unique to its debt position, as well as a systemic global derisking of the dollar, then Latin American economies (and their currencies) could offer a counterintuitive safe haven.

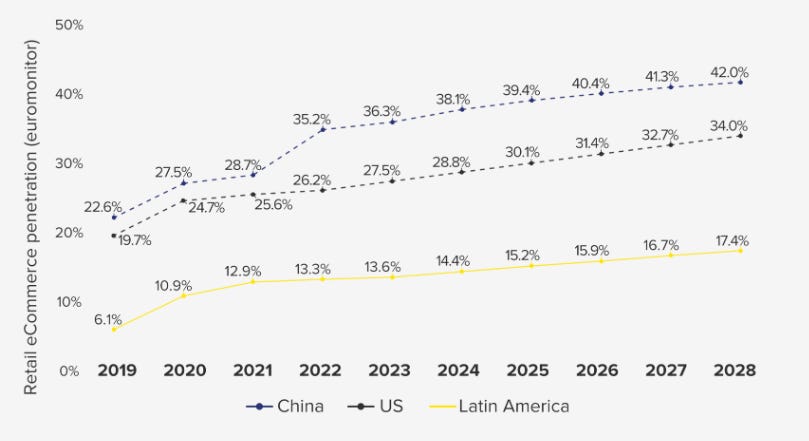

Growth:

As the company will be the first to tell you, Latin America is lagging other regions in both ecommerce penetration and the availability of financial solutions. Ecommerce penetration “lags the US by almost a decade”, according to its own Investor Relations page. That makes it much easier for MercadoLibre to ride the wave of a nascent market that it already dominates, rather than fighting to grow by gaining market share.

“We see a huge runway for growth as Mercado Libre leads the shift of offline retail online by delivering an ever-improving value proposition. Ecommerce penetration is currently a mid-teens percentage of total retail in Latin America, lagging the USA by almost a decade. Third-party forecasts point to the market growing by 54% from $151bn in 2023 to $232bn by 2028.”

Source: MercadoLibre

Beyond e-commerce and financial services penetration, Latin America is simply a more virgin market. It has further to go with it comes to both ecommerce and digital banking solutions. This is evidenced by MELI’s relatively low volume, continued massive growth, and leadership in its markets.

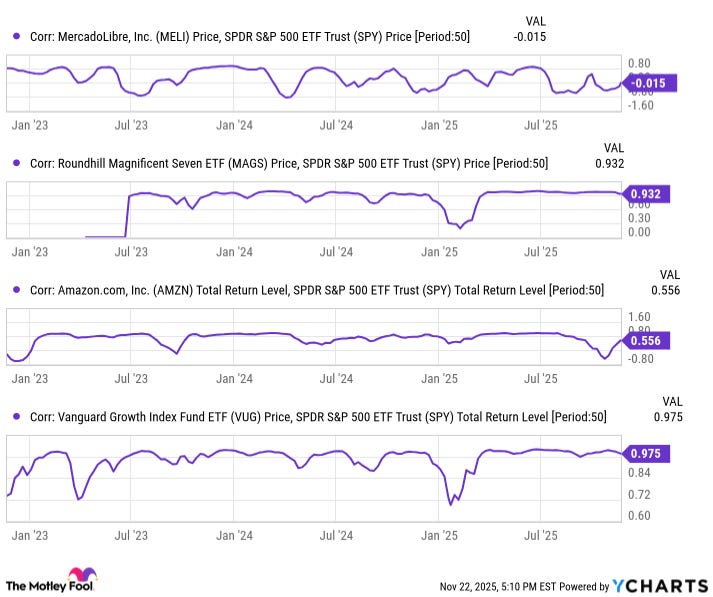

A Beta-Light Growth Play

Everyone knows about diversification, but fewer people know about Beta. That is a shame, and a blessing because we do not view Beta as a measure of business risk. However, for our purposes, Beta can be described as the correlation in the price movement between an asset, like MELI, AMZN, or Bitcoin, and the S&P 500. The chart above shows the historical correlations in returns between the S&P 500 and those two stocks, as well as an ETF that tracks The Magnificent Seven. This correlation naturally moves around on especially good and bad weeks for an individual stock when the market didn’t much, or vice versa.

MELI: High Returns, Lower Beta

Source: Ycharts

A Beta of 1 implies perfect correlation, while -1 would be perfectly inverted correlation, like an inverse ETF that shorts the S&P 500. A Beta of 1.5 would mean that when the market moved up 10%, the stock was expected to move up 15%, and vice versa.

Since the Magnificent Seven comprises nearly 40% of the S&P’s total market cap, it makes sense that the correlation usually floats around 1. You can see that all three assets are positively correlated with the market, at least most of the time. Only MELI is consistently the least correlated with the S&P 500, with frequent sustained dips into negative correlation.

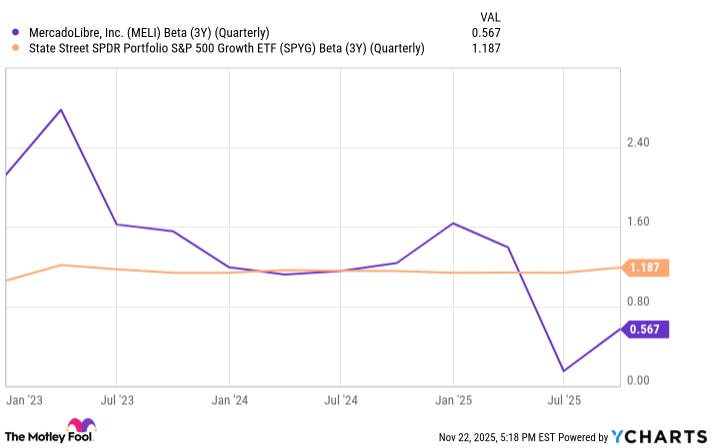

The chart below shows MELI’s 3-year average Beta vs. the SPYG, an ETF that tracks American growth stocks. The SPYG tends to have a beta slightly above 1, as it tracks the market but is more sensitive to changes in sentiment.

Like a typical growth stock, MELI’s Beta used to be well above 1, swinging on general market moves, as one would expect of a growing tech company with a high earnings multiple. It soared during the pandemic with other tech companies on aggressive government stimulus, fervent sentiment, and real benefits to its business model. It crashed in 2022 on quantitative tightening and a general flight to safety.

Solid Fundamental Performance Drives DeCorrelation

Source: Ycharts

However, since 2022, we’ve seen a gradual reduction in Beta, as the company began to stand more firmly on its own consistent performance, rather than following market swings of other highly speculative growth stocks.

It’s no accident that the fall in Beta has coincided with the company achieving meaningful profits, from less than $100 million in 2021 to over $2 billion in the past twelve months. For the first time since 2015, its 3-year Beta sits well below 1. This comes at a time when uncertainty pervades the US economy, and investors are rightly looking for a safe hedge that also offers serious growth.

True Diversification

Mercadolibre has always been valued for what it could be in the future, and like most growth stocks, it therefore swung around with market sentiment. That is changing, and as MELI matures into the growth that investors predicted, it combines the rare qualities of growth, portfolio diversification and blue-chip security.

You can probably guess one reason that Mercadolibre doesn’t move with the US stock market to the extent of most growth stocks: it doesn’t operate in the United States! Mercadolibre gets plenty of capital from the United States, and has partnered with American firms, but it’s fundamentally a Latin company. That means that the US consumer market has little bearing on its top line, and changing supply chains in the US have little bearing on its bottom line.

Further Divergence?

It is possible that a changing macroeconomic environment could bolster MELI’s bifurcation from the broader market. The rumblings of recession

If the United States did enter a recession, it is very likely that major Latin American markets would join it. That happened in 2020, 2009, and every major American recession since the 1980s. However, MELI’s growth trajectory would likely be more resilient, since it is just as dependent on increased tech adoption in a nascent market as it is on changes in discretionary income.

Additionally, MELI may see a currency boost in an economic downtown. The US, already perilously perched between employment, inflation, and a massive debt problem, has to contend with a growing international desire to diversify away from the dollar.

MercadoLibre: Strong Books, Great Growth, Attractive Hedge

It’s rare to find a company with strong fundamentals, powerful market tailwinds, and a relatively low correlation (beta) with the broader US stock market. Mercadolibre is one such company, and its steep valuation reflects it.

As we’ve discussed, we loved Adobe’s fundamentals but were worried about its continued position in the market, fears that unfortunately appear to be warranted. We love IBKR’s fundamentals and market leadership, and maintain that it is one of the best companies in the sector, but we are concerned that it may not be buoyed by QE as other companies are, or that it could even be harmed.

Mercado Libre gives us strong fundamentals, powerful market drivers, and a unique macroeconomic environment. It is certainly subject to its own risks, including the unique structural risks of its Latin American markets. However, these risks and opportunities are different from those of the broader US market, which is part of its appeal.

To summarize, we like Mercadolibre for its fundamentals and historical performance. We like the massive market that it continues to nurture and lead. Lastly, we like Mercadolibre for its potential as a high-growth stock with lower correlation with the US market, making it a stronger diversification play than a typical risk-on investment.

We appreciate your time in reading our MercadoLibre Deep Dive. We will continue tracking MELI’s performance and strategic evolution through periodic updates and implication reports available to subscribers.

Disclaimer

This report is for informational and educational purposes only and does not constitute investment advice, a recommendation, or a solicitation to buy or sell any securities. All opinions expressed reflect the author’s judgment as of the publication date and are subject to change without notice.

The author does not currently hold shares of MercadoLibre (MELI) but may initiate a position in the future without further notice.

For the full disclaimer, click here.

Copyright © 2025 Business Deep Dives. All rights reserved.

Business Deep Dives is an independent research publication operating on a pre-incorporation basis. All content is protected under applicable international copyright principles.

Regarding the topic, you've convinced me MELI's growth tragectory is quite impressive.